IT SECTOR REPORT CARD FOR Q3FY22

One sector that relatively outperformed others in India last year was the IT sector. The companies in this sector have reported earnings results for the quarter ended Dec 31.

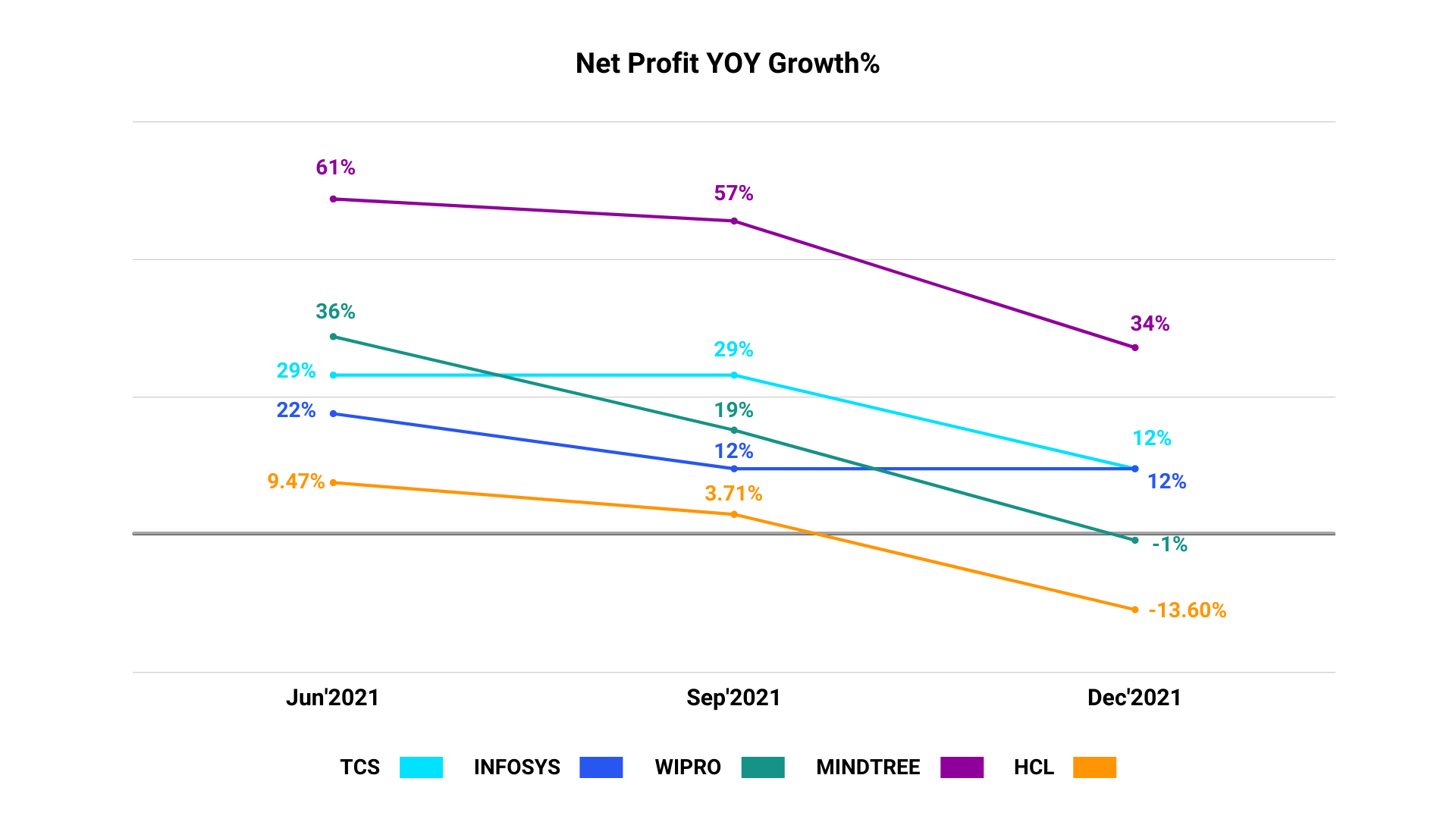

Wipro Ltd, during the quarter, reported a 29.6% revenue growth from a year ago on account of solid growth coming from both organic and inorganic businesses. However, the company only recorded a 3.3% QoQ revenue growth in dollar terms which was lower than the outlook given by the organization during the September-quarter results announcement. The net profit growth for the company remained subdued on a YOY basis despite the higher revenue growth recorded during the quarter.

