ITC is one of the country’s largest agri businesses and a pioneer in rural transformation where it works with farmers to improve productivity and quality of various crops. ITC’s agri business delivers sustainable competitive advantage to ITC’s Foods Business through high-quality and cost-competitive agri sourcing.

ITC is the second largest exporter of agri products from the country. It trades in feed ingredients, food grains, marine products, processed fruits, coffee etc. It also exports leaf tobacco under this vertical and is also the world’s 5th largest leaf tobacco exporter.

Industry Overview:

The agricultural sector is pivotal to the Indian economy, employing about half of the country’s workforce. India is amongst the leading producers in the world of several agri-commodities, including milk, rice, wheat, sugarcane, cotton, pulses, spices, fruits & vegetables. India’s agri exports peaked at US$ 53 billion in FY 2022-23 before witnessing a decline to US$ 49 billion in FY 2023-24 due to restrictions imposed during the year on agri-commodity trading, led by concerns over food security and inflation amid geopolitical tensions.

The gross value addition in the food processing sector has increased from Rs. 1.34 lakh crore in 2014-15 to Rs 2.27 lakh crore in 2019-20. The food processing sector is the largest employment provider for the organized manufacturing segment providing employment to more than 20 lakh people. Since 2014-15, the sector has attracted about US $ 6.36 billion worth of Foreign Direct Investment till June 2023. The exports of processed food have increased from US $ 4.9 billion in 2014-15 to over US $ 13.01 billion in 2022- 23 growing at a CAGR of 13%.

India is blessed with diverse agro-climatic zones and thus we produce large quantities as well as diverse types of foods from cereals, pulses to fruits and vegetables to millets. India is the largest producer of pulses, millets and milk, second largest producer of wheat, rice, ground nuts, fruits & vegetables. There exists a huge potential and immense opportunities for entrepreneurs, MSMEs, global companies to set up infrastructure to meet the increasing consumer demand.

Watershed Stewardship Program:

ITC’s Watershed Stewardship Programme (WSP) is a collaborative initiative to ensure long-term water security for all stakeholders. The program aims to improve water use efficiency and conserve water in its units and across its value chain partners, especially the following two key stakeholder groups:

- Farming communities associated with agricultural value chains

- Communities living in the neighborhood of its production units

ITC’s Watershed Stewardship Program focuses on the following:

- Rainwater Harvesting: ITC helps build infrastructure that collects and stores rainwater. This water is used to recharge groundwater levels and irrigate fields, creating a buffer against droughts.

- Soil and Water Conservation: Through contour bunding (creating raised barriers along the slope of land), check dams, and percolation ponds, ITC helps prevent soil erosion and water run-off. These methods increase water retention in the soil, leading to better crop yields.

- Community Involvement: What makes this program unique is that ITC doesn’t impose solutions from the top down. Instead, it trains local farmers and communities to manage these water resources independently. This ensures that the program is sustainable long after ITC’s involvement is over.

As on 31st March 2024, ITC’s integrated watershed development projects covering over 1.6 million acres of land have created a total rainwater harvesting potential (RWH) of over 54 million kl. In total, nearly 55 million kl of rainwater has been harvested, including within the fence, which is over four times the net water consumed by Company’s operations in FY 2023-24.

The beauty of ITC’s Watershed Stewardship Program lies in how it aligns business goals with environmental conservation. By ensuring a stable water supply, ITC secures its agribusiness raw materials—such as wheat, rice, and spices—while simultaneously improving the lives of rural communities. This is a shared value creation at its finest, where the prosperity of one sector ensures the growth of the other.

ITC Value Chain & Value Creation

ITC is a leading player in spices such as Chilli, Turmeric, Coriander and Cumin. ITC is one of the leading exporters of value-added frozen marine products from India with expertise in processing Individually Quick Frozen (IQF), raw and cooked products, adhering to the highest standards of safety and hygiene prevalent in developed markets such as the US, EU and Japan.

And Company has emerged as one of the top 3 exporters of frozen shrimps from India to the EU market by expanding its footprint in sustainably sourced shrimps leveraging the Aquaculture Stewardship Council (ASC) program.

In the Processed Fruits & Vegetables segment, the Business continues to expand its footprint in the fruit pulp and tomato paste categories through a robust network comprising many small and marginal farmers in four states.

ITC is one of India’s largest procurers and exporters of agri-commodities, sourcing over 3 million tons from 20 crop value chain clusters across 22 States. It is India’s second largest procurer of wheat after the Government’s Food Corporation of India.

- The Wheat Value Chain

The Wheat Value Chain is primarily anchored by the Aashirvaad brand, which is synonymous with quality flour. ITC sources wheat directly from farmers, ensuring fair prices and building long-term relationships. This chain not only supports local agriculture but also empowers farmers by providing them with training in sustainable farming practices. Through this initiative, ITC not only meets the growing demand for high-quality flour but also contributes to food security in India.

