Tata Power, a subsidiary of the Tata Group, is one of India’s largest integrated power companies with a legacy spanning over a century. The company started as the Tata Hydroelectric power supply company in 1910 which amalgamated with the Andhra Valley power supply company in 1916.

Tata Power Company Ltd is primarily involved in the generation, transmission and distribution of electricity. It aims to produce electricity completely through renewable sources. It also manufactures solar roofs and plans to build 1 lakh EV charging stations by 2025.

Business Overview:

Tata Power is omnipresent in the industry with operations across the power value chain. The business clusters are of 4 different types:

- Renewables: This cluster encompasses utility-scale solar, hybrid, and complex assets, manufacturing of solar modules and cells, and solar EPC business.

- New-Age Energy solutions: This cluster offers rooftop solar for clean home energy, electric vehicles for a cleaner commute, microgrids for reliable power, and home automation for optimized energy use and comfort.

- Transmission and Distribution: This cluster spans 6,277 circuit kilometres (Ckm) of transmission lines (including under construction), serving 12.5 million customers in Mumbai, Delhi, Odisha, and Ajmer.

- Generation: Comprises of generation of power from hydroelectric sources and thermal sources (Coal, gas and oil) from plants owned and operated under lease agreement and related services. This cluster includes conventional assets, like hydro and thermal plants, spread across North, West, and East India, which has a combined capacity of over 10,000 MW.

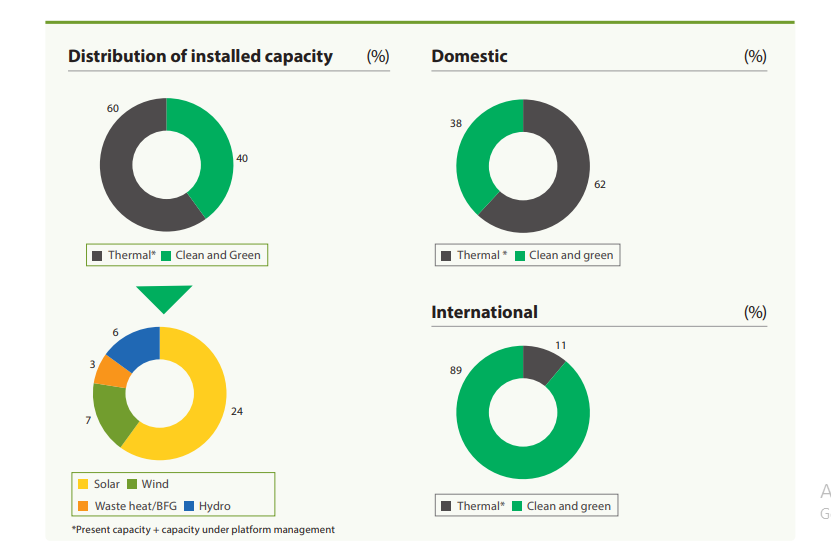

Distribution of Installed Capacity:

The company’s installed capacity is 60% thermal energy and 40% clean & green energy which is further divided as:

- Solar – 24%

- Wind – 7%

- Waste heat/ BFG – 3%

- Hydro – 6%.

As of March 2024, the company had a total capacity of 14,407 MW across:

- Thermal – 8,860 MW

- Wind – 1,034 MW

- Hydro – 880 MW

- Waste heat recovery – 443 MW

- Solar – 3,490 MW.

Industry Overview:

In India, there are variety of sources through which the power is generated:

- Thermal energy contributes to 54.5% needs

- Renewable energy contributes to 33.2% needs

- Hydro energy – 10.5%

- Nuclear energy – 1.8%

The energy requirement, closely associated with GDP, rose by 7.4% to reach 1,626 billion units (BU) in FY24.

Peak demand also soared by 13% to a new high of 243 GW observed in September 2023, an unusual occurrence, because peaks are typically seen in summer months. The irregular monsoon rainfall led to a 17% y-o-y dip in hydroelectric power generation increasing reliance on thermal generation.

Renewable energy saw a continued push, with the government directing the tendering of 50 GW of renewable capacities annually until FY28. In 2023, a record 22.9 GW of capacities were auctioned, more than doubling the previous year’s figure.

India’s installed generation capacity stood at 442 GW (Source: CEA) as of March 31, 2024, with a capacity addition of 26 GW in FY24.

The share of thermal capacities in the total installed generation capacity declined from 64% in FY19 to 55% in FY24, while the share of renewable capacities grew from 22% to 33%.

