The impact of Russia-Ukraine crisis on Indian financial market

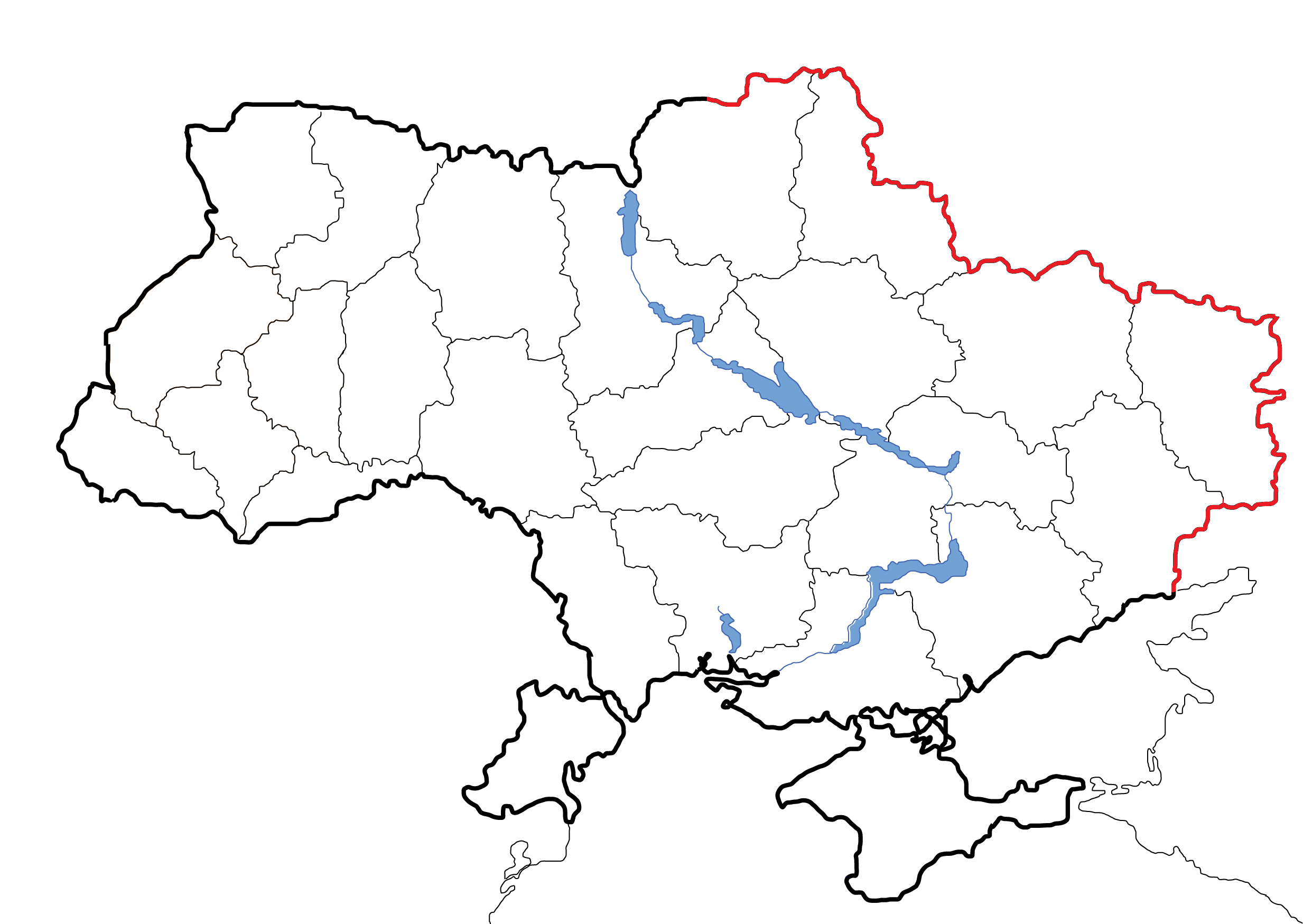

Russia has started military operations across Ukraine. Explosions have been observed in eastern Ukraine as well as in Kyiv (capital of Ukraine) during Thursday. This has caused a lot of fear in global markets and has triggered a shift towards safer assets. India has adopted an “Independent position” and called for “constructive diplomacy” at the UN Security council meeting on Monday.

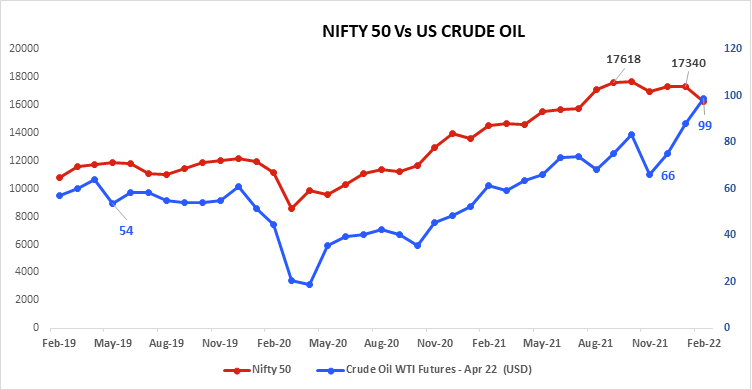

The US market corrected sharply during the Wednesday trading session. NASDAQ closed -2.60% down nearly 20% low from all-time high. The Nifty 50 corrected about 4.8% on Thursday, while Brent crude oil futures (May expiry) crossed $100. As the sentiment is turning negative, international gold prices surged to $1950 up 1.51%. India is one of the largest crude oil importers and high crude oil prices can become a potential risk for the Indian economy. High crude oil prices can extend India’s Current Account Deficit (CAD: Higher import than Export) which currently stands at 1.3% of India’s GDP during Q2FY22.

