Union Budget 2025 – New Income Tax structure

The Union Budget, which was released today, mentioned multiple important points, out of which the budget lays a strong foundation for India’s economic roadmap, which is focusing on growth, fiscal stability, and strengthening key sectors.

Indian government with a vision to boost investments, encourage domestic manufacturing, and improve infrastructure.

The Union Budget also introduced several measures to focus on taxation, which supports businesses and enhances public welfare.

One of the most significant aspects of this union budget is the revision in tax policies, which can shape the economy and which are aimed at increasing disposable income and stimulating economic activity.

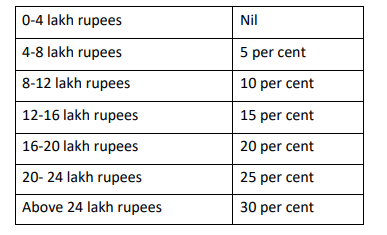

Changes in Income tax structure:

Here’s a clear breakdown of how ₹12 lakh can be tax-free under the new tax regime:

Tax Calculation for ₹12 Lakh Income

| Income Slab | Tax Rate | Tax Calculation |

| Up to ₹4 lakh | 0% | No tax |

| ₹4 lakh – ₹8 lakh | 5% | ₹20,000 (5% of ₹4L) |

| ₹8 lakh – ₹12 lakh | 10% | ₹40,000 (10% of ₹4L) |

| Total Tax Before Rebates | ₹60,000 |

How is the Tax Waived?

The government provides tax rebates and deductions that completely help you in getting exemption from taxes.

For salaried individuals, the standard deduction is INR 75,000 which increases the effective tax-free income limit to INR 12.75 lakh.

Thus, despite having an INR 12 lakh income, the applicable rebates and deductions ensure that no tax is payable under the new tax regime.

But now we need to understand the impact of this on stock markets.

The increase in tax-free income to INR 12 lakh means people will now have more money in their hands which they can spend on consumer foods, or FMCG which can boost the overall spending and increased demand for those segments.

This will boost the economy and stock markets as well.

Additionally, people spend surplus income on investments and in the stock markets also. These things will boost the real-estate demand and stock markets may also attract huge investments.

Increased consumption boosts corporate earnings, driving stock prices and market sentiment.

This, in turn, creates a multiplier effect on the economy, resulting in GDP growth and attracting foreign investments. Overall, tax relief acts as a positive thing and boost for economic expansion, driving consumption, investment, and market growth.

Discussions