Strengths:

- Work orders: Tata Power has a well-diversified utility-scale solar EPC order book and is the market leader in rooftop solar EPC with a 13.1% market share. The solar EPC orderbook (large-scale utility, group captive and rooftop) stood at ₹ 16,252 crore.

- Company secured an order worth approximately ₹ 1,744 crore to implement a smart metering project for Chhattisgarh State Power Distribution Company Limited.

- Solar Projects: Tata Power Solar has installed over 17 utility scale solar energy projects across 13 states in India totaling 1.5 GW. These plants have recorded higher power output than the predicted rate, exceeding expectations in power generation and effortless maintenance.

- Tata Power Renewable Energy Limited (TPREL), a prominent player in India’s renewable energy sector and a subsidiary of Tata Power, announces the successful commissioning of the Omkareshwar Floating Solar Project. With an impressive capacity of 126 MW, this project stands as one of India’s largest floating solar installations, marking a significant milestone in the country’s renewable energy journey. The EPC contract worth ₹596 crore was awarded by NHDC Limited to TPREL.

- EV Charging stations: Tata Power is one of the leading players in the electric vehicle (EV) charging infrastructure space in India.

- Tata Power is the market leader in India with more than 5,400 public chargers and nearly 850 bus chargers, in addition to 86,000 home chargers.

- Tata Power has expanded its network under the brand name of EZ Charge to over 1,00,000 home chargers, 5,500+ public, semi-public, and fleet charging points, along with 1100+ bus charging stations across 530 cities and towns. Tata Power and Tata Motors signed an MoU to set up 200 fast-charging stations for electric CVs in major metro cities of India.

Tata Power has strategically installed EV chargers in key areas across India. These locations include:

- Highways: To support long-distance travel, especially between cities.

- Public Spaces: Malls, airports, parking lots, and major shopping centers.

- Residential Complexes: To make EV charging more accessible for urban dwellers.

- Corporate Offices: Offering charging solutions for employees driving electric vehicles.

- Diversified business profile: Tata Power had around 12.92 GW of capacity as on June 30, 2024 (excluding 1,980 MW of Prayagraj), including its thermal and clean energy generation businesses, which include around 4.7 GW (operational capacity) of RE capacity through TPREL. Its presence across the power value chain (generation, transmission and distribution, power trading, as well as fuel supply (imported coal mining and shipping) cushions it from project-specific issues and helps achieve operating efficiency and better working capital management at the group level. Furthermore, ongoing commissioning and ramp up of solar cell plus module manufacturing capacity under TP Solar (Tata Power’s step-down subsidiary) will further mitigate risks related to project execution as the company focuses on growing in the RE space. While the module manufacturing capacity was commissioned in fiscal 2024, cell manufacturing capacity was commissioned in September 2024.

- Strong financial flexibility: The company has strong financial flexibility, driven by stable and healthy cash accruals from the existing businesses and adequate liquidity. Though there are sizeable repayments due over the near to medium term, past trends of timely refinancing supported by being a part of the Tata group increases access to the capital market and the banking system and provides comfort.

Risks:

- Mundra Project Issue: The Mundra Power Plant, run by Tata Power, faced major financial troubles due to unexpected changes in coal pricing. Built to provide affordable electricity using low-cost coal imported from Indonesia, the project hit a roadblock in 2010 when Indonesia changed its laws, linking coal prices to global rates. This made coal much more expensive, but Tata Power couldn’t raise electricity prices because of its agreement with the government. As a result, the plant started losing over ₹1,700 crore every year. After a long legal battle, the Supreme Court ruled that Tata Power had to stick to the original tariffs. To reduce losses, Tata Power transferred most of the plant’s ownership to the Gujarat government while keeping operational control.

- The Mundra UMPP continues to face losses due to the mismatch between the bid tariff and rising fuel costs caused by changes in Indonesia’s mining regulations. The project is operating under a Section 11 directive from the Ministry of Power, with a fuel cost pass-through arrangement. However, there is still some under-recovery due to adjustments in coal mining profits. Despite this, the combined profitability from the coal mines and Mundra plant remains positive. Tata Power is in talks with off-takers to establish a long-term compensatory tariff for passing through variable costs, subject to agreed terms.

- Competition Intensity: The power sector in India is highly competitive, driven by a mix of public and private players. Large companies like NTPC, Adani Power, and Tata Power dominate the market, while state-owned firms compete in generation, transmission, and distribution. The rise in renewable energy (solar, wind) has intensified competition, with new entrants focusing on green energy projects. Additionally, competitive bidding in power procurement and the push for privatization of distribution further fuels competition. Regulatory changes and cost-efficiency drives keep the market dynamic and challenging.

