Will India see the next round of fuel price hikes due to 17-year high WPI inflation?

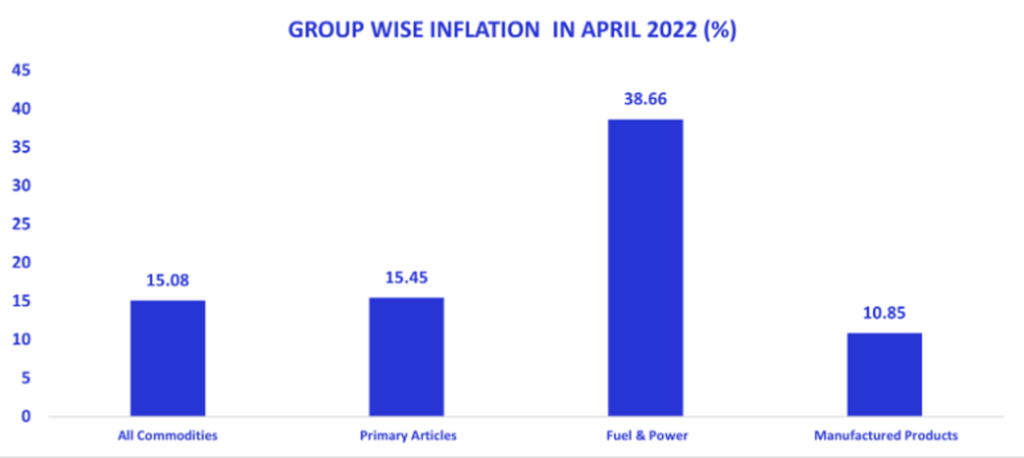

Corporates and rural businesses of India started facing high-cost pressure at the beginning of FY22 (April 2021 – March 2022). It was earlier expected that inflation would be transitory or short-lived, but it became stickier throughout the year, driven by supply-side challenges and geopolitical factors. Consequently, Indian manufacturers reported nearly 17-year high WPI (Wholesale Price Index) inflation at 15.08% in April 2022.

Savart Trivia: WPI inflation refers to the increase or change in the price of goods produced by the manufacturers. It tracks the increase in prices of goods before they reach the consumers.

WPI inflation has been very rapid with the sharp increase in primary articles that recorded a sharp increase in inflation at 15.45% in April 2022 on a YOY basis (compared to the same period last year). Primary articles consist of food articles and non-food articles that recorded an 8.35% increase in prices due to a sharp rise in prices coming from wheat (+10.07%), cereals (+7.8%) and vegetables (+23.24%).

Wheat prices increased globally as the supplies from Russia and Ukraine reduced significantly due to the ongoing war. Russia and Ukraine together supply nearly 25% of global wheat, and the supply side shortages are driving wheat prices higher.

On the domestic front, the wheat supply is also facing challenges as India faced heavy heatwaves in March and April’2022. This resulted in wheat becoming shriveled and disrupting the supply chain. Consequently, wheat prices have gone up domestically as well. The government has also banned wheat exports to control the domestic prices.

Fuel & Power are vital elements of business. Producers experienced 38.66% inflation in the production of fuel and power in April’2022. Fuel production price increased 60.63% in April’2022 on a YOY basis, LPG production prices increased 38.48%, and diesel production prices increased 66.14% for the respective manufacturers. Fuel prices for producers have gone up primarily because of increased crude oil prices, which have increased to $113 per barrel from $70 per barrel last year. This directly impacts oil marketing companies as they face high-cost pressures in their respective businesses.

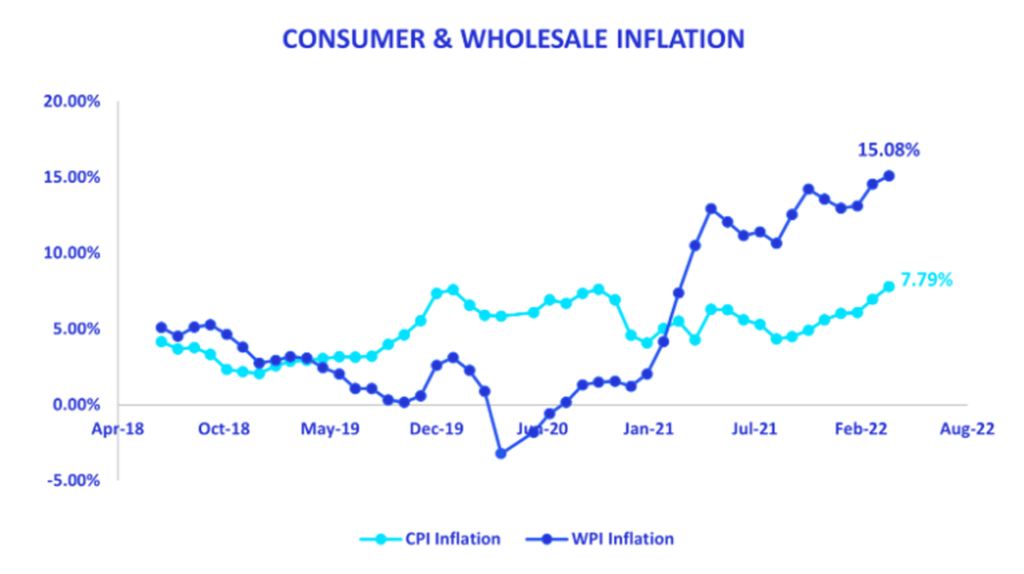

In the last few quarters, it has been evident that businesses across India faced high-cost pressures because of the increase in raw material prices. Their profitability has come down as they have not passed down the increase in raw material prices to end consumers. The CPI inflation in India was recorded at 7.79% in April 2022, whereas WPI inflation was around 15.08%. It shows the gap between inflation pressure absorbed by producers and faced by the consumers.

Savart Trivia: CPI (Consumer Price Index) reflects the increase or change in the prices of goods and services paid by the end consumers. The gap between CPI & WPI numbers indicates that the producers have only passed on the partial price increase to the end consumers.

As mentioned above, consumers have only seen a partial increase in prices from producers. In the near term, corporate India is more likely to pass on further price hikes to the consumers to manage these unprecedented inflation levels. As a result, consumers might face higher inflation going ahead and might end up with lower savings.

We have already seen fuel prices increasing significantly post the state-wide election. However, as fuel manufacturers are experiencing inflation as high as 60%, oil marketing companies are likely to take price hikes at retail pumps in the near term. So, oil prices might continue to pinch our pockets.

How is RBI acting on it?

As this underlying inflation is essentially supply-side driven, global central banks need to be more careful. Central Banks such as RBI, the Federal Reserve of the United States are well equipped to control demand-driven inflation, but supply chains are not under the direct control of central banks.

To reduce the demand-supply gap, central banks are likely to increase the interest rate so that demand is closer to the available supply. In the near term, RBI is expected to take further interest rate hikes to control the existing demand, which would mean higher EMIs for borrowers. Consequently, with a fall in demand, growth is also expected to slow down on the domestic front.

How should investors act in this situation?

With inflation surging, interest rates going up and growth slowing down, it is essential to invest properly so that investments can generate a higher return than inflation and build wealth over the long run with adequate risk management. However, one needs to be very selective while investing in equities because of existing economic uncertainties as businesses may face many operational challenges in the near term.

Our APART algorithm helps SAVART identify the opportunities in the market during these uncertain periods and generate wealth for the long term. Download the app to get in touch with us.