INSIGHT

HCL Tech Is Poised For

A Good Performance

This Year

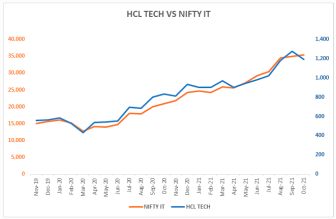

Indian IT Sector recorded strong growth during September ended quarter FY22. The pandemic has accelerated the pace of transition towards digital transformation and it is evident from the quarterly numbers reported by the industry players. HCL Tech has reported 10.5% revenue growth in constant currency basis beating the estimates on account of the strong performance of the service segment. HCL Technology posted the digital segment of the business contributes significantly to the overall portfolio. HCL Tech recorded positive growth in net income at 3.9% YOY basis.

How to help clients using Big Data

Application services, Digital consulting, Data analytics, Engineering services and cloud services contribute 85% of the overall growth. The service portfolio recorded 13.1% growth (YOY) and 5.2% sequential growth in constant currency. The Mode -2 offerings include IT & Business Services and Engineering & R&D services. Mode-2 offerings recorded strong positive growth of 36.3% YOY on account of the acceleration in demand for cloud migration and digital services. recorded strong positive growth of 36.3% YOY on account of the acceleration in demand for cloud migration and digital services.

The service portfolio recorded 13.1% growth (YOY)

and 5.2% sequential growth in constant currency.

IT companies’ margins for the quarter took a hit across the industry. The elevated attrition level has led to higher employee wages and supply side challenges. HCL recorded attrition levels of 15.5% in Q2FY22 vs 12.2% in Q2FY21. The EBITDA margins for this quarter took a hit and came down to 23.4% in Q2FY22 vs 26.60% in Q2FY21 on account of prevailing higher wage inflation in the IT Sector.

The new deal wins remain robust in this quarter as well. TCV of new deal wins recorded 38% YOY growth in Q2FY22 at US$2.24 billion on account of 14 new large deal wins. US$ 100 million + clients are up by 1 YOY basis, US$ 50 million clients are up by 12 YOY basis, US$ 20 million clients are up by 18 YOY basis.

Explore other Blogs

Why Indian Stock Markets Generally Rally After A U.S. Recession

The United States, being a superpower, can cause its domestic economic

Learn More

Why Indian Stock Markets Generally Rally After A U.S. Recession

The United States, being a superpower, can cause its domestic economic

Learn More

Kotak Mahindra Bank Reports Stellar Loan Growth In Sept-qtr

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmo

Learn More

-

Individual investors engage in stock market activity for a variety of reasons, e.g., long-term gains, short-term gratification, experiencing daily highs/lows, learning, applying intellectual strategies, etc. Their approaches to achieving these objectives can be broadly classified as active or passive in terms of the time spent analyzing the markets and their frequency of transactions. Let’s understand […]

-

7 Common Investing Mistakes That Can Reduce Your Returns from the Market Investing is an exciting experience. But it can also overwhelm people, especially those who are starting afresh. By their very nature, stock markets go up and down – disciplined investors understand this, and develop strategies to reduce their risks during market lows (as […]