Sweltering summers have transformed air conditioners from a luxury to a necessity today. Not just summers, but luxury housing, commercial high rises with their all-glass design all demand air conditioning and in most cases, not just a split but a centralized air conditioning as well. When there’s this sizable number of people who can’t do without them, it indicates a substantial market for air conditioners. We’ll now delve into analyzing one of the most prominent players in the Air Conditioners industry, Blue Star.

Blue Star Ltd. (BSL) is India’s leading air conditioning and commercial refrigeration company. It has a dominant market share and is amongst the top 3 in most of the categories where it has a presence. Today, 1 out of 3 every commercial building in India has a Bluestar product.

The company exports its products to 19+ countries across the Middle East, Africa, SAARC, and the ASEAN region. The Company has 5 manufacturing facilities including 2 in Himachal, 1 each in Dadra, Wada, and Ahmedabad, 32 offices & 3,600 channel partners.

While Blue Star may be a giant today, every successful enterprise is a testament of the commitment & vision of the people behind it. The story of Blue Star starts with the story of the founder, Mr. Mohan T. Advani.

Mohan Advani was born in Hyderabad (Sindh) on November 11,1912 to Gulibai and Tolasing Advani. He graduated from the D.J. Sind College in 1934. While his father wanted him to join the Indian Civil Services (ICS), he graduated with a BA in History and Economics. He fell in love with a girl, who was a one-year junior to him in college named Padmini. He married her in the later years.

Mohan sailed to London on October 20,1934 to begin his career. He spent nearly 9 months at the Frigidaire factory in London, training in commercial refrigeration and air-conditioning, which was then a sunrise industry in India. He was one of the first Indians to obtain training in this field.

He returned to India in 1935 and joined as a Sales Manager in Bombay Garage. He worked in the company for years, especially during the tough periods of the Great Depression and wars. When government restrictions on imports had led the Bombay Garage’s business to slow down, he left his job and started the “Blue star Engineering company” on September 27, 1943.

Since the government had banned imports, he decided that Bluestar would Initially buy, recondition, and sell used equipment. It is interesting to note that Bluestar had also entered the cigarettes industry and stopped within six months as Mohan Advani realized that it was hard to compete with large players in the cigarettes business.

In 1946 he made his first exploratory trip to the USA and ordered modern refrigeration equipment including ice cream makers, soda fountains, bottle coolers.

He knew nobody in the US. He emptied his corporate bank account and set off on an odyssey to the west. He flew off in a converted Lancaster bomber, it took three uncertain days for him to reach London and crossing the Atlantic. For three weeks he stayed in a winter of record-breaking severity rationing of daily necessities. But finally, he made it to united states.

After he’d pay for his airline ticket, he had nothing left in his bank account. But he went there and took a suite at the exclusive Waldorf Astoria Hotel and started phoning various companies for distributorships.

Mohan ordered all the modern refrigeration equipment – ice cream makers, soda fountains, display cases, bottle coolers, deep freezers. Then he phoned their team who sold them before the shipments arrived. And the interesting part here is, they opened a letter of credit and sold the first shipment at 100% mark-up even before the shipment arrived.

It was also then Bluestar began to manufacture the Ice candy machines and bottle coolers. Bluestar was the pioneer in the manufacturing of electrically operated water coolers.

Mohan made another trip to USA and obtained the sole agency of Melchior Armstrong Dessau, a well-known manufacturer of Refrigeration and air conditioning equipment.

In 1950, Blue star completed its first central air-conditioning installation at the Shangrila Biscuit Factory at Bhandup, Bombay.

In 1960, its income crossed INR 1 Crore and four years later, staff strength crossed 1000. Bluestar also became the first air conditioning and refrigeration company to be listed on the Bombay Stock Exchange in 1969, with its maiden issue being subscribed ten times. By 1972, its income crossed INR 10 Crores and the staff strength had crossed 2000.

In 1971-72, Bluestar received its largest order ever yet, an 1800-ton central air-conditioning plant for the Air India Headquarters building at Bombay. Interesting part is that this order was approved by JRD Tata, whose business empire already included Voltas, another leading AC brand.

In 1973 Bluestar celebrated its 30th Anniversary, a growth from 2 employees to 2000, revenue of INR 1 lakh to INR 15 crores in thirty years. Over the years, Blue Star grew steadily, expanding its product line and market presence. The company gained a reputation for quality and reliability in the air conditioning and refrigeration industry. Blue Star diversified its offerings to include a wide range of cooling solutions for various sectors such as residential, commercial, and industrial applications.

Mohan Advani, though being a BA graduate, engineered and innovated the products himself. He proved that innovation doesn’t need any engineering degrees as his passion and dedication led Blue Star to market leadership.

