Understanding the Share Buyback Phenomenon

In the corporate world, a share buyback acts as a strategic move where a company reacquires its own shares from investors. This move isn’t just a financial transaction; it’s a strong message of self-belief and a harbinger of potential growth. By reducing the number of shares available in the market, a buyback can boost the earnings per share (EPS), enhance shareholder value, and refine the company’s capital structure.

The Anatomy of a Buyback

When a company like Tata Consultancy Services (TCS) opts for a share buyback, it’s signalling its confidence in the business and making a clear statement about its financial health. The mechanism is designed to provide investors with an alternate exit strategy, often at a premium to the current market price. For existing shareholders, the aftermath of a buyback can mean a greater claim over the company’s earnings and potentially a higher stock price due to the reduced share count and improved demand-supply dynamics.

TCS’s Trust with Buybacks: A Historical Perspective

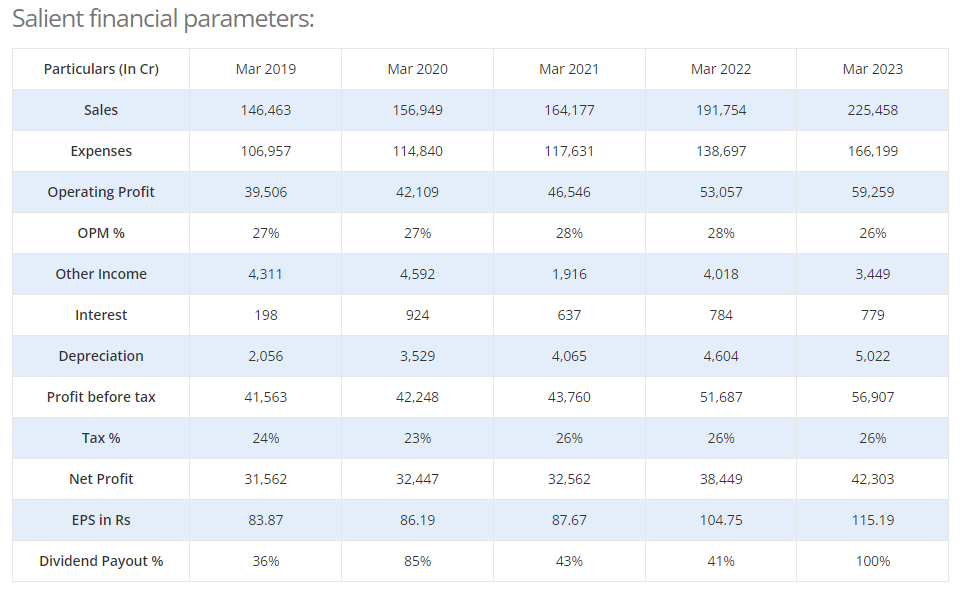

TCS, a titan in the IT sector, has a storied history with share buybacks. The 2023 buyback will be its fifth in six years, a testament to its strong cash reserves and commitment to returning value to shareholders. Over the past six years, TCS has channelled Rs 66,000 crore back to its shareholders, reinforcing its stature as a company with resilient financials and a generous approach to investor returns.

TCS Buyback 2023: The Essentials

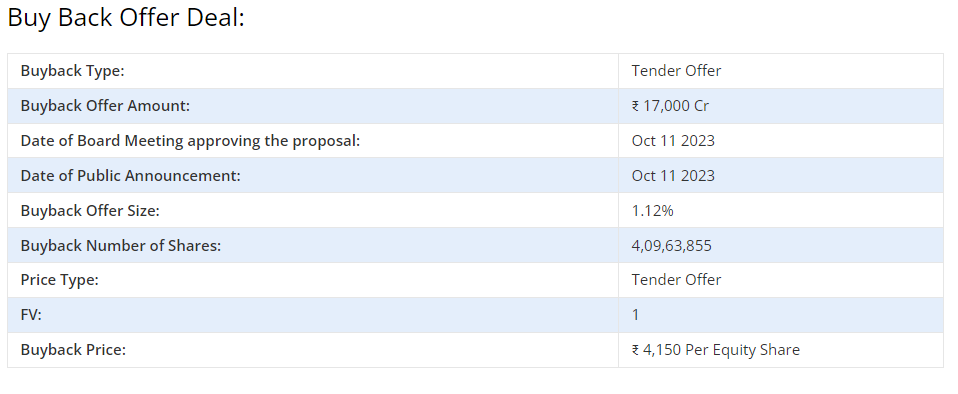

The 2023 share buyback from TCS is particularly notable. Scheduled alongside its second-quarter earnings on October 11, TCS has earmarked a mammoth ₹17,000 crore for this purpose. Set at a price of ₹4,150 per share, the buyback represents 1.12% of the total paid-up equity share capital and will be executed under the tender offer route through stock exchange mechanisms. As per regulations, this exercise is contingent on shareholder approval via a special resolution through a postal ballot.

How to Participate in the TCS Buyback

As a shareholder, participating in a buyback like TCS’s could be a lucrative opportunity. Here’s a step-by-step guide:

- Check Your Eligibility: You must hold shares in TCS as of the ‘record date’ to be eligible for the buyback offer.

- Await the Letter of Offer: If you’re eligible, you’ll receive a notification detailing the terms of the buyback. It is crucial to understand the offer before you decide to participate.

- Access Your Demat Account: Through your broker’s platform, log in to your demat account where your TCS shares are held.

- Locate the Buyback Option: Find the section for buyback on your broker’s dashboard. If you encounter any issues, do not hesitate to reach out to customer service.

- Decide on Participation: Decide how many shares you are willing to tender in the buyback. Remember, the final acceptance of your shares will depend on the acceptance ratio.

- Tender Your Shares: Submit your tender and your shares will be locked in until the finalization of the buyback process.

- Finalization: If your shares are accepted, the buyback amount will be credited to your bank account. Any shares not accepted will remain in your demat account.

The Strategic Advantage for Shareholders

For investors, a buyback provides a dual advantage. First, it offers an opportunity to liquidate shares at a premium, which could be particularly attractive if the market price is lower than the buyback price. Secondly, if investors choose not to participate, they may benefit from a potential increase in the share price post-buyback and own a slightly larger proportion of the company due to the reduced number of shares outstanding.

TCS’s Financial Stewardship and Shareholder Value

The TCS buyback of 2023 is not just a financial maneuver but a narrative of enduring value and trust. It’s a reflection of the company’s robust balance sheet and its strategic focus on enhancing shareholder wealth. For shareholders, the buyback is a clear indication of the company’s bullish outlook on its own future and its commitment to sharing its success with its investors. As TCS continues to forge ahead, its buyback history will likely be remembered as a series of strategic milestones, marking the company’s relentless march towards growth and profitability.