The Tap Is Being Turned Off

Understanding the impact of higher interest rates and lower liquidity on stock market prices

Over the last few days, the Indian rupee has hit a lifetime low of 78.20 against the US dollar while oil prices remained at their elevated levels. Additionally, the US reported a 40-year high inflation rate of 8.6%, and the US Federal Bank raised interest rates, again.

Inflation continues to plague nations around the globe – it is more supply-driven and there is no vivid indication of when it will reach acceptable levels.

Trivia: High inflation is an increase in the prices of goods and services which brings down the purchasing power of money.

Major banks in the USA, Europe, England, and Canada are considering various actions to control inflation as they attempt to take the excess liquidity off the system. In simple terms, liquidity means access to money.

Going back in history:

After the 2008 financial crisis, the US Federal Bank turned on the tap of excess liquidity to support the economy. The central banks of other countries joined the US and make it easier to access money to support economic growth. This meant that the banks and other financial institutions started having access to funds that exceeded their needs. The additional/surplus money started flowing across the emerging countries like India, looking for better returns on the investment. Equity investments saw new heights with this additional capital.

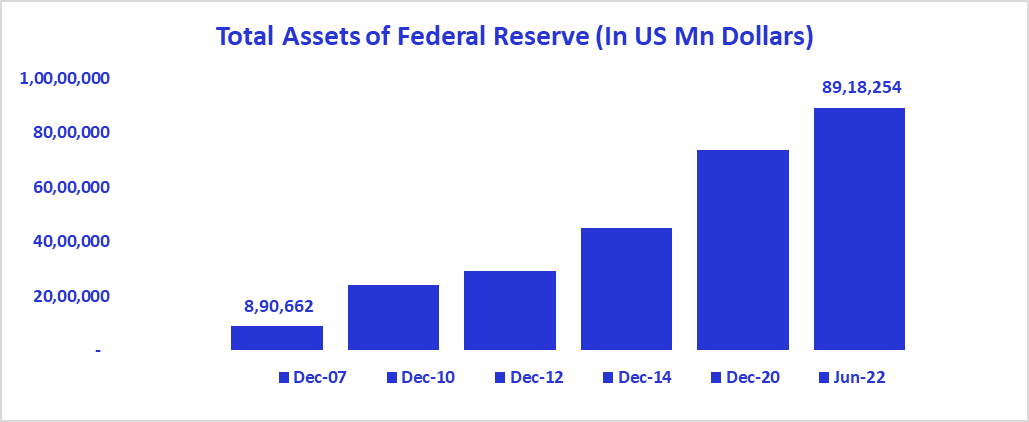

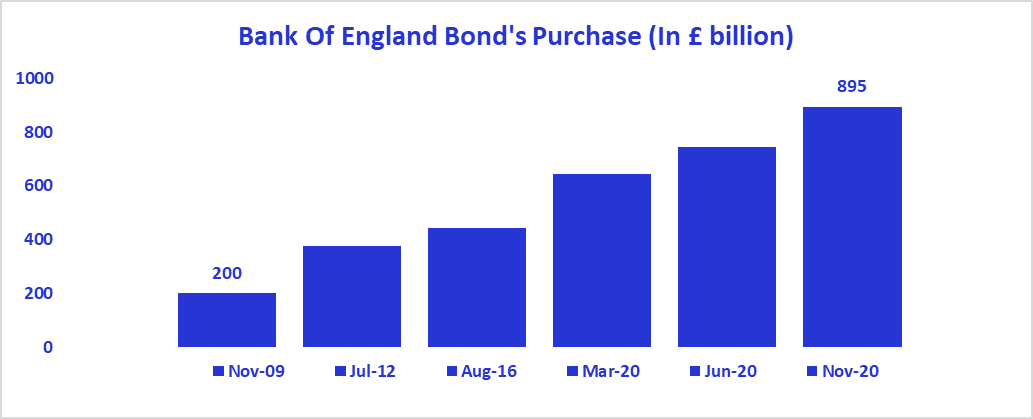

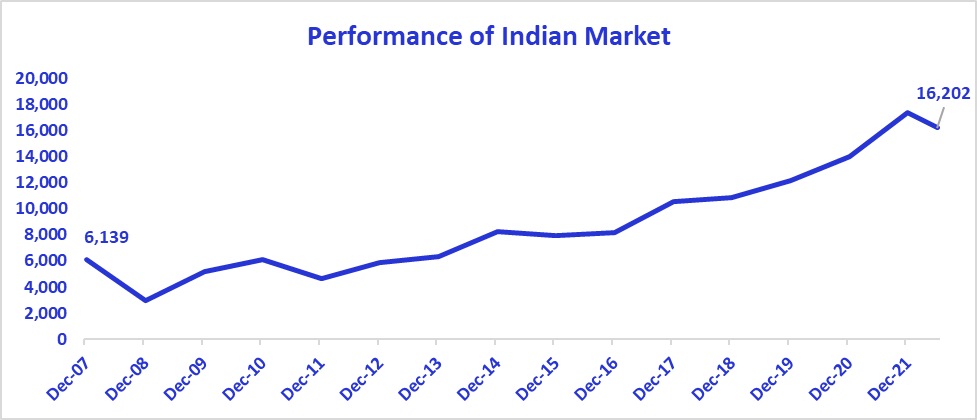

The graphs given below reflect the money added into the systems by Central Banks over the last 15 years.

Source: Federal Reserve of United States

Source: Bank of England

Source: Investing.com (Nifty50)

Back to the current times:

The US Federal Bank stopped buying bonds in March’2022 resulting in reduced liquidity. Bank of Canada also stopped buying bonds in April’2022, the European Central Bank is expected to stop buying bonds from June’2022, and the Bank of England ended the bond purchase program in December 2021.

The US Federal Reserve has started to sell its bonds – this means that it has moved from cutting the growth in liquidity to actively extracting liquidity from the system. RBI has also increased its CRR (Cash Reserve Ratio) which would take out the excess liquidity from the system. It means the banks have relatively lower funds to disburse.

Read:

Changing Tides: The Moves Away From Low Interest Rates

All of this might lead to higher financing expenses and lower margins (profitability) for business which could materially cause some challenging environment for the equities in the near term.

As the interest rates in the USA are expected to increase further and with the withdrawal of excess liquidity from the system, we might see FII (Foreign Institutional Investors) continue to pull money out of the Indian markets. As a result, the Indian currency might depreciate further.

For retail investors, the fundamental takeaway is that one needs to be selective about their investments to find ones that are more likely to survive the current macroeconomic scenario. It requires a deep understanding of the economic environment and insightful study of individual companies. Savart is one such investment advisory service that guides investors to make high-quality investments – even in moments of market volatility. Download the Savart app today and enjoy a powerful investment experience.

-

Individual investors engage in stock market activity for a variety of reasons, e.g., long-term gains, short-term gratification, experiencing daily highs/lows, learning, applying intellectual strategies, etc. Their approaches to achieving these objectives can be broadly classified as active or passive in terms of the time spent analyzing the markets and their frequency of transactions. Let’s understand […]

-

7 Common Investing Mistakes That Can Reduce Your Returns from the Market Investing is an exciting experience. But it can also overwhelm people, especially those who are starting afresh. By their very nature, stock markets go up and down – disciplined investors understand this, and develop strategies to reduce their risks during market lows (as […]