Zomato Stock Analysis 2024: The Rise of a Food-tech Giant | Is It a Buy or Sell?

A year ago, Zomato returned more than 280% in a year. Can we consider this as a signal to buy the stock? Absolutely No. The same stock in the prior year eroded investors’ wealth in a tragic manner, with the stock tumbling from a peak price of Rs. 140-150 to an all-time low of Rs. 46. Did that signify a sell sign then? No.

Investment is about ownership in a business, and it cannot be decided by just considering share price movements. Fundamental research and understanding of the business are crucial to make an investment decision. In this video, we will discuss about the birth & rise of Zomato: what was once a loss-making & almost bankrupt company is now a profitable listed company and a flagbearer of successful Indian startups.

Let’s start with what does Zomato do?

Whenever we talk about “Zomato”, the first thing that comes to our mind is their online food delivery platform. But Zomato is much more than that, with 4 distinct revenue lines:

- The first revenue line is Zomato Hyperpure: Hyperpure by Zomato is a B2B platform for kitchen supplies and an end-to-end restaurant supply chain solution, operating as a one-stop-shop for the HoReCa (Hotels, Restaurants & Caterers) industry.

- The second line of business is Zomato Dining-out service: It is a platform where customers can book tables, search and discover restaurants, read and write customer reviews, view and upload photos, etc.

- The next line of business is Quick commerce: Blinkit is a Quick commerce platform which delivers groceries in less than 15 minutes. Zomato acquired the Blinkit in a stock deal in the year 2022 for $569 million. It was recently reported that this unit alone is worth over $13 Billion and will be bigger than all the other units combined.

- The fourth line of business is Food Delivery: This is an online food delivery platform which delivers food to the doorstep of customers from restaurants. This doesn’t need much introduction.

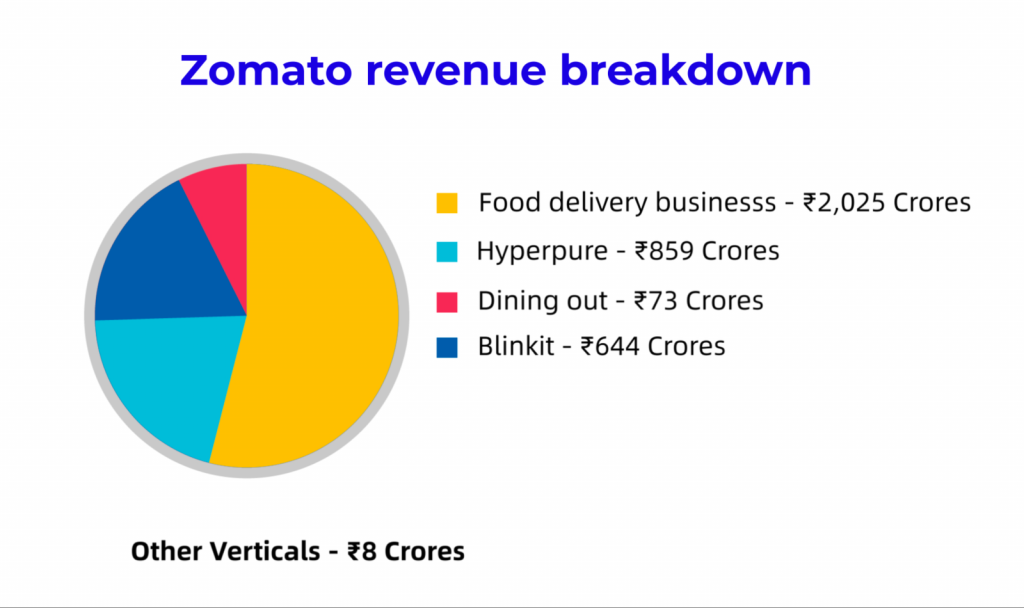

Zomato announced an adjusted revenue of Rs. 3,609 crores in its Q3 FY24 report with Rs. 2025 crores from its food delivery business, Rs. 859 crores from the Hyperpure business, Rs. 73 crores from Dining out vertical & Rs. 8 Crores from other verticals.

But where did it all start?