Today, Blue Star is one of India’s leading air conditioning and refrigeration companies, with a strong presence not only in India but also in international markets. The company continues to innovate and develop cutting-edge cooling technologies while maintaining its commitment to quality and customer satisfaction. A few important patents that the company won include:

“Refrigerant Recovery in Multi-Air Conditioner System” – The invention, as the name goes, helps in detecting shortage of refrigerant and ensuring its recovery when the load on the system is very low in a Multi-Air Conditioner VRF system where multiple IDUs are connected to multiple Outdoor Units (ODUs), in a single refrigeration system.

“System and Method for Maintaining Optimum Condensing Temperature at Low Load in Heating Mode in VRF systems” – This invention is related to a VRF system operating in heating mode. The invention helps resolve the issue of a fall in the condensing temperature encountered by the system while in heating mode, which could result in cold air draft from Indoor Units (IDUs).

Industry Analysis

The Air Conditioning (AC) market penetration in India currently stands at approximately 14-16%, significantly lower than the global average of 42%. This indicates a substantial growth potential for the AC industry in the country. From FY15-20, the industry witnessed healthy growth rates of around 14% and 16% in value and volume terms, respectively. In FY23, it is anticipated that the AC industry will experience growth exceeding 20% due to a lower base and pent-up demand from the preceding two years. Moreover, the growth trajectory is expected to continue in FY24, driven by long-term growth catalysts. Additionally, commercial refrigeration adoption in India remains below 5%. However, factors such as rapid urbanization, expansion in pharmaceuticals and food & beverage sectors, reopening of shops, malls, and offices post-pandemic, as well as increased construction activities, are anticipated to fuel strong industry growth. The unfortunate increase of global temperatures due to global warming could also increase the demand for AC products.

What does Blue Star do?

Blue Star’s business is divided into three segments:

Electro-Mechanical Projects and Commercial Air Conditioning Systems

- Electro-Mechanical Projects: They design, engineer, and execute large central air conditioning & ventilation projects, Electrical projects, Plumbing projects, Fire-fighting projects in buildings, factories, and Infrastructure segments.

- Commercial Air Conditioning Systems: Complete range of energy-efficient air conditioners and Ducted Split air conditioners.

- VRF (variable refrigerant flow) is a technology that circulates only the minimum amount of refrigerant needed during a single heating or cooling period.

- Highly Energy Efficient water cooled VRF.

- Highly Efficient oil free chillers.

- Energy-efficient Inverter Scroll chillers: Inverter scroll chillers are crucial for buildings with significant load fluctuations throughout the day. They enable the machinery to operate efficiently and reliably, ensuring power consumption savings.

Unitary Products:

- Room Air Conditioners

- Deep Freezers, Bottle coolers, VLSI Coolers, cold rooms, Supermarket Refrigeration & Medical Refrigeration.

- Water Purifiers

Professional Electronics & Industrial Systems:

It is managed by the Company’s wholly owned subsidiary, Bluestar Engineering & Electronics Ltd. and handles Healthcare systems, Data security Solutions, Infra Security system, Testing Machines, NDT systems & Industrial Automation

Business Strengths

- Focused R&D and Innovation: Blue Star’s R&D has best-in-class infrastructure including performance test labs, reliability testing facilities, electronics lab, design studio, and high-end workstations for CAD and analysis, amongst others. Today, with many patents to its credit including the four won during FY20, the Company prides itself on having one of the best R&D centers in the Indian HVAC industry. The company has six registered designs and has applied for 30 patents. Blue star inaugurated a world-class Innovation Center in Thane in FY23, and the generous grant of Rs. 100 crores spread over five years. This was made after inauguration.

- Gold standard service: Blue Star continues to invest in improving customer service operations under the gold standard service mission. They are also expanding the after-sales services network in Tier 2,3,4 and 5 cities and towns.

- Company with widespread network: The company has a modest presence in the Middle East, Africa, and south Asia Regions. They are also planning to enter North America and Europe.