- The Spices Value Chain

Sourced from local farmers, ITC’s Sunrise brand of spices undergo rigorous quality checks, ensuring they meet international standards. By promoting traditional farming methods, ITC helps preserve the rich heritage of Indian spices while supporting local communities.

- The Potato Value Chain

In the Potato Value Chain, ITC drives innovation through Bingo! Snacks. By sourcing potatoes from local farmers, ITC not only provides a market for their produce but also invests in advanced processing technologies to create delicious snacks. This approach ensures that farmers benefit from stable demand while consumers enjoy high-quality, tasty snacks.

- The Fruits Value Chain

The Fruits Value Chain is powered by B-Natural juices, which epitomizes ITC’s dedication to freshness and health. By collaborating with local farmers, ITC sources a variety of fruits, ensuring that each bottle of juice captures the essence of nature.

- The Dairy Value Chain

The Dairy Value Chain leverages Aashirvaad Svasti dairy products and Sunfeast Wonderz milk-based beverages. By sourcing milk from local dairy farmers, ITC enhances the quality of dairy products while ensuring fair compensation. This value chain reflects ITC’s commitment to the welfare of dairy farmers and the production of high-quality, nutritious dairy items.

- The Vegetable Value Chain

Powered by Farmland and Master Chef brands, the Vegetable Value Chain emphasizes sourcing fresh vegetables from local farmers. ITC focuses on providing consumers with high-quality, farm-fresh vegetables while supporting sustainable farming practices. This approach not only enhances food quality but also contributes to the livelihoods of farmers.

- The Bamboo Value Chain: Sustainable Alternatives

Through the Bamboo Value Chain, ITC introduces Mangaldeep Agarbattis, a product that highlights the use of bamboo in creating sustainable goods. By utilizing bamboo, ITC supports eco-friendly practices while empowering local artisans. This initiative showcases the versatility of bamboo and its potential to drive sustainable development.

- The Wood Value Chain: Quality Stationery

The Wood Value Chain is exemplified by products like Classmate and Paperkraft notebooks. ITC sources wood sustainably, ensuring that its stationery products are eco-friendly. So, the reason why we discussed all these value-chains is ITC is building its business in such a way that everything is inter-linked. It is important to understand each of the verticals to understand ITC overall.

FMCG – others:

Industry Overview:

The Fast-Moving Consumer Goods (FMCG) sector is one of largest and fastest growing sectors in India. The industry in India mainly consists of three major segments – Household & Personal Care products, Healthcare products and Food & Beverages where 50% is comprised of products from the household and personal care category, while food & beverages contributes 31% to the total FMCG sales in India and the remaining 19% comes from health care related products.

The market size of India’s FMCG sector is expected to touch $220 billion by 2025 from $110 billion in 2020. The FMCG market in India stood at $167 billion in 2023 and $145 billion in 2022.

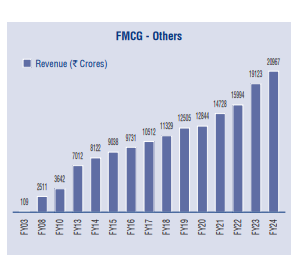

Now let’s talk about the FMCG segment of the ITC:

ITC’s FMCG brands have achieved impressive market standing across categories: Aashirvaad is No. 1 in Branded Atta, Bingo! is No. 1 in the Bridges segment of Snack Foods, Sunfeast is No. 1 in the Cream Biscuits segment, Classmate is No. 1 in Notebooks, YiPPee! is No. 2 in Noodles, Fiama is No. 2 in Bodywash and Mangaldeep is No. 2 in Agarbattis (No. 1 in Dhoop segment). Most of the raw materials for this segment are in-sourced, adding to the profitability of the company. This is why we discussed the value chain segment in detail.

Strengths of ITC:

- Backward Integration: Backward integration refers to a business strategy where a company takes control of its supply chain by acquiring or merging with suppliers or directly engaging in the production of raw materials. This strategy allows companies to enhance efficiency, reduce costs, ensure quality, and secure a consistent supply of essential inputs. ITC Limited has effectively implemented backward integration across its various business segments, particularly in its agribusiness and FMCG (Fast-Moving Consumer Goods) sectors.

- Market Leader: ITC is the market leader in most of the segments that it operates in, which is remarkable given the operational and executional diversity involved in getting this done, especially in the FMCG segment.

In FY 2008 the overall revenues of the FMCG segment were just INR 109 crores but it is now at INR 20,967 crore.

Risks of ITC:

- High Reliance on Tobacco Segments: ITC is heavily reliant on its cigarette business for its revenue. Although it has tried to diversify its FMCG segment, cigarettes still account for around 40% of revenues and about 81% of operating income.