Zomato’s founding story traces back to 2008 when Deepinder Goyal and Pankaj Chaddah, employees at Bain & Company, envisioned a solution to simplify restaurant discovery and food ordering in India. They started by compiling restaurant menus online, eventually expanding to provide reviews, ratings, and online ordering services. Initially named “Foodiebay,” the platform underwent several iterations before rebranding as “Zomato” in 2010. Zomato quickly gained traction, capitalizing on the rise of ‘eating out’ in India and later expanding internationally.

In its early days, Zomato caught the eye of Sanjeev Bikhchandani, the founder of Info Edge, who first became interested in Zomato when he noticed its potential to revolutionize the food industry in India. Recognizing the innovative approach Zomato was taking towards restaurant discovery and online food ordering, Bikhchandani approached Deepinder Goyal and Pankaj Chaddah, the founders of Zomato, with an investment offer. Impressed by Zomato’s vision and growth trajectory, Info Edge became one of the earliest investors in the company, providing crucial funding that supported Zomato’s expansion and solidified its position as a leading player in the food tech industry.

The Making of a Multi-bagger

Info Edge’s initial investment of INR 4.7 crore in Zomato back in 2010 grew to almost 633x times by the time of Zomato’s IPO. Here is the mind-boggling data posted by Sanjeev on Twitter during Zomato’s IPO.

As per the latest reports and shareholding data, InfoEdge owns 13.55% of the stake in the company. Today this stake is valued at around Rs. 22795.42 crores.

Industry:

According to the Redseer, The Indian food services market is projected to exceed $100 billion by 2028, growing at a CAGR of 10–12%. Traditionally, food service as an industry encompassed either a formal agreement outlining regular meal provisions by an external party or the handling—from storage and preparation to serving and cleaning—of food intended for consumption within a specific establishment.

In recent years, there has been a consistent rise in the development of novel services including food delivery, cloud kitchens & transformation of dining venues such as restaurants, hotels, and cafes, especially after Covid. Whether operated by restaurant chains, hotel franchises, or independent proprietors, businesses are actively expanding their operations innovatively and at a scale that was earlier considered possible only for the likes of the QSR biggies like KFC & McDonald’s.

So, what advantage does Zomato have in this industry?

- Market Leader: Zomato has nearly 55% market share and a clear leadership in the food delivery vertical, while its closest rival Swiggy has 44% market share in India. This growth has been organic & inorganic with Zomato making a total of 26 acquisitions and investments in multiple sectors, such as food tech and online grocery, while Swiggy making 10.

- Increase in the GOV (Gross order value): As per the Q3 FY24 data, the consolidated GOV is nearly Rs. 12886 crores, which is 47% more than the earlier year.

- Continuous operating leverage: With most of the costs fixed, the platforms enjoy a strong operating leverage. The costs are generally frontloaded in nature leading to higher losses in the initial years. Zomato may now be close to leveraging its deep investments in tech & infra completely.

- Increasing pricing power: As the platforms scale, the pricing power grows as the dependency of ecosystem players on the platform rises. Besides, a larger platform provides greater value to the ecosystem players and thus enjoys higher pricing power.

- Hyperpure: The Hyperpure vertical has steered Zomato firmly into profitability. Hyperpure operates in 10 cities with a farm-to-fork model that currently provides next-day delivery on a wide range of quality ingredients – staples, packaged and frozen products, fresh fruits and vegetables, poultry, meats & seafood, sustainable packaging, and ready-to-serve products.

- Cost Efficiency: By eliminating middlemen, Hyper Pure keeps costs low, making it more economical for restaurants to order.

- High Average Order Values (AOV): With an AOV of INR 1,500 and a margin of 10-12%, Hyperpure’s high AOV covers last-mile costs and warehouse expenses, contributing significantly to Zomato’s overall profitability.

- Low Customer Acquisition Costs: Unlike other verticals, Hyper Pure refrains from offering discounts, keeping customer acquisition costs remarkably low. This, combined with its other advantages, has led to a threefold increase in Hyper Pure’s revenue over the past year.

- Platform fees: Zomato added an INR 5 platform fee, which is a positive factor in the company financials. Zomato started platform fee with INR 2 per order in the year 2023, revised it to INR 3 and then to INR 4 in January 2024 before arriving at the current price.

Risks:

- Growing Marketing Expenses: As per Zomato’s Q3FY24 results, it spent INR 317 crore on sales promotion and advertising in Q3FY24. This marks an 8.2% increase in ad spending over the same quarter from the previous fiscal year, where it spent INR 293 crore. This number could keep increasing, given the company must protect its market share from a well-funded player like Swiggy.