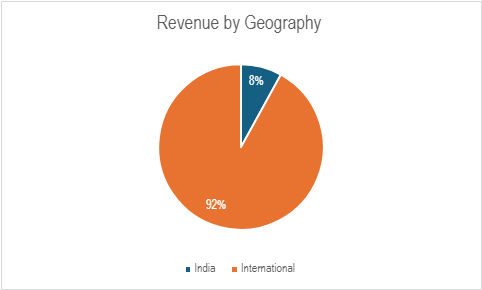

Geography wise revenue breakdown:

- Huge manufacturing footprint:

| Place | Established Year | Area | Products |

| Himachal Pradesh | 2005 | 16,000 sq.m. | Room Air Conditioners |

| Himachal Pradesh | 2011 | 9,800 sq.m. | Air Conditioners |

| Ahmedabad | 2012 | 9,360 sq.m. | Deep Freezers |

| Dadra | 1997 | 12,000 sq.m. | Ducted Air Conditioners & VRF |

| WADA 1 | 2007 | 29,900 sq.m. | Chillers, cold rooms, storage water coolers |

| WADA 2 | 2022 | 19,300 sq.m. | Deep Freezers, Storage |

| Sri city | 2023 | 3,1874 sq.m. | Room Air Conditioners |

Source: Blue star Annual Report

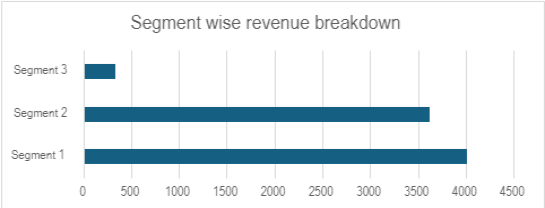

- High product strength & depth: A look at the revenue breakdown by segment reveals a diversified cooling behemoth. Product segment wise revenue breakdown:

- If we look at the revenue breakdown for FY23, the overall revenue is Rs. 7977 crores, out of which

- Segment-1: Rs. 4015.63 Crores

- Segment-2: Rs. 3626.93 crores

- Segment –3: Rs. 334.76 crores.

Segment 1: Electro-Mechanical Projects and Commercial Air Conditioning Systems

Segment 2: Unitary Products

Segment 3: Professional Electronics & Industrial Systems

Blue Star’s product base is vast and diversified into various categories: Inverter Split AC, Window AC, Air cooler, Portable AC, Air Purifier, VRF V Plus system, Air cooled screw chiller, water cooled VRF System, centrifugal chiller, storage water cooler, VLSI cooler & Super Cooler.

We understand that you may be unfamiliar with most of these terms, however, as Warren Buffett suggested: Never invest in a business that you don’t understand. So, even at the cost of making this explanation long, we want to explain what an air conditioner actually is & how it is built.

What is an Air Conditioner? How is it built?

There are four major components of an air conditioning system:

- Evaporator coil

- Compressor

- Condenser

- Expansion valve.

Evaporator Coil

- The evaporator coil is the component in your AC system that absorbs the heat from the air inside your home.

- The evaporator coil is essential for heat exchange in the AC system & is made of copper.

- These coils are usually made from copper but can also be made of steel or aluminum. Copper is the preferred choice because it has better thermal conductivity, is easier to work with, and is effortless to maintain.

“Copper is essential so as we are not having enough copper production in the country and are dependent on China and other countries for the evaporator coils. India spent INR 27,131 crore on copper imports in 2022-23, up from INR 21,985 crore a year earlier. What exactly changed this? Hold on! We are making a detailed explanation on India’s Copper story – stay tuned to learn more in this regard.”

- The evaporator coil is found in the indoor unit generally, while in a central AC system, it is in the air handler. Refrigerant, which is flowing through the system, is cooled to a low temperature just before entering the evaporator coils.

Compressor:

- The compressor is the power unit of the air-conditioning system that puts the refrigerant under high pressure before it pumps it into the condenser, where it changes from a gas to a liquid.

- Statistics show that nearly 85% of the compressors are being imported at the moment.

The reason why we are not able to manufacture the Compressors in a large scale is because of the following reasons:

- Substantial investment is required due to the intricate and IP-dependent nature of the process.

- The know-how involved is complex and layered.

- Also, enterprises are not engaged, even in producing components or subsystems essential for compressors.

Condenser and Expansion valve: The opposite of the evaporator, the condenser coil pulls away heat from the refrigerant and ejects it to the outside environment. It is in the outdoor unit of your air conditioner. In between the condenser and evaporator, there is another little gadget called an expansion valve. The expansion valve removes pressure from the liquid refrigerant to allow expansion or change of state from a liquid to a vapor in the evaporator.

Risks

The Cost Factor:

The estimated component wise cost of manufacturing an AC is as follows:

| Component | % of total cost |

| Valves | 2 |

| Fan Motor | 10 |

| Compressor | 30 |

| Sheet Metal | 5 |

| Fan Blade | 3 |

| Blower | 3 |

| Aluminum + Copper Tubes | 20 |

| Printed circuit board/controllers | 20 |

| Others | 7 |

| Total | 100 |

Compiled from multiple sources.

This data suggests that an increase in the cost of components could also send the AC prices skyrocketing or lower the net margin of the business.