- As of FY 2024, the FMCG – Cigarettes contributed INR 30,596 crore.

- Any impact on the overall business of the Tobacco industry will impact the overall finances of the company.

- High Competition from Existing Players: Nestlé dominates key categories such as dairy, coffee, nutrition, and packaged foods (e.g., Maggi, Nescafé, KitKat). Marico Known for its presence in hair oils, personal care, and health foods (e.g., Parachute, Saffola), Marico has a strong foothold in niche categories.

- Hindustan Unilever As India’s largest FMCG company, HUL has a vast product portfolio, covering categories from personal care and household products to food and beverages.

- Rising Input Costs: ITC, like many FMCG companies, operates in sectors with minimal margins. Rising raw material costs directly reduce profit margins because increasing prices to compensate for higher costs can be challenging in price-sensitive markets like India. The company’s ability to pass these costs on to consumers is limited, as competitors might not follow suit, leading to a loss of market share if ITC hikes its prices.

- Businesses in Regulatory Environment: Not Just the ITC cigarettes business, but also agri-business is in a highly regulated industry:

For Example: While India’s Agri exports have grown strongly in recent years to a peak of US$ 53 billion in FY 2022-23, it witnessed a decline to US$ 49 billion in FY 2023-24 due to restrictions imposed during the year on Agri-commodity trading led by concerns over food security and inflation on the back of geopolitical tensions and climate emergencies. So, any restrictions imposed by the government will impact the business of ITC and similar players in that particular segment.

Financials:

| Mar-17 | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | |

| Sales | 42,768 | 43,449 | 48,340 | 49,388 | 49,257 | 60,645 | 70,919 | 70,866 |

| Expenses | 27,298 | 26,928 | 29,802 | 30,044 | 32,193 | 40,021 | 45,215 | 44,634 |

| Net Profit | 10,477 | 11,493 | 12,836 | 15,593 | 13,383 | 15,503 | 19,477 | 20,751 |

Sales rose steadily from ₹42,768 crore in March 2017 to ₹70,866 crore by March 2024, reflecting the company’s expanding operations and product diversification. The only minor dip occurred in 2021, with sales at ₹49,257 crore, likely impacted by the pandemic.

Despite rising costs, ITC maintained strong profitability. Net profit grew from ₹10,477 crore in 2017 to an impressive ₹20,751 crore by 2024, with its sharpest jump between 2022 and 2023.

Shareholding pattern:

| Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | Jun-24 | |

| FIIs | 14.65% | 12.79% | 11.99% | 43.35% | 40.95% | 40.47% |

| DIIs | 42.46% | 42.50% | 42.77% | 42.08% | 43.76% | 44.02% |

| Government | 0.00% | 0.00% | 0.00% | 0.04% | 0.04% | 0.04% |

| Public | 42.89% | 44.71% | 45.24% | 14.52% | 15.23% | 15.47% |

| No. of Shareholders | 1,302,214 | 2,196,475 | 2,840,964 | 2,930,527 | 3,648,537 | 3,756,541 |

From 2017 to 2024, the ownership landscape of ITC has seen notable shifts. Foreign Institutional Investors (FIIs) started with a 20.08% stake in 2017, which gradually declined to 14.65% by 2020 seemingly owing to concerns about ITC’s cigarette business. However, by 2023, FIIs made a significant comeback, boosting their stake to 43.35%, though it slightly tapered to 40.47% by June 2024.

Domestic Institutional Investors (DIIs) steadily increased their stake, rising from 35.79% in 2017 to 44.02% in June 2024. Meanwhile, the public shareholding fluctuated, starting at 44.13% in 2017, dipping to 14.52% by 2023, but slightly recovering to 15.47% by mid-2024. Notably, the number of shareholders has grown rapidly, from 547,642 in 2017 to 3.75 million by June 2024, indicating strong retail interest in ITC over the years.

Growth Triggers:

- Travel Industry Growth: With growing per capita income, rapid urbanization, increasing societal aspirations and low room supply penetration levels, the sector is poised to witness a long runway of growth helping ITC’s hotels business.

- Growing demand for packaging paper & paperboard: Demand for better quality packaging of FMCG products, textiles, pharmaceuticals, among others, as well as booming e-commerce and rising healthcare spends are among the factors that are driving the growth of packaging paper & paperboard market in India.

- Expansion in FMCG Products: ITC has already made significant progress with brands like Aashirvaad, Sunfeast, Bingo, Yippee, Fiama, and Vivel. Continued innovation, new product lines, and premiumization of existing products offer a huge growth opportunity in India’s rapidly expanding consumer market.

