Here’s How You Can Retire with INR 14 Cr By Investing INR 10K Per Month

Imagine yourself at 60 years of age. What would you like to be doing? You may want to spend time with your family. Maybe you want to be traveling the world and looking for new adventures. You may also want to take up a hobby such as gardening or painting. However, whichever pursuit you would like to undertake in your golden years, you need to be financially secure so you can peacefully carry-on doing things that make you happy.

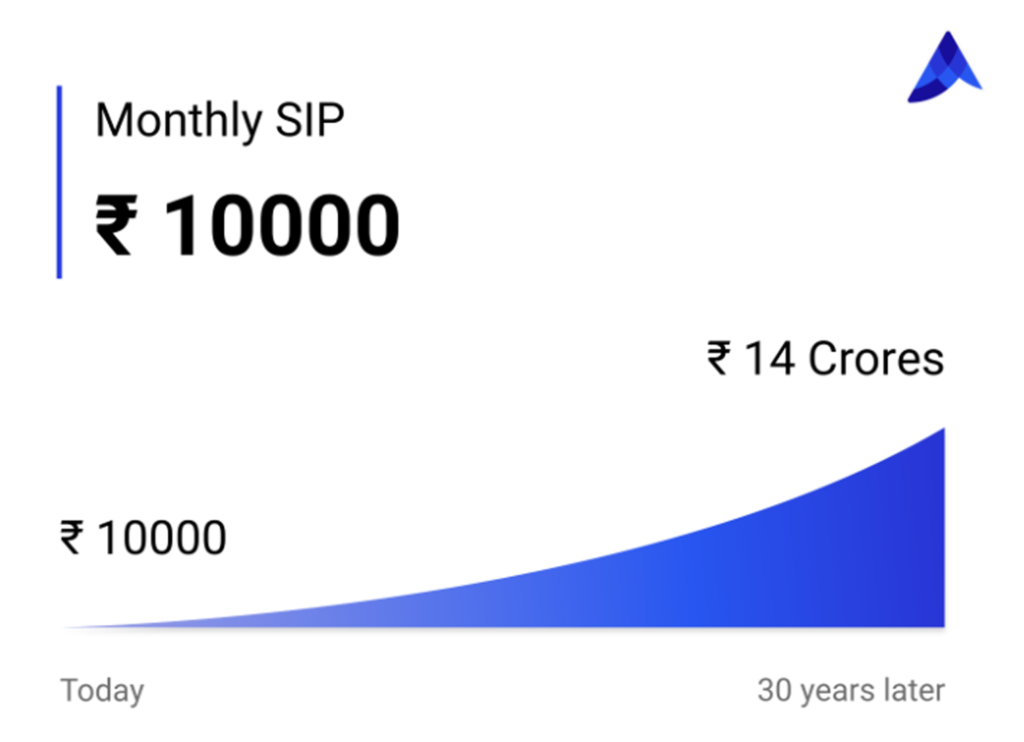

How much you can invest will depend on your income levels and lifestyle, however, if you save about INR 10,000 each month in stocks and mutual funds when you are 30 years old, you can hang up your boots with over INR 14 crores. This will be enough to cover any expense you may have during that time.

The way we have arrived at that number is by calculating the income you can earn by assuming a compounded annual growth rate (CAGR) of 18%. CAGR is a measure to calculate how much your investment could grow over a period, assuming you have not withdrawn any of the profits from that investment. A CAGR of 18% means if you invest INR 1000 on Jan 1, 2021, your investment on Dec 31, 2021, would reach INR 1,180. If you stay invested for another year, the growth would be 18% of that amount, i.e., 18% of 1,180, which is just over INR 1,392. This will further compound in successive years, and if you stay invested over a lengthy period, can grow to a huge sum.

CAGR can also reveal how long it takes for your investment amount to double. For example, a CAGR of 18% means that your investment will double in about four years and two months. It will subsequently keep doubling after every four years and two months elapse.

The formula to calculate your final profit by using CAGR is as follows.

V = A * [(1+i)n-1] * (1+i)/i

Where:

FV = Final value including profit

A = SIP Amount

i = (CAGR/100)/12, which is the multiple at which we expect the investment to compound

(For 18% CAGR, this value is (18/100)/12 = 0.015)

n = Number of months. For 30 years, this would be 30*12, which is 360 months

Using this formula, we can calculate how much you can earn with an investment of INR 10,000 over 30 years. In this example, ‘A’ will be 10,000, ‘r’ will be 18% and ‘n’ is 30 years.

The formula will read. Replace the terms with the numbers above and calculate your returns, you will arrive at about INR 14.32 crores. This is your final amount when you retire. See the illustration below.

FV = 10,000 * [(1+0.015)360-1] * (1+0.015)/0.015

FV = 10,000 * 211.70 * 67.67

FV = 14.32 Crores

As you can see, you can retire with a large corpus of wealth by investing just tiny amounts each month. Your amount can even increase if you raise the number of years, you have stayed invested or the SIP amount you invest.

However, all this depends on your portfolio maintaining the average CAGR of 18%. This is where Savart can help you.

To be financially secure during your retirement, start planning for it right away. As salaried individuals, our monthly pay out may be our only source of income. It is prudent that one saves a small part of their income so that they can secure their future. Retirement funds not only help the individual but can also come in handy for their children’s education or marriage. These are important expenses during the retirement years.

To be financially secure during your retirement, start planning for it right away. As salaried individuals, our monthly pay out may be our only source of income. It is prudent that one saves a small part of their income so that they can secure their future. Retirement funds not only help the individual but can also come in handy for their children’s education or marriage. These are important expenses during the retirement years.

To be financially secure during your retirement, start planning for it right away. As salaried individuals, our monthly pay out may be our only source of income. It is prudent that one saves a small part of their income so that they can secure their future. Retirement funds not only help the individual but can also come in handy for their children’s education or marriage. These are important expenses during the retirement years.

To be financially secure during your retirement, start planning for it right away. As salaried individuals, our monthly pay out may be our only source of income. It is prudent that one saves a small part of their income so that they can secure their future. Retirement funds not only help the individual but can also come in handy for their children’s education or marriage. These are important expenses during the retirement years.

Savart can customize your investments based on your lifestyle and financial goals, so you can get high returns on your portfolio. Our average CAGR since inception has been over 30%, which is well above the CAGR taken for this calculation. Therefore, thousands of investors have trusted us with their hard-earned money, and we have touched over INR 300 crores in assets under advisory.

Request a call from Savart today and our expert will walk you through how we can help. You can also download the Savart all from the Play Store or App Store. To learn how to use the Savart app, watch this walkthrough video. Sign up for our services today and enjoy unmatched returns on your portfolio.

Disclaimer: The calculations taken here are for illustrative purposes only. This article is meant to educate and does not constitute a recommendation. Market forces are always at play, and we encourage investors to thoroughly research before they make any investments.

Discussions