The global oil market is experiencing significant fluctuations, and the implications of this surge in oil prices are of great concern. In this blog post, we’ll delve into the forecasts, reasons for the price hike, oil demand projections, implications for India, and sectors that will be closely watched as we navigate through these challenging times.

Forecasts by Goldman Sachs

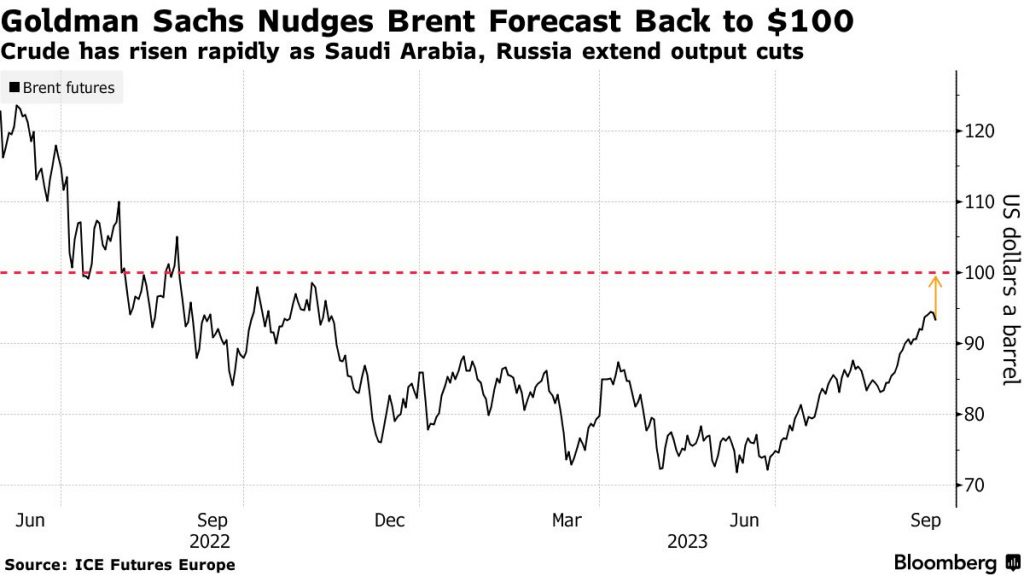

Goldman Sachs, a prominent US investment bank, has set some rather eye-catching predictions regarding crude oil prices. They anticipate that oil prices could reach $90 per barrel by the end of the year, with the potential to soar to $110 per barrel in early next year. These forecasts signal a major shift in the oil market dynamics.

Reasons for the Hike

- Robust Demand: One of the key drivers behind the surge in oil prices is the robust recovery in the demand for oil. The global economy has been steadily rebounding from the impacts of the COVID-19 pandemic, leading to increased demand for oil.

- Limited Supply: While demand has been on the rise, the supply of oil remains limited. This has created a supply-demand imbalance, which in turn, has put upward pressure on oil prices.

- OPEC’s Production Strategy: The Organization of the Petroleum Exporting Countries (OPEC) and its allies are signaling gradual production increases. This comes after significant output cuts during the pandemic to stabilize oil prices. The anticipation of increased production adds to the complex dynamics of the oil market.

- Natural Gas Shortages: Shortages of natural gas in Europe and Asia have led to an increased demand for oil for power generation. This unexpected surge in demand has added to the price hike.

Oil Demand Projections

Goldman Sachs foresees oil demand recovering to pre-Covid levels, approximating around 100 million barrels per day (bpd). What’s interesting is that the shift from gas to oil for various applications is expected to contribute an additional demand of at least 1 million bpd. This shift is an important factor to watch in the coming months.

Implications for India

India, as a major importer of oil, is particularly sensitive to fluctuations in global oil prices. If global crude prices surge by 30%, petrol prices in India could reach Rs 150 per litre, and diesel could cost Rs 140 per litre. This would exacerbate the already high fuel prices, which have been a matter of concern.

Madan Sabnavis from CARE Ratings points out that rising oil prices will have implications for India’s import bill and could further strain the Indian rupee, which is currently above Rs 75 against the US dollar. It’s a complex challenge that India needs to navigate carefully.

Sectors to Watch

Several sectors will be closely watched as they are particularly sensitive to oil price fluctuations:

- Aviation: The aviation sector, already reeling from the pandemic’s impacts, is particularly vulnerable to rising oil prices. Increased crude prices mean escalated input costs, which can significantly impact the profitability of airlines.

- Refining: Companies involved in oil refining will be affected by fluctuations in crude oil prices, as it directly impacts their input costs.

- Lubricants: Lubricant manufacturers also face challenges, as the cost of producing lubricants is closely tied to oil prices.

- Tyres: The tire industry relies on petrochemicals, and as oil prices rise, the cost of manufacturing tires increases. This can potentially impact both producers and consumers.

Global Conflicts and Their Effects on Oil Prices

The Ukraine and Gaza Context

- Ukraine Crisis: The conflict in Ukraine, particularly with Russia, has several implications for the oil market

- Transit Routes: Ukraine is a significant transit country for Russian gas to Europe. Any disruption or tension can lead to concerns over supply to a major consumer market, leading to hikes in prices.

- Sanctions: In response to the conflict, Western countries have imposed sanctions on Russia. Given Russia’s role as a major oil and gas producer, any sanctions that impact its energy sector can have repercussions on global oil prices.

Speculative Trading: The uncertainties arising from the conflict often lead to speculative trading. Traders, fearing supply disruptions, might buy futures contracts pushing the prices up. - Gaza and Middle East Tensions: The Middle East has long been a flashpoint for geopolitical conflicts, and the Gaza strip is one such hotspot. While Gaza itself isn’t a significant oil producer, the ripple effects of any conflict in the region can be felt across the entire Middle East, which houses a significant portion of the world’s oil reserves.

- Perception of Supply Risk: Any conflict in the Middle East raises concerns about the stability of oil supplies. Even if oil production is not directly impacted, the mere perception of a risk can push prices upwards.

- Strategic Locations: The Suez Canal and the Strait of Hormuz are two critical chokepoints for global oil transportation. Any conflict in or near these areas can lead to fears of supply disruptions.

- Proxy Conflicts: Tensions in Gaza can escalate into broader regional conflicts, given the intricate web of alliances and animosities in the Middle East. A small flare-up can drag major oil producers into conflicts, directly impacting oil production and prices.

To conclude , The global oil market is at a critical crossroads, with forecasts like those from Goldman Sachs predicting potentially higher oil prices. This situation is shaped by a confluence of factors: a robust rebound in demand, supply constraints, and strategic decisions by key players like OPEC.

Complicating matters further are geopolitical tensions in areas like Ukraine and the Middle East, particularly Gaza. The strategic significance of these regions means any unrest can significantly impact global oil prices.

For oil-dependent countries like India, this presents a multifaceted challenge. Balancing domestic economic needs with global market trends will require strategic foresight and proactive policymaking. Industries ranging from aviation to tire manufacturing will also feel the effects and must adapt accordingly.