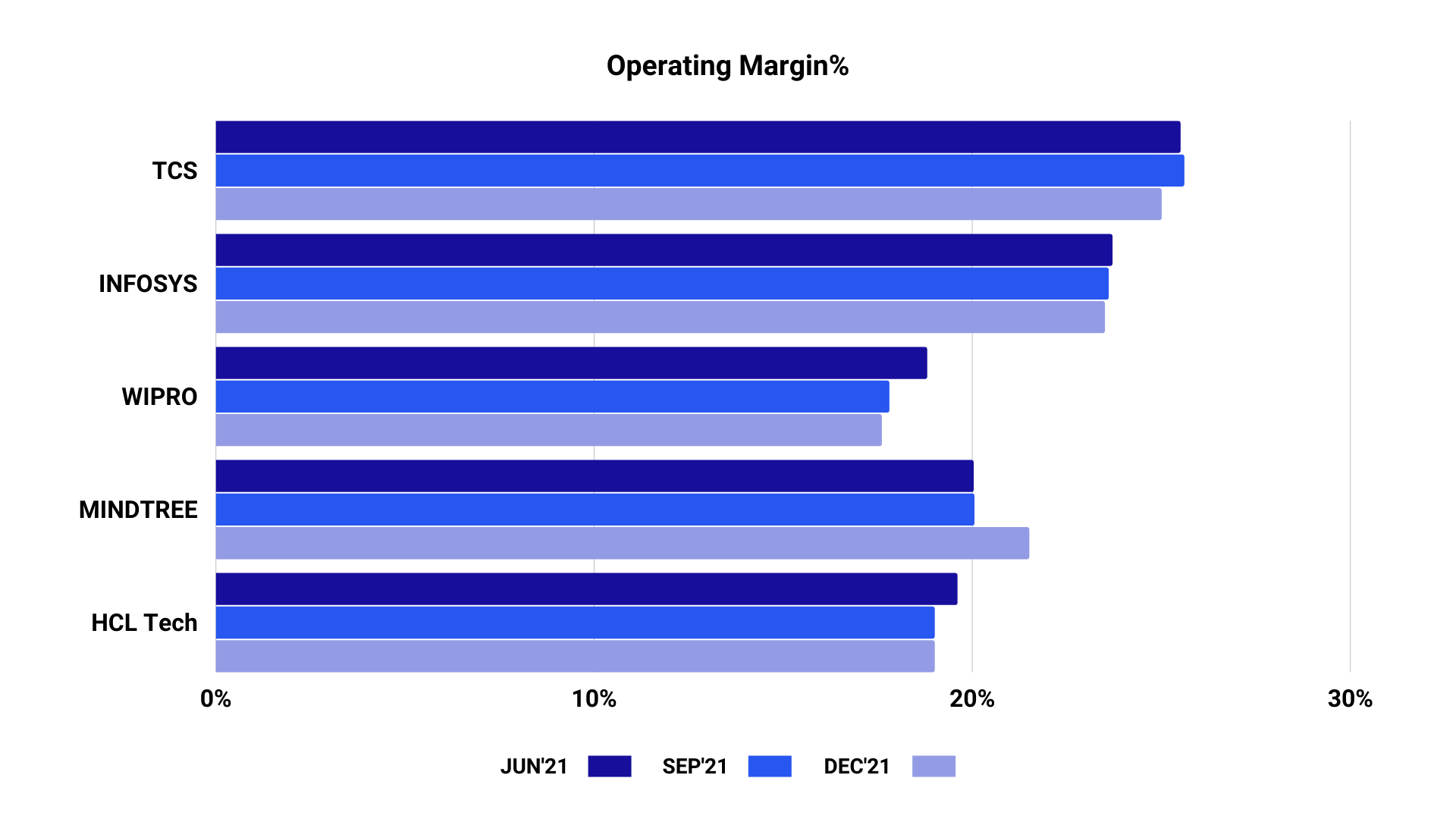

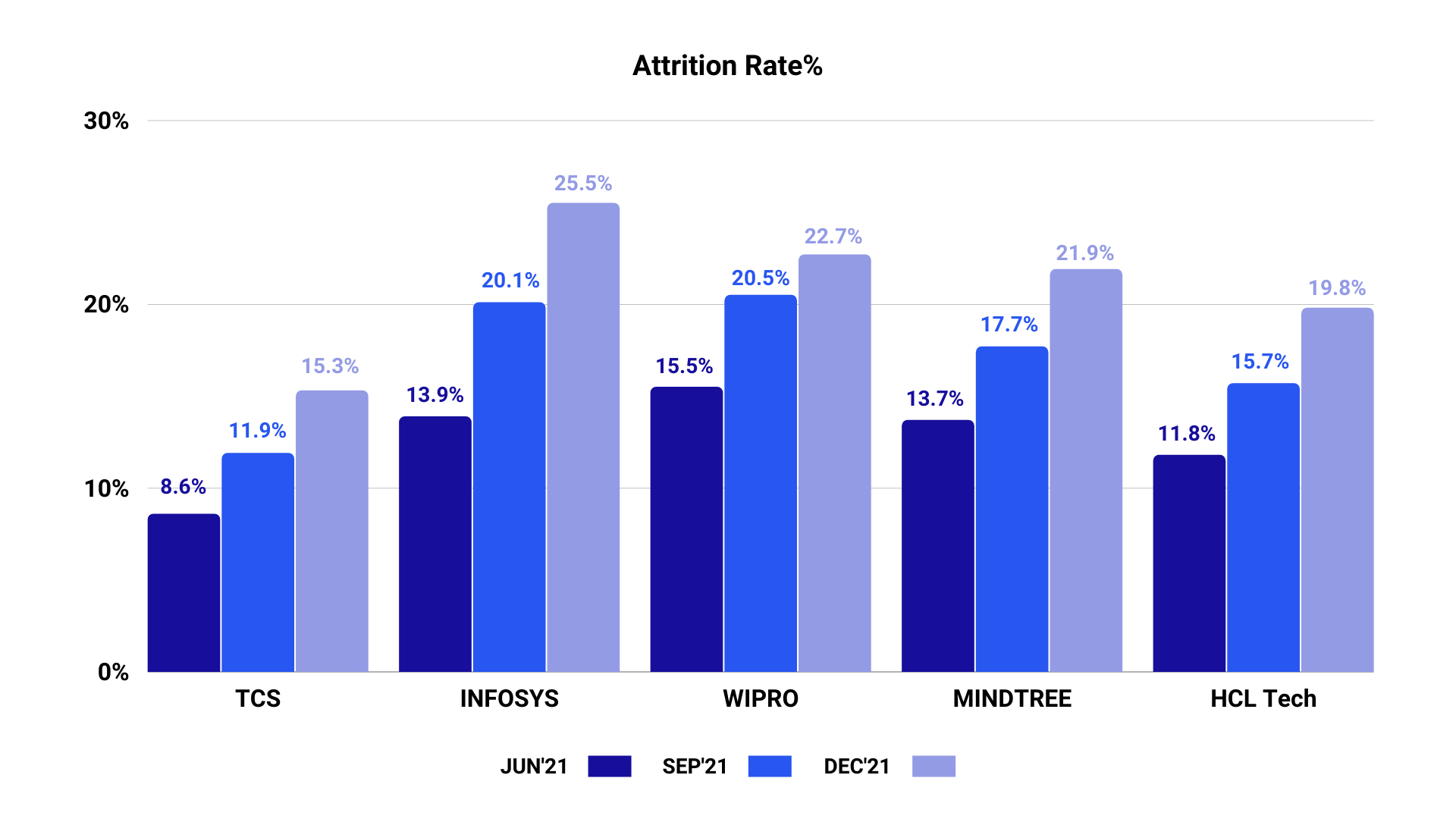

Wipro recorded a sharp increase in attrition rate due to the supply side constraints prevailing in the industry. The attrition rate for the company inched up to 22.70% during the quarter from 20.5% of the September quarter. As a result, the operating margin for the company fell to 17.6% from 17.79% of the September ended quarter FY22.

