Benefits of Investing Early For Retirement

“The best time to plant a tree was 20 years ago. The second best time is now.”

Similarly, we are often asked: What’s the right time to begin investing in the market? Our steadfast answer: Now, or as early as you can.

But have you ever wondered why you should start investing early? How does it benefit you in the long run? The reason is the simple mathematical principle of compounding. When you begin investing early in life, your money has more time to experience the magic of compounding.

What is compounding?

Compounding is the process in which an investment’s growth (from either capital gains or dividends), is reinvested to generate additional earnings over time. This growth, calculated using exponential functions, occurs because the investment will generate earnings from both its initial principal and the accumulated earnings from preceding periods. (Investopedia)

How compounding works

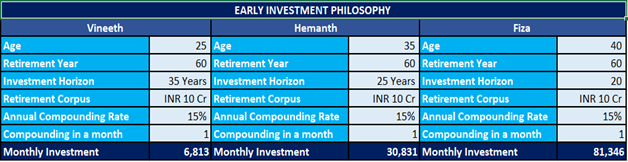

Let us examine the power of compounding with three friends who all have the same financial goal, but begin to take action on it at different points in their lives:

Illustration 1:

Vineet starts saving Rs. 6,813 per month from his income at the age of 25. He decides to invest this amount into Mutual Funds through a Systematic Investment Plan (SIP). With this plan, he will have a corpus of Rs. 10 crores when he turns 60, assuming a 15% annual rate of return on his investment.

Illustration 2

Hemanth has the same goal, i.e., to retire at 60 with INR 10 Cr as the retirement corpus. However, Hemanth starts investing at the age of 35. He now has only 25 years to execute this plan (as compared to 35 years with Vineet), hence he will need to invest Rs. 30,831 each month assuming the same 15% annual rate of return on his investment.

Illustration 3

In the third illustration, we have Fiza, who starts investing at the age of 40 aiming to retire at the age of 60 with the same corpus of Rs 10 Cr at the time of retirement. For this financial goal, Fiza must invest Rs. 81,346 monthly to reach the target amount, assuming a 15% compounded annual return.

As you can see from the above illustration, Vineet, who started investing earliest has the advantage of time on his side; hence he will need to invest less each month for the same outcome. The other advantage of starting to invest early is that you will have more time to recover losses. Markets keep moving up and down. Starting early, and maintaining the discipline, gives you the leverage to recover any losses you may incur on your investment journey in the short term.

Starting early, you have more time for your corpus to compound and grow, and you can effectively get better returns from your investments. So, if you’re able to start investing early, it’s something you should consider!

Looking for advice on how and where to invest regularly to achieve your financial goals? Savart offers unmatched, high-quality, and objective advice on stocks, mutual funds, bonds, and gold. Download our app from the Google Play Store or the Apple App Store. Please watch the walkthrough video here for a detailed explanation of using the Savart system.

Benefits of Investing Early For Retirement

“The best time to plant a tree was 20 years ago. The second best time is now.”

Similarly, we are often asked: What’s the right time to begin investing in the market? Our steadfast answer: Now, or as early as you can.

But have you ever wondered why you should start investing early? How does it benefit you in the long run? The reason is the simple mathematical principle of compounding. When you begin investing early in life, your money has more time to experience the magic of compounding.

What is compounding?

Compounding is the process in which an investment’s growth (from either capital gains or dividends), is reinvested to generate additional earnings over time. This growth, calculated using exponential functions, occurs because the investment will generate earnings from both its initial principal and the accumulated earnings from preceding periods. (Investopedia)

How compounding works

Let us examine the power of compounding with three friends who all have the same financial goal, but begin to take action on it at different points in their lives:

Illustration 1:

Vineet starts saving Rs. 6,813 per month from his income at the age of 25. He decides to invest this amount into Mutual Funds through a Systematic Investment Plan (SIP). With this plan, he will have a corpus of Rs. 10 crores when he turns 60, assuming a 15% annual rate of return on his investment.

Illustration 2

Hemanth has the same goal, i.e., to retire at 60 with INR 10 Cr as the retirement corpus. However, Hemanth starts investing at the age of 35. He now has only 25 years to execute this plan (as compared to 35 years with Vineet), hence he will need to invest Rs. 30,831 each month assuming the same 15% annual rate of return on his investment.

Illustration 3

In the third illustration, we have Fiza, who starts investing at the age of 40 aiming to retire at the age of 60 with the same corpus of Rs 10 Cr at the time of retirement. For this financial goal, Fiza must invest Rs. 81,346 monthly to reach the target amount, assuming a 15% compounded annual return.

As you can see from the above illustration, Vineet, who started investing earliest has the advantage of time on his side; hence he will need to invest less each month for the same outcome. The other advantage of starting to invest early is that you will have more time to recover losses. Markets keep moving up and down. Starting early, and maintaining the discipline, gives you the leverage to recover any losses you may incur on your investment journey in the short term.

Starting early, you have more time for your corpus to compound and grow, and you can effectively get better returns from your investments. So, if you’re able to start investing early, it’s something you should consider!

Looking for advice on how and where to invest regularly to achieve your financial goals? Savart offers unmatched, high-quality, and objective advice on stocks, mutual funds, bonds, and gold. Download our app from the Google Play Store or the Apple App Store. Please watch the walkthrough video here for a detailed explanation of using the Savart system.