If India can produce the copper and other components it would allow the AC Companies in India to manufacture them at a cost lower than what they are doing now. Most Indian AC manufactures tag their products as completely made in India, but this is far from reality.

A look under the hood of the air conditioners reveals that over 50 percent of components including compressors, controllers, motors, and copper tubes come from China.

Blue Star’s new RAC (Room Air Conditioner) plant in Sri City would provide cost optimization and reduce its inventory days. This will be a fully integrated plant and have higher in-house manufactured content, thus reducing reliance on imports.

Dynamic Macro Environment Risk:

- The Electro-Mechanical and Commercial Air Conditioning system segment is cyclical in nature and is exposed to the volatile macro-economic environment.

- A prolonged economic slowdown may impact the flow of orders and consequently the growth of revenue for this segment. The international operations are also exposed to geo-political risks such as changes in tax-regime and geo-political developments.

Seasonality Risks:

- All the businesses in the company’s unitary products segments are seasonal in Nature. Unforeseen weather patterns such as extended winter, pleasant summer, less than normal monsoon during the peak selling seasons may impact the company’s process and planning.

Profitability Risks:

- The company’s profitability could be negatively affected by volatility in commodity prices, an increase in input costs or ocean freight or even credit defaults by customers.

Regulatory and Compliance Risks:

- The company’s businesses are exposed to evolving technologies and adherence to many regulatory compliances.

- Emphasis on usage of eco-friendly refrigerants and collection and e-friendly disposal of e-wastes are some of the specific requirements the company must adhere to.

Growth Triggers:

Soaring temperatures to boost demand for RACs: Demand for air conditioners is surging in markets where both incomes and temperatures are rising, populous places like India, China, Indonesia, and the Philippines. According to one estimate, the world will add 1 billion ACs before the end of the decade. The market is projected to nearly double before 2040.

- Furthermore, structural growth catalysts such as favorable demographics, increasing per capita incomes, urbanization trends, diverse financing options, consistent power supply, and the adoption of energy-efficient models are projected to sustain the growth of Refrigeration and Air Conditioning (RAC) industry.

- Moreover, commercial refrigeration penetration in India remains below 5%, yet with rapid urbanization, expansion in pharmaceutical and food & beverage sectors, and the resurgence of retail outlets, malls, and offices post-pandemic, significant growth is anticipated.

- As a prominent player with extensive market presence and a diverse product portfolio spanning both RAC and commercial refrigeration segments, Blue Star is poised to reap substantial benefits from this growth trajectory.

- PLI Scheme: Unlike the PLI scheme for mobile phones, where the finished goods as well as components are covered, the scheme for ACs only focus on the production of the components.

The Production Linked Incentive (PLI) scheme plays a crucial role in bolstering the Air Conditioning (AC) industry in several ways:

- Encouragement for Domestic Manufacturing: The PLI scheme offers financial incentives to manufacturers based on their incremental sales of locally produced goods. This incentive encourages AC manufacturers to expand their domestic production capacities, reducing dependency on imports and promoting indigenous manufacturing.

- Cost Reduction: By incentivizing production, the scheme helps manufacturers achieve economies of scale, leading to cost reductions in manufacturing processes. This, in turn, can make ACs more affordable for consumers, thus stimulating demand.

- Technology Upgradation: To qualify for PLI benefits, manufacturers need to invest in technology upgrades and research and development activities. This promotes innovation and the adoption of advanced technologies in the AC industry, enhancing product quality and efficiency.

- Competitiveness: The scheme enhances the competitiveness of domestic AC manufacturers by providing them with financial support, leveling the playing field with international competitors. This can help strengthen the position of Indian AC manufacturers in both domestic and global markets.

Financials of the company:

| Mar-13 | Mar-14 | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | |

| Sales | 2,924 | 2,934 | 3,182 | 3,798 | 4,385 | 4,639 | 5,235 | 5,360 | 4,264 | 6,064 | 7,977 | 9,685 |

| Net Profit | 39 | 78 | 54 | 106 | 123 | 144 | 190 | 144 | 101 | 168 | 401 | 414 |

| EPS in Rs | 2.17 | 4.31 | 3.01 | 5.82 | 6.44 | 7.5 | 9.87 | 7.44 | 5.21 | 8.71 | 20.79 | 20.18 |

| Dividend Payout % | 73% | 46% | 83% | 56% | 58% | 67% | 51% | 67% | 38% | 57% | 29% | 35% |

Consolidated P&L. All numbers in Crores.

Blue Star is demonstrating strong financial health and growth. The company’s Sales, net Profit & EPS have consistently grown each year, indicating robust performance and market demand for its products & services.