- Project Delays: In the con-call report of Q2 FY 25, the company mentioned that many of their projects got delayed, because their DCR line and cell line got delayed. They had to be executed in Q2 and Q3 but have been delayed due to these reasons. They also mentioned that the faster pace of execution would happen in coming quarters, which may result in strong capacity expansion in Q4.

Financials:

| Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | |

| Sales | 26,840 | 29,881 | 29,136 | 32,703 | 42,816 | 55,109 | 61,449 |

| Operating Profit | 2,295 | 3,070 | 6,805 | 6,921 | 7,031 | 7,728 | 10,735 |

| OPM % | 9% | 10% | 23% | 21% | 16% | 14% | 17% |

| Interest | 3,761 | 4,170 | 4,494 | 4,010 | 3,859 | 4,372 | 4,633 |

| Net Profit | 2,611 | 2,606 | 1,316 | 1,439 | 2,156 | 3,810 | 4,280 |

| EPS in Rs | 8.9 | 8.71 | 3.76 | 3.53 | 5.45 | 10.44 | 11.57 |

Sales have steadily risen from ₹29,494 crore in 2016 to ₹61,449 crore in 2024, showcasing a consistent expansion, particularly in recent years, driven by operational and market growth. However, OPM% fluctuated, peaking at 23% in 2020 before stabilizing at 17% in 2024, indicating periods of operational challenges and recovery.

Interest costs have remained high, rising from ₹3,236 crore in 2016 to ₹4,633 crore in 2024, suggesting a notable debt burden that could impact net profitability.

Net profit has grown significantly from ₹786 crore in 2016 to ₹4,280 crore in 2024, reflecting strong bottom-line performance despite fluctuating margins. EPS has followed a similar trajectory, climbing from ₹2.45 in 2016 to ₹11.57 in 2024, signaling value creation for shareholders.

Borrowings: Borrowings have remained substantial, increasing from ₹37,882 crore in 2013 to ₹58,314 crore in September 2024. While the company has leveraged debt to fund growth and expansion, the steadily rising trend increased potential interest burdens. As the power sector is a highly-capex led industry, borrowing also plays a key role.

Shareholding Pattern:

| Mar-17 | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | Sep-24 | |

| Promoters | 33.02% | 33.02% | 33.00% | 37.22% | 46.86% | 46.86% | 46.86% | 46.86% | 46.86% |

| FIIs | 27.26% | 28.14% | 26.57% | 18.62% | 12.17% | 10.82% | 9.45% | 9.44% | 9.15% |

| DIIs | 23.41% | 23.60% | 24.66% | 26.89% | 20.06% | 15.89% | 14.16% | 15.47% | 16.63% |

| Government | 0.13% | 0.01% | 0.26% | 0.95% | 0.80% | 0.32% | 0.32% | 0.33% | 0.33% |

| Public | 16.18% | 15.23% | 15.52% | 16.33% | 20.11% | 26.12% | 29.21% | 27.91% | 27.02% |

| No. of Shareholders | 288,907 | 319,502 | 326,465 | 358,541 | 986,433 | 3,430,598 | 3,890,518 | 4,435,226 | 4,545,438 |

The shareholding pattern of the company reveals an intriguing evolution over the years. Promoters have steadily increased their stake from 33% in 2017 to a solid 46.86% by 2021, showcasing unwavering confidence in the business. In contrast, FIIs have significantly reduced their holdings, dropping from 27.26% in 2017 to just 9.15% by September 2024, indicating a shift in foreign investor sentiment.

Meanwhile, DIIs exhibited a fluctuating trend, peaking at 26.89% in 2020, before dipping to 14.16% in 2023, and recovering to 16.63% in 2024, reflecting cautious optimism. Public participation has surged dramatically, rising from 16.18% in 2017 to 27.02% by 2024, fueled by growing retail interest, as evidenced by a meteoric rise in the number of shareholders from 288,907 in 2017 to over 4.54 million in 2024.

With healthy promoter holding, increased public trust, and dynamic institutional movements, the company’s ownership structure reflects a strength, aligned with market trends and investor confidence.

Growth Triggers:

- Growing Demand: Indian Railways aims to become a net-zero carbon emitter by 2030 and achieve 100% electrification by 2025. This transition will increase power demand by about 23 BUs annually from 2025 to 2029. While railway electrification will drive most of this demand, energy efficiency improvements will help reduce the overall increase in consumption per kilometer.

In addition, metro rail in India has been growing rapidly, and this growth is expected to accelerate. As of May 2024, 712 km of metro rail is under construction, with 1,878 km more planned. This expansion will add 5-6 BUs of incremental power demand annually between 2025 and 2029. Although metro projects currently contribute a small share of total power demand, their contribution will grow significantly due to the large number of upcoming projects.