During the 2022 budget, the government announced capex programs to stimulate private investment. However, high crude oil prices can further dampen the producers’ sentiment to expand capacity if they struggle to pass on the price hikes. Consequently, this could further expand the fiscal deficits (Higher expenses than revenue) for the government. However, crude oil prices are also subject to supply levels determined by OPEC nations. Any extra ordinary measurement such as increasing the output, can also help to ease the crude oil prices and that would be favorable for Indian financial Market.

Source: Investing.com

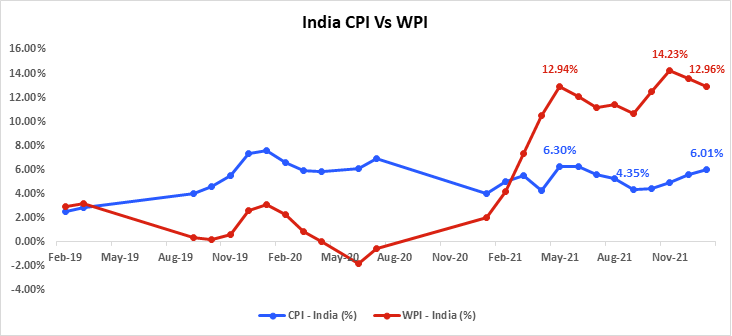

The high crude oil prices can impact the Indian economy on multiple fronts. Indian economy is largely dependent on oil as it is primarily used in crucial activities such as fueling transportation and other production activities. Crude oil is the primary input in oil and India imports nearly 80% of the crude oil that it processes. So, high international crude oil prices might put further pressure on consumer inflation as well as cost of production for the businesses.

RBI has mentioned that CPI (Consumer Price Index) inflation for Q4FY22 is expected to be at 5.7% i.e., closer to the upper threshold of 6%. The CPI inflation for the month of Jan’ 2022 was recorded at 6.01%, above the upper tolerance threshold level. The high crude oil prices can cause further pressure on CPI.

Source: investing.com

The WPI (Wholesale Price Index), which reflects the inflation on producers’ front, also remained at elevated levels of 12.96% for the month of Jan’22 whereas WPI was around 3% during Jan’2020. If crude oil continues to remain at elevated level, it might further extend the margin pressure across manufacturing and service sector.

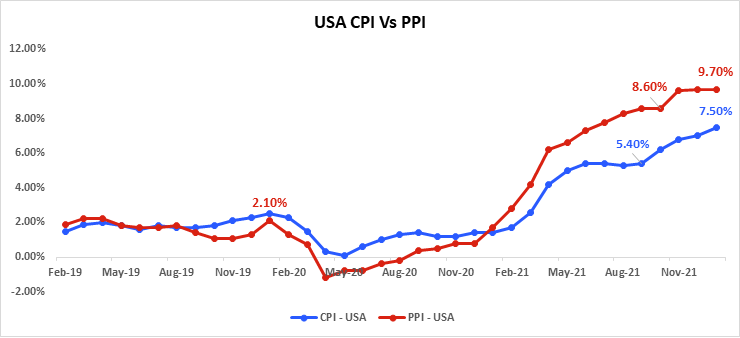

The CPI inflation across USA, United Kingdom and European Union is at historical levels. Central banks such as BOE have already increased interest rates and Federal reserve is also expected to hike its rate during March’22 meeting to control inflation. So, the financials market including India may not have as much central bank’s stimulus as it had last year.

High crude prices, on top of faster than anticipated normalization of monetary policy across the developed nations, can further extend the financial strain on emerging markets. Though the central bank of India is behind the curve on policy normalization, high crude oil prices can put further pressure for faster policy normalization, and it might cause some potential volatility in Indian market for a short-term basis.

Indian market might remain volatile in the near term due to geopolitical issues, uncertainty over central bank policies and other economic challenges. However, the long-term structure for Indian financial market remains intact. Current situation in Indian market requires selective approach for long term investment. At Savart, we adopt a comprehensive approach covering fundamentals & also macro-economic factors including geo-political events to advise outperforming investments.

Disclaimer: This article is for educational purposes only and does not constitute a recommendation. We suggest our readers conduct thorough research before they make any investment decision.

-

Individual investors engage in stock market activity for a variety of reasons, e.g., long-term gains, short-term gratification, experiencing daily highs/lows, learning, applying intellectual strategies, etc. Their approaches to achieving these objectives can be broadly classified as active or passive in terms of the time spent analyzing the markets and their frequency of transactions. Let’s understand […]

-

7 Common Investing Mistakes That Can Reduce Your Returns from the Market Investing is an exciting experience. But it can also overwhelm people, especially those who are starting afresh. By their very nature, stock markets go up and down – disciplined investors understand this, and develop strategies to reduce their risks during market lows (as […]