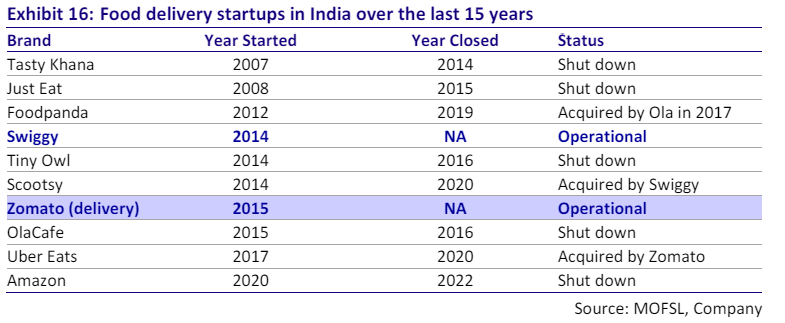

- Low entry barriers & Competition: While Zomato is the clear market leader today, the chances of disruption are strong especially from restaurant associations, unions & other players who could simply undercut the incumbents on commissions & margins to grab market share.

- Premium Subscribers: Zomato Gold was launched several times and failed, forcing the company to review pricing multiple times. As of FY 23, there are 1.8 million subscribers for the Gold program (10% of overall customers). It remains to be how much they can scale this part of the business.

- The ONDC factor: ONDC, or the Open Network for Digital Commerce, is an initiative by the Government of India to make digital commerce experience fairer, more convenient, and innovative. ONDC wants to create a user-friendly platform that eliminates the need for multiple delivery apps, making online shopping easier for everyone. It also wants to encourage more choices for consumers and create a level playing field for businesses in the digital commerce industry. ONDC (Open Network for Digital Commerce) is a potential threat to Zomato only if it meaningfully scales up across categories. How is it a threat?

- Lower Prices: The competitive advantage of ONDC’s lower prices could potentially impact platforms like Zomato and Swiggy in several ways. First, it may compel Zomato and Swiggy to reassess their pricing strategies to remain competitive. They might need to consider offering discounts or implementing other cost-saving measures to retain their customer base.

Secondly, Zomato and Swiggy might face pressure to enhance their value proposition through additional services or features to justify their pricing compared to ONDC. This could lead to innovations in their platforms or the introduction of loyalty programs to incentivize continued usage, thus impacting margins negatively.

- Government-backed initiative: Being supported by the Department for Promotion of Industry and Internal Trade (DPIIT) of the Government of India, ONDC is backed by the government itself. This official support gives ONDC extra credibility. It means that users can trust that the platform is legitimate and follows all the rules set by the government.

Financials of the company:

| Mar-18 | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | TTM | |

| Sales | 466 | 1,313 | 2,605 | 1,994 | 4,192 | 7,079 | 10,608 |

| Net Profit | -107 | -1,010 | -2,386 | -816 | -1,222 | -971 | -12 |

| EPS in Rs | -3,070.18 | -28,574.18 | -70,096.54 | -23,123.76 | -1.54 | -1.14 | -0.02 |

The company has made steady financial progress and has swung into a profit recently. It remains to be seen how sustainable this growth in top line and bottom line is.

Growth Triggers:

In the food delivery business, Zomato is having tough competition from Swiggy, but in quick commerce Blinkit is having competition with the likes of Zepto. Blinkit constitutes nearly contributes INR 644 crores in revenue to Zomato already.

What is quick commerce exactly? Quick commerce is the next step in the evolution of eCommerce and as the name suggests it’s all about speed. Quick commerce generally means consumers can expect delivery within one hour of placing an order. But usually, Blinkit and other competitors deliver it in less than 15 minutes.

The quick commerce sector is growing at a decent CAGR but still represents just around 1% of the total domestic grocery market at $ 620 billion. With a large addressable market of $ 45 billion, it is set to grow to 10-15x its current size by 2025E, according to Redseer.

Further, India is experiencing a faster adoption of quick commerce market than its peers. According to Redseer, India has a quick commerce penetration of 13% v/s 7%/3% in China/EU, respectively.

Why Blinkit is important for Zomato?