- Policy Support:

PM Surya Ghar Muft Bijli Yojna: For sustainable development and people’s well-being, the Central Government in February 2024 launched the PM Surya Ghar Muft Bijli Yojna. This scheme has a proposed outlay of Rs. 750 billion and aims to light up 10 million households by providing up to 300 units of free electricity every month.

CPSU Scheme: The Central government introduced the CPSU scheme Phase-I in 2015 to promote the set-up of 1,000 MW grid-connected solar PV power projects by CPSUs and government organizations with Viability Gap Funding (VGF). Further, the Central Government in March 2019, approved implementation of CPSU Scheme Phase-II for setting up grid-connected Solar PV Power Projects by Central and State PSUs, Government Organizations, with VGF support of Rs 85.8 billion, for self-use or use by Government/ Government entities, either directly or through Discoms.

Solar parks and ultra mega solar power projects: One of the most important initiatives by the GoI has been setting up of solar parks in the country. To overcome the land and transmission related challenges, the scheme for “Development of Solar Parks and Ultra-Mega Solar Power Projects” was rolled out in December 2014 with an objective to facilitate the solar project developers to set up projects expeditiously.

ESG:

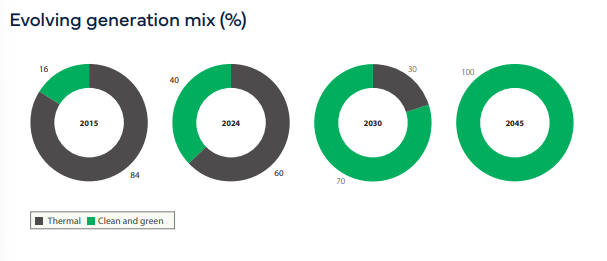

Environmental: Tata power company is pledging to become a 100% clean and green energy provider before 2045. The company set a target to achieve net zero before 2045.

In 2015, the percentage of thermal energy stood at 84%, but now it stands at 60% in 2024. By 2030 this thermal energy percentage comes down to 30% and by 2045 it will be zero. As per the plans of Tata Power.

Project Aalingana: Tata Group has set a unique approach to achieve planet resilience by embedding sustainability into business strategy and collaboratively developed with group companies. Aalingana is focused on three interconnected pillars: driving the decarbonization of our businesses and value chain; applying a systemic, circular economy approach to reduce resource-use and waste; and preserving and restoring the natural environment.

Social:

- Tata Power was recognized at the Corporate Citizen Conclave Awars for its outstanding efforts in CSR, Sustainability and Governance.

- TPCODL was awarded the India CSR Leadership Award for 2023 by India ESG Summit and India CSR. The company has spent INR 58 crore on CSR activities. Tata power has a total employees of 23,652.

- The 7 skills for Highly Sustainable People program, hosted over Gyankosh and LinkedIn Learning equips Tata Power employees with essential sustainability skills across three proficiency levels—beginner, intermediate, and advanced.

- Through the collaboration with TISS, they provide training in new technical skills such as EV charging and solar technicians.

Governance:

Adaro, a Singapore-based Indonesian mining company, has accused Tata Power of breaching the contract and is seeking $106 million (approximately ₹879.8 crore) in arbitration. In response, Tata Power counterclaimed $229.94 million (around ₹1,908 crore) for the non-supply of coal.

During the performance of the agreement, differences arose between both the parties. Adaro issued a notice alleging a breach by TPCL, which was followed by the request for arbitration with an alleged claim of $106 million. To this, TPCL responded and raised counterclaims of $229.947 million for non-supply under the agreement,” Tata power said in a regulatory filing.

And coming to the governance structure of Tata Power, there are 2 women directors on board and 6 independent directors on board.

Conclusion:

The Tata Power is one of the market leaders and is one of India’s largest vertically integrated power company.

The company is growing profits every financial year, whereas on the other hand borrowings are rising gradually. As the company is operating in a high-capex industry, borrowings are essential but a rise in borrowings will lead to high interest payments which in future may impact on the profits of the company.

The rising demand for renewable and EV sectors will obviously provide an extra edge for the edge. But the future performance of the company depends upon how well it executes its work orders and handles its finances. So, while the future of the company looks positive, please conduct thorough due diligence before making your investment decision.

Savart is a SEBI-registered investment advisor, founded by Sankarsh Chanda. The purpose of this content is to educate, not to advise or recommend any particular security. Please remember that investments are subject to market risks. Please conduct thorough due diligence or seek professional guidance before making any investment. Do not believe in any speculations.