Your Money.

Managed, Guided, and Grown.

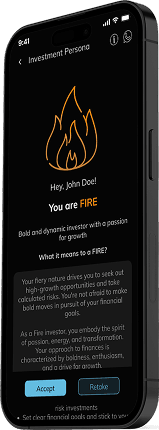

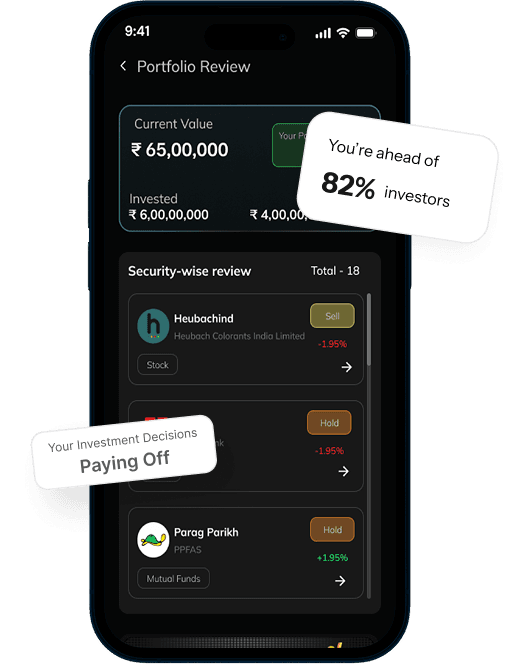

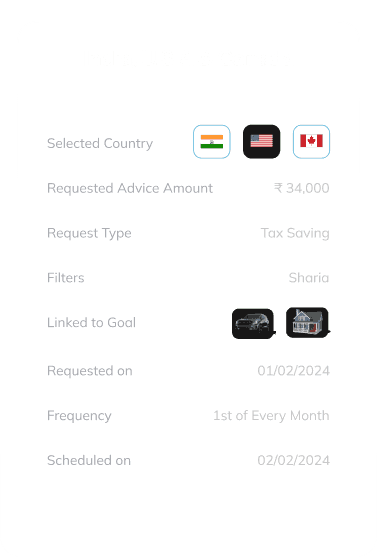

Savart helps you invest better, plan smarter, and grow faster with a unified ecosystem.

How much do you plan to invest

the next 12 months?

Our recommendation for you

Savart XLite

A smart start for new investors with expertly curated mutual funds, reviews, and ongoing portfolio care.

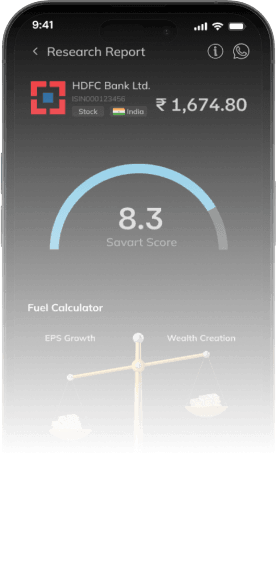

Know what to buy, when to sell

Power through the stock market with confidence.

4 Lakh+

Users

₹4500 Cr

Assets under advice

SEBI

Registered

19.5%

CAGR in 5 Years

Achieve Your Goals, Live Your Dream Life

Build the wealth you need today to live the life you envision tomorrow