Manage every aspect of your finance with Savart One

Your trusted companion in the journey of financial freedom.

Make right money decisions with your personal expert wealth adviser.

Get all your money-related questions answered

How much money do I need to become financially free?

Stocks or mutual funds or real estate? Which one should I be investing in and how much?

Should I repay my loan or continue with it?

Can I save more money in taxes?

Is this real estate property right for me as per my financial health?

I want to save for my retirement, my child’s higher education and go on vacation, how can I go about this?

Experts advise and manage your finances

So that you achieve your goals stress-free

Embarking on the journey to financial freedom is about more than just meeting financial goals—it’s about creating a life filled with aspiration and free from financial stress.

With Savart One Wealth Planning – a complete financial planning and management suite – we will be your partners in this journey.

We ensure that every step you take is a step towards a brighter, more secure future. Start your journey with Savart One and turn your financial dreams into a lived reality.

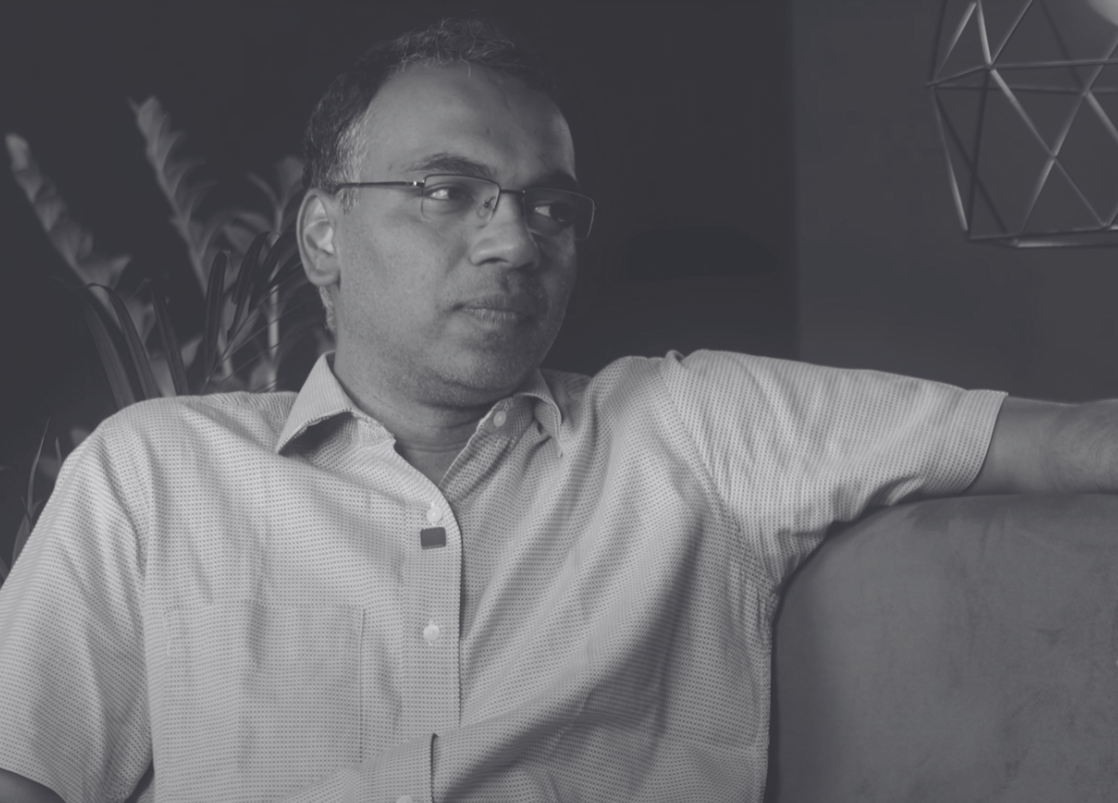

Know Your Wealth Manager

Sridhar Vetapalem

Mr. Sridhar is the Head of the Personal Finance & Wealth Management at Savart. He has over 21 years of experience in Financial Planning. His expertise spans investment advisory, retirement planning, lifestyle management, and objective-based solutions. He is also an esteemed sought-after lecturer at top MBA colleges in Pune.

Mr. Sridhar believes that financial freedom is essential for unlocking creativity and reaching one’s full potential. Over the years, he has successfully guided numerous clients to live comfortably off their savings and investments.

Case Studies

Ashwini Ramji

Mr. Ashwini is on a mission to achieve early retirement and financial freedom by the age of 50, with the ultimate goal of owning a resort on the outskirts of Bengaluru. To support this ambition, we have crafted a comprehensive financial plan that includes a well-balanced asset allocation strategy. His savings have been strategically diverted into balanced growth portfolios to maximize returns while managing risk.

Mahesh Oswal

Mr. Mahesh was paying ₹2,20,000 annually for an insurance cover of ₹6 crore. After Savart One, he pays just ₹49,000 per year for a revised cover of ₹3 crore, which is better aligned with his current requirements. We have also provided guidance on the necessary actions to take with his existing insurance covers to ensure he does not forfeit any invested funds.

Pavni Seshadri

For Ms. Pavni, we have developed a robust financial plan that ensures her family can enjoy a comfortable lifestyle supported by their savings. Her investment portfolio is designed to provide both growth and a steady income stream. This plan aims to balance investment growth with the need for regular income, ensuring that Ms. Pavni and her family can live comfortably and securely from their investments.

Ultra-personalized financial planning

Identify your future needs

Start by discussing your dreams and goals with us so that we can identify your future needs and objectives. Then we help you convert them into financial goals.

Set a Timeline

We’ll evaluate your current lifestyle and future projected costs, determine your surplus savings, create your family budget and help you set a timeline for achieving your financial goals

Develop a Financial Plan

We’ll do your risk planning, determine your insurance cover estimation and required investment returns, and select the right financial products for you. We’ll develop a robust financial plan and take care of the execution as well.

Monitor & Evaluate Progress

Your investments and finances will be regularly tracked and reviewed, and you’ll have 24/7 access to your wealth manager for any questions or concerns. We’ll ensure that your financial goals are met in time.

Financial Freedom is the ability to live life on your own terms