- Asset (Delivery fleet utilization): By acquiring a grocery delivery business, Zomato can broaden its scope of operations, expanding its product portfolio to cover a wider range of services throughout the day. This diversification allows Zomato to cater to more consumer needs across different time frames, beyond just peak mealtimes and weekends. Consequently, this strategic move not only enhances profitability but also optimizes asset utilization, particularly the fleet, resulting in an improved cost-benefit ratio.

- Ad-Revenue: Zomato also believes that ad revenue is higher in quick-commerce as compared to food delivery simply because consumer brands and packaged goods have much larger digital media spends as compared to restaurants and cloud kitchens.

- Building vs Buying: To build a company like Blinkit, it requires huge capital and time. Blinkit already had developed its foundation and a huge customer base. Zomato’s acquisition of Blinkit seems like a smart move.

ESG (Environmental, Social & Governance):

ESG reporting frameworks are used by companies for the disclosure of data covering business operations, opportunities, impact and risks from an environmental, social and governance (ESG) perspective.

In FY23, the company aligned with the United Nations Sustainable Development Goals to make business sustainable. The company has outlined 8 themes to make their ESG management approach and disclosures more comprehensive.

- Climate conscious deliveries

- Waste free world

- Zero hunger

- Sustainable livelihoods

- Health, safety and wellbeing for all

- Diversity, equity and inclusion

- Customer centricity

- Sustainable governance, security and privacy.

Zomato’s newest goal is to reach ‘Net Zero’ emissions across their food ordering and delivery value chain in the next 10 years, i.e., by 2033. This is applicable to the value chain of the food ordering and delivery business, i.e. services under Zomato Limited (standalone entity).

• Zomato is committed to 100% EV-based deliveries by 2030 and has joined the Climate Group’s EV100 initiative. ~2,37,000 delivery partners have been made aware of the benefits of EVs via digital and offline communication campaigns.

• More than 50 Partnerships signed with various players in the 2W EV ecosystem including OEMs, Battery as-a-service operators and EV rental companies.

• Zomato was awarded the ‘Best ESG Performance in Sustainable Transportation’ by Transformance Forums in April 2023.

Social:

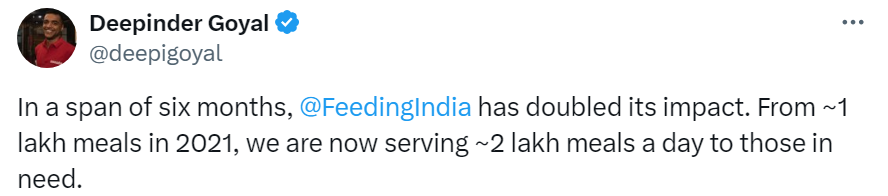

- Feeding India by Zomato: Feeding India is a not-for-profit organization, designing interventions to reduce hunger among underserved communities in India. In January 2019, Zomato and Feeding India (registered as Hunger Heroes) collaborated to eradicate hunger and malnutrition in India.

- Oxygen for India: This initiative was started to provide oxygen and related supplies to hospitals and patients for free.

Governance:

- Independent Board: 5 out of 8 board members are Independent. The chairman of the board is also an independent director. This ensures higher chances of rational decision making, which is much better than having a bunch of yes-men around the promoter who question nothing and cannot protect the interest of the shareholders.

- There are no pecuniary relationships or transactions with non-executive independent directors of the Company apart from payment of annual remuneration and sitting fees for attending meetings of the Board and committees. The Company has not paid any remuneration and sitting fees to non-executive nominee director(s) of the Company

- While there were few corporate governance concerns raised during the Blinkit acquisition, they were duly responded to by the management.

While Zomato passes the initial governance tests. Our AI system APART checks such qualitative matters very deeply and across 1,000+ parameters. Hence, this video must not be considered an investment recommendation or comprehensive research.

Conclusion: Zomato’s continued investment in innovation, technology and customer centricity will remain key factors in determining the winner in this sought-after industry. While it is difficult to predict which vertical will do best, the greatest solace for Zomato’s investors is that it has multiple high growth & high potential lines of business. It is going to be an interesting journey for sure.

Savart is a SEBI registered investment advisor. The purpose of this content is to educate & not advise/recommend any particular security. Please remember that investments are subject to market risks. Please conduct thorough due diligence or seek professional guidance before making any investment. Do not believe in any speculations.

We thank you for watching this video. If you would like to know more about various listed companies, business models, investment strategies and personal finance, subscribe to our YouTube channel.

Always, Dream Up.

Discussions