How You Can Save Up To INR 50 Lakhs For Your Child’s College With An SIP Of INR 5,000

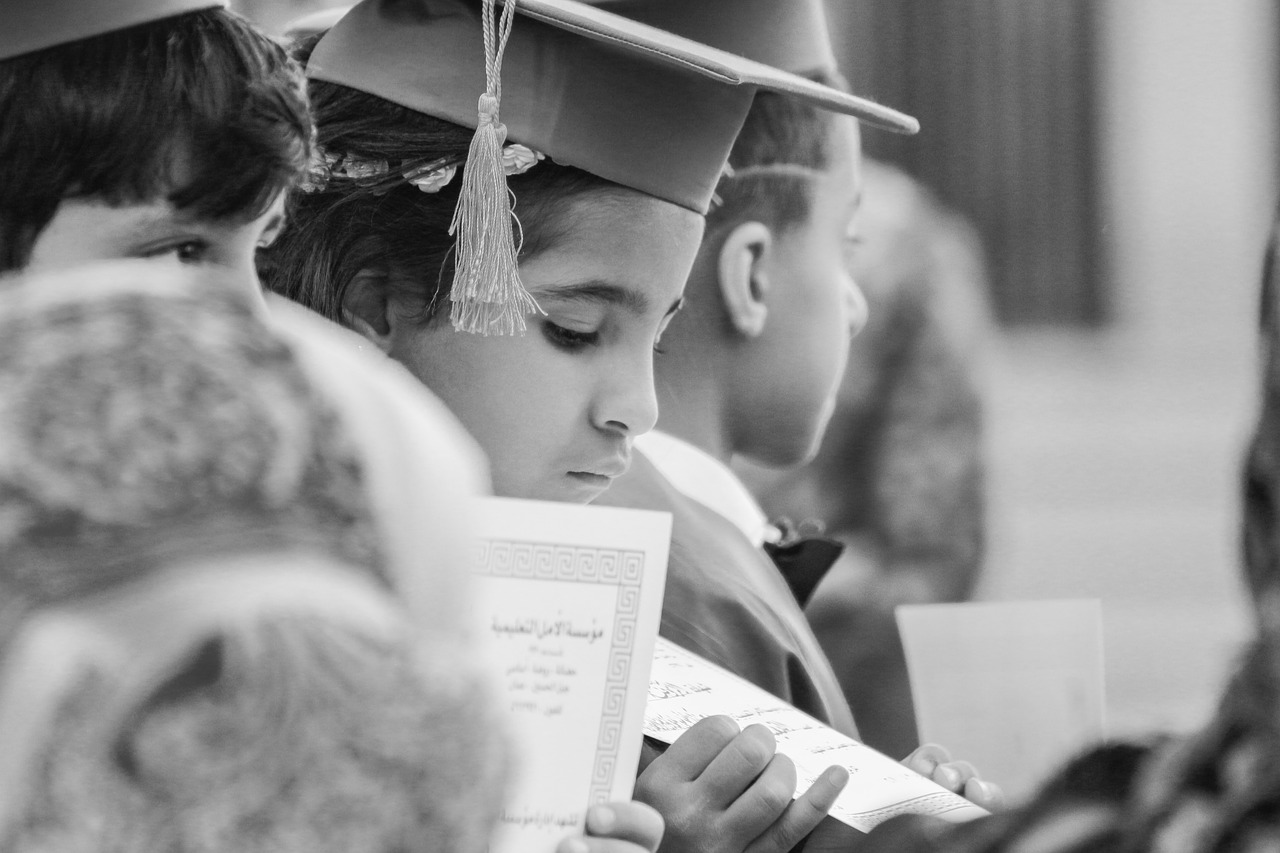

The worry of any parent is to see their children well educated and well settled in their adulthood. We empathize with such parents, who put in their blood, sweat, and toil for their children so that they are happy. It is hard work being a parent, we know that. Children are the pride and joy of our lives, but can also be a handful, and their well-being is on the minds of every parent. Savart wishes to offer praise and kudos to every parent. Though we are in the business of investment advice and wealth management, we recognize the work that parents put in bringing up children, who are the future of society and our communities. We would also like to help every parent realize their dream of giving their children the best possible future.

Every parent can use this advice, so we urge you to read on and understand how you can save for your child’s education effectively.

Let’s say you want your child to study at Harvard University in the United States, and that would cost you INR 50 lakhs for a four-year degree overall. You may think you need to slog at the office all your life, take on huge amounts of debt and pay off this debt till you are six feet under, while your children continue to pay it off thereafter.

We are here to tell you that all this is not needed. With consistent investing of just INR 5,000 as soon as your child is born, you can easily raise this amount and send your child to one of the best universities in the world. We’ll show you how.

The way we have arrived at that number is by calculating the income you can earn by assuming a compounded annual growth rate (CAGR) of 18%. CAGR is a measure to calculate how much your investment could grow over a period, assuming you have not withdrawn any of the profits from that investment. A CAGR of 18% means if you invest INR 1000 on Jan 1, 2021, your investment on Dec 31, 2021, would reach INR 1,180. If you stay invested for another year, the growth would be 18% of that amount, i.e., 18% of 1,180, which is just over INR 1,392. This will further compound in successive years, and if you stay invested over a lengthy period, can grow to a huge sum.

The formula to calculate your final profit by using CAGR is as follows.

FV = A * [(1+i)n-1] * (1+i)/i

Where:

FV = Final value including profit

A = SIP Amount

i = (CAGR/100)/12, which is the multiple at which we expect the investment to compound

(For 18% CAGR, this value is (18/100)/12 = 0.015)

n = Number of months. For 30 years, this would be 30*12, which is 360 months

FV = 5,000 * [(1+0.015)216-1] * (1+0.015)/0.015

FV = 5,000 * 211.70 * 67.67

FV = 80 Lakhs

A CAGR of 18% is quite possible with Savart’s help, you can send your child to Harvard an investment of INR 5,000 monthly. Invest this amount as soon as your child is born and keep investing till their 18th birthday. This will earn you returns of INR 80 lakhs, which is much higher than the INR 50 lakhs you need.

Savart can customize your investments based on your lifestyle and financial goals, so you can get high returns on your portfolio. Our average CAGR since inception has been over 30%, which is well above the CAGR taken for this calculation. Therefore, thousands of investors have trusted us with their hard-earned money, and we have touched over INR 300 crores in assets under advisory.

To get such customized investment advice delivered to you, reach out to Savart today! You can also download our app from the Google Play Store or the Apple App Store. For a detailed explanation of how to use our app, watch the walkthrough video here.

Disclaimer: The calculations taken here are for illustrative purposes only. This article is meant to educate and does not constitute a recommendation. Market forces are always at play, and we encourage investors to thoroughly research before they make any investments.

-

Individual investors engage in stock market activity for a variety of reasons, e.g., long-term gains, short-term gratification, experiencing daily highs/lows, learning, applying intellectual strategies, etc. Their approaches to achieving these objectives can be broadly classified as active or passive in terms of the time spent analyzing the markets and their frequency of transactions. Let’s understand […]

-

7 Common Investing Mistakes That Can Reduce Your Returns from the Market Investing is an exciting experience. But it can also overwhelm people, especially those who are starting afresh. By their very nature, stock markets go up and down – disciplined investors understand this, and develop strategies to reduce their risks during market lows (as […]