- Health & Wellness Trends: ITC’s ability to tap into the growing demand for health-focused products with its offerings like Aashirvaad multi-grain atta, Sunfeast Farmlite biscuits, and B Natural juices puts it in a strong position to capitalize on the health-conscious consumer segment.

- Rural Market Penetration: ITC’s wide distribution network and agri-business give it an edge in penetrating rural markets, where consumption of branded FMCG products is growing rapidly.

- Digital Transformation & e-Commerce Growth: The company has already ventured into direct-to-consumer (D2C) channels and has been increasing its online presence.By selling products directly to consumers via its own platforms, ITC can enhance customer loyalty, gather valuable consumer insights, and drive higher margins by bypassing intermediaries.

ESG:

Environmental:

- ITC has been pursuing a low-carbon growth strategy through extensive decarbonization programs across its value chain. ITC is also implementing adaptation measures based on nature-based solutions, across its operations and sites.

- ITC has the distinction of being the first in India to have obtained the Forest Stewardship Council-Forest Management (FSC®-FM) certification, which confirms compliance with the highest international benchmarks of plantation management across the dimensions of environmental responsibility, social benefit and economic viability.

- The company has received FSC®-FM certification for over 1.49 lakh acres of plantations involving over 25,000 farmers. During the year, nearly 4.85 lakh tonnes of FSC®-certified wood were procured from these certified plantations.

- ITC’s Paperboards & Specialty Papers Business recycled nearly 89,000 tonnes of externally sourced post-consumer wastepaper.

- Under its Watershed Stewardship Program, it covered over 16 lakh Acres. And in terms of afforestation, it has greened over 11.6 lakh acres.

Social:

- The footprint of ITC CSR projects is spread across 26 States/Union Territories covering over 300 districts.

- ITC’s social investment initiatives follow a two-horizon approach for supporting and sustaining livelihoods of communities, keeping women and other vulnerable sections of society at the core. Horizon-I focuses on strengthening the dominant sources of livelihoods by promoting climate smart agriculture, providing access to natural resources like water, and helping households diversify into off-farm and other on-farm activities. Horizon-II aims at building capabilities for the future through programs for women empowerment, support to education, public health including maternal and child health, skilling, sanitation & waste management, etc.

- ITC has supported over 15 lakh children for their education

Governance:

- ITC Ltd has faced several legal and governance challenges, primarily linked to its involvement in the tobacco industry. A notable case against the company involved the Indian government’s efforts to enforce tobacco control laws, specifically the Cigarettes and Other Tobacco Products Act, 2003, which restricts the advertisement and sale of tobacco products. In the case of Union of India vs ITC Ltd, the company challenged the implementation of rules that prohibited smoking in public places and imposed strict regulations on tobacco sales. The court rejected ITC’s plea to stay the enforcement of these rules, and the case remains a significant example of the ongoing legal battles concerning tobacco regulation.

- Nestle v/s ITC:. The dispute arose over the trademark of the word “Magic”. ITC has a popular instant noodle brand called “Sunfeast Yippee Magic Masala”, while Nestle markets its “Maggi” instant noodles, which is an iconic brand in India.

- ITC accused Nestlé of trademark infringement, claiming that Nestle’s use of the word “Magic” for its instant noodles was too similar to ITC’s “Magic Masala” flavor of Yippee noodles

- ITC argued that this similarity could confuse consumers, given that both companies are competitors in the noodles market, and “Magic Masala” was a well-established flavor under ITC’s Yippee brand.

- ITC filed a lawsuit against Nestle, seeking a court injunction to stop Nestle from using the word “Magic” on its products, particularly noodles.

- The Madras High Court ruled in favor of ITC, granting the company an injunction that restrained Nestle from using the term “Magic Masala” on its noodle products.

- The court found that there was enough similarity between the terms used by the two companies, which could potentially mislead consumers.

- The ITC vs Nestle case serves as a reminder of the significance of protecting trademarks in competitive industries, where even seemingly generic terms like “Magic” can become the subject of legal battles due to their association with a particular brand or product.

With no promoter around, ITC also has a well-diversified board that includes a mix of executive, non-executive, and independent directors.

Conclusion:

The ITC conglomerate stands strong with its diversified business model and a rich portfolio spanning FMCG, hotels, agri-business, and paperboards. Diversification can be a double-edged sword; while it provides growth opportunities, it can also lead to businesses losing focus, which might impact the company’s overall performance and financials.

It is thus important to view all the ITC’s varied moving parts as investors often get confused by so much that’s happening with this business.

We hope this super long analysis of ITC helps you understand this business better!

Savart is a SEBI-registered investment advisor. The purpose of this content is to educate, not advise or recommend any particular security. Please remember that investments are subject to market risks. Please conduct thorough due diligence or seek professional guidance before making any investment. Do not believe in any speculations.