Shareholding pattern of the company:

| Jun-21 | Sep-21 | Dec-21 | Mar-22 | Jun-22 | Sep-22 | Dec-22 | Mar-23 | Jun-23 | Sep-23 | Dec-23 | Mar-24 | |

| Promoters | 38.76% | 38.76% | 38.76% | 38.78% | 38.78% | 38.79% | 38.79% | 38.79% | 38.91% | 36.49% | 36.50% | 36.50% |

| FIIs | 10.81% | 10.72% | 11.09% | 11.83% | 12.25% | 11.79% | 10.96% | 10.45% | 11.06% | 14.89% | 15.38% | 15.93% |

| DIIs | 21.94% | 22.69% | 22.83% | 22.44% | 22.06% | 23.07% | 24.64% | 25.13% | 24.51% | 25.24% | 24.82% | 24.69% |

| Public | 28.49% | 27.83% | 27.32% | 26.96% | 26.92% | 26.36% | 25.63% | 25.65% | 25.54% | 23.39% | 23.29% | 22.89% |

While there has been a slight reduction in the promoter holding, there has been a steady rise in institutional interest in the business.

ESG (Environmental, Social and Governance):

Cooling is a big contributor to global warming. Much of the existing cooling equipment uses hydrofluorocarbon refrigerants, which are potent greenhouse gases, and use a lot of energy, making them a double burden for climate change. Since 2018, all Blue Star split ACs have phased out the use of R22 refrigerant, which has a high global warming potential, and replaced it with more eco-friendly alternatives like R32 and R410.

Environmental:

- Environmentally conscious operating practices: It includes initiatives such as the use of eco-friendly refrigerants and tree-planting drives around its facilities.

- Blue star’s factories are built to be “green” in their design, processes, and operations.

- The WADA factory is Gold rated and the wholly owned subsidiary Bluestar ClimaTech Ltd has applied for the IGBC Gold rating for its Sri city Plant.

- In terms of its e-wastes compliance processes, Bluestar is ranked Number 1 in the Room ACs Industry.

- Hazardous Waste Management: The company ensures that its products do not contain lead, mercury, cadmium or any such hazardous substances beyond the levels permitted by the country’s environmental laws.

- Water Management: The company uses the latest technology to aid in quality improvement, energy, and water savings. Treated water is used for flushing and local irrigation. It also has a rainwater harvesting project at its Dadra plant that serves the daily needs of the plant (80KL).

- Green Building Movement: Green building is the practice of creating structures and using processes that are environmentally responsible and resource-efficient throughout a building’s life cycle from siting to design, construction, operation, maintenance, renovation, and deconstruction.

- Bluestar is a founding member of the Indian Green Building council (IGBC) and plays an active role in the ‘green building movement’.

Social:

- The company adheres to the Diversity, Equity and Inclusion (DEI) policy and drives gender diversity across all levels in the organization. The gender ratio amongst the Management staff stands at 9% in FY23.

- In the area of skill development, Bluestar employs around 956 apprentices every year under the NETAP Program of the Central Government.

- The company helps differently abled children by providing them with therapeutic rehabilitation support.

- In FY23, Bluestar foundation supported 52 bachelor’s students from various engineering and diploma colleges and 41 diploma students as well.

- Bluestar supports farmer producer organizations in Tamil Nadu in producing and marketing processed foods.

Governance:

- Bluestar has a well-enumerated policy named Whistle Blower policy. It is available not only to employees but also across its network of business associates, providing them with a robust platform to report any unethical business practices without any hesitation to fear.

- As of March 31, 2023, the Board comprised ten Directors. Out of the ten, eight (i.e. 80 Percent) were Non-Executive Directors and five (i.e. 50 Percent) were Independent Directors. The Board comprised two women Directors, out of whom one is an Independent Director.

- The Chairman of the Board is an Independent Director.

- The company implemented an Integrated Vigil Mechanism framework and has been ahead of the curve in its processes related to Enterprise Risk Management, Related party Transactions, and Internal Financial Controls.

Conclusions:

Blue Star Limited, with its robust legacy and innovative strides, stands well-positioned to capitalize on the growing demand for air conditioning and refrigeration solutions in India and beyond. The company’s extensive market presence, diversified product portfolio, and commitment to research and development lay a strong foundation for sustained growth.

You can read over other stock analysis report here. Click on the link: A-Z stock analysis.

Savart is a SEBI registered investment advisor. The purpose of this content is to educate & not advise/recommend any particular security. Investments are subject to market risks. Please conduct thorough due diligence or seek professional guidance before making any investment.