TCS, the largest IT company in India, recorded 16.3% revenue growth during the December quarter on a YOY basis because of strong growth in retail, CPG, BFSI, Manufacturing, and healthcare. In addition, the company highlighted the accelerated transition of businesses towards the cloud, cyber security, IoT, and digital engineering. However, TCS faced high attrition rates, moving up to 15.3% during December ended quarter FY22 from 11.9% of September ended quarter FY22.

As a result, the company observed moderation in operating margin on both sequential and annual basis. The operating margin for the company declined to 25% during the December ended quarter FY22 from 25.60% of September ended quarter’21. During the December ended quarter, the trajectory for net profit growth also declined due to unfavorable supply-side challenges. The net profit growth during the December quarter FY22 was 12.3% on a YOY basis compared to 28.75% recorded during September ended quarter FY22.

Infosys reported the highest quarterly revenue growth among the IT trio of Wipro, TCS, and Infy on a QoQ basis beating the market expectations. Infosys recorded 7.7% quarterly revenue growth, and 22.9% annual revenue growth during the December ended quarter’2021. Infosys recorded such strong revenue growth in India, North America, and Europe regions. India recorded the highest growth of 38% among all the regions.

Infosys was no exception to the supply side challenges prevailing in the industry. Infosys also experienced a deterioration in the attrition rate. The attrition rate for the company increased to 25.50% during December ended quarter FY22 from the 20.1% attrition rate of September ended quarter FY22. The sub-contracting dynamics and unfavorable supply-side challenges have led to 10 basis points fall in operating margin. The operating margin was recorded at 23.5% and the company recorded 11.64% stable net profit growth for the quarter ended December’21.

HCL Tech, one of the largest IT players, has a relatively different business compared to the trio of the IT sector. It recorded strong revenue growth of 15.7% during the quarter on YOY and 8.1% on a sequential basis. The service segment recorded strong revenue growth of 5.3% on QoQ and 16.1% on a YoY basis. The robust growth in IT and Business services on account of solid traction towards the cloud, IoT, and digital operations propelled the overall growth in the Service segment of the business. The product and platform business outperformed the sequential growth of the service segment at 24.5% during the December quarter.

The company recorded a flat EBIT margin of 19% on the margin front during Q3FY22. However, the service segment that contributes over 85% of the overall revenue recorded a sharp fall of 190 basis points in EBIT margin due to higher salary wages, higher recruitment & retention, seasonal leave, and investment expenses. The fall in service segment margin was offset by the higher product and platform (P&P) segment EBIT margin at 31.9%. However, the management cited that a high P&P segment margin would rationalize to the historical levels, and the margins in the service segment would improve in the coming quarters.

Mindtree has reported the most robust growth in revenue numbers during the December-ended quarter. The company recorded revenue growth of 35.9% during the quarter on a YOY basis. The growth was broad-based and across sectors. The Travel, Transportation, and Hospitality (TTH) segment of the business picked up significantly from the pandemic-induced stress and it recorded 56.4% YOY growth. Cloud, data, and intelligence segments of the service lines continued to grow over 7% on a sequential basis. Mindtree also reported higher attrition numbers during the quarter. The attrition numbers reached 21.9% during the December ended quarter FY22 from 17.70% of the previous quarter. However, the company managed to expand its operating margin on a sequential basis to 21.90% from 20.05%. Despite supply-side headwinds, the company capitalized on the adequate mix of experienced and fresher employee structure and sub-contracting costs to expand their margins on a sequential basis.

Looking at industry-wide numbers, it is quite evident that a robust demand environment is propelling the sector’s growth story. However, valuations for most businesses in the sector has become very expensive.

The IT sector remains a strong bet for the long term, but requires a selective investment approach in the near to medium term.

P.S. Savart takes into consideration sector-specific fundamentals as well as stock-specific microanalysis to construct a portfolio. Click here to request a callback from us so you can know more about all our services.

Disclaimer: This article does not constitute a recommendation, and is only intended to state our interpretation of events that have occurred. Financial markets are subject to volatility and we request our readers to carefully consider all risk factors before investing in any security.