Should You Invest In LIC IPO? – The Complete Analysis

Go through this quick read to avoid investing with FOMO (Fear Of Missing Out) & make informed investment decisions with India’s largest ever IPO.

Indian insurance giant Life Insurance Corporation (LIC) has arrived with its Initial Public Offering.

Savart Trivia: Initial Public Offering (IPO) refers to the process of offering shares of a private company to the public in a new stock issuance.

The numbers involved in LIC are staggering!

The state-owned company is planning to raise Rs 20,557 crores through the IPO by diluting a 3.5 per cent stake.

LIC reserved up to 22,137,492 or 10 per cent of equity shares for LIC policyholders. Eligible LIC employees have 1,581,249 or 0.70 equity shares reserved.

How big is LIC?

LIC was formed in 1956 after nationalizing and merging 25 private life insurance companies & was the only life insurance company in India until the year 2000.

LIC globally has 286 million in-force life insurance policies for individuals.

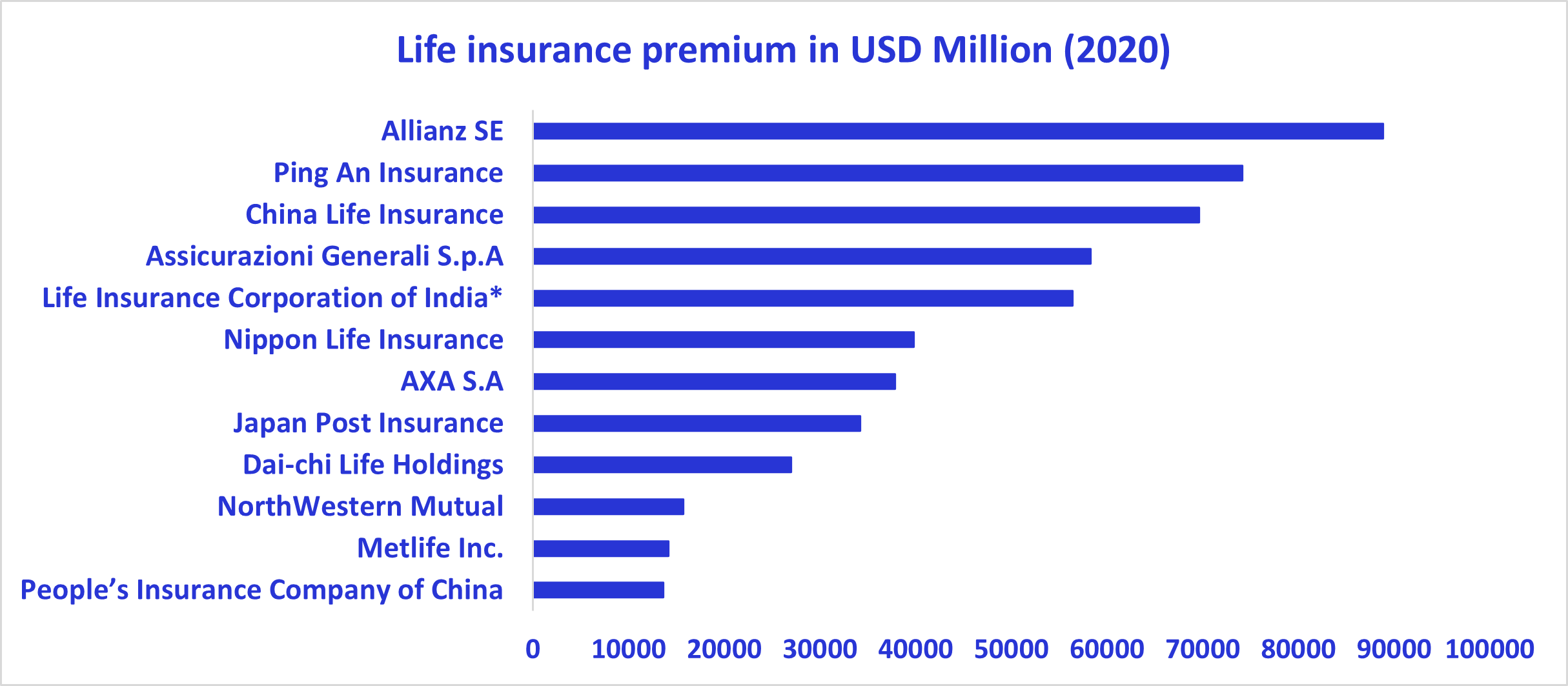

LIC is the fifth-largest insurer globally in Gross Written Premium (GWP) and the tenth-largest insurer in total assets.

LIC sells over 70% of the insurance policies sold in the country and receives 65% of the total new premiums.

For Assets Under Management (AUM), LIC is 16 times larger than the insurer next to it and higher than the AUM of the entire Mutual Fund Industry.

Outlook for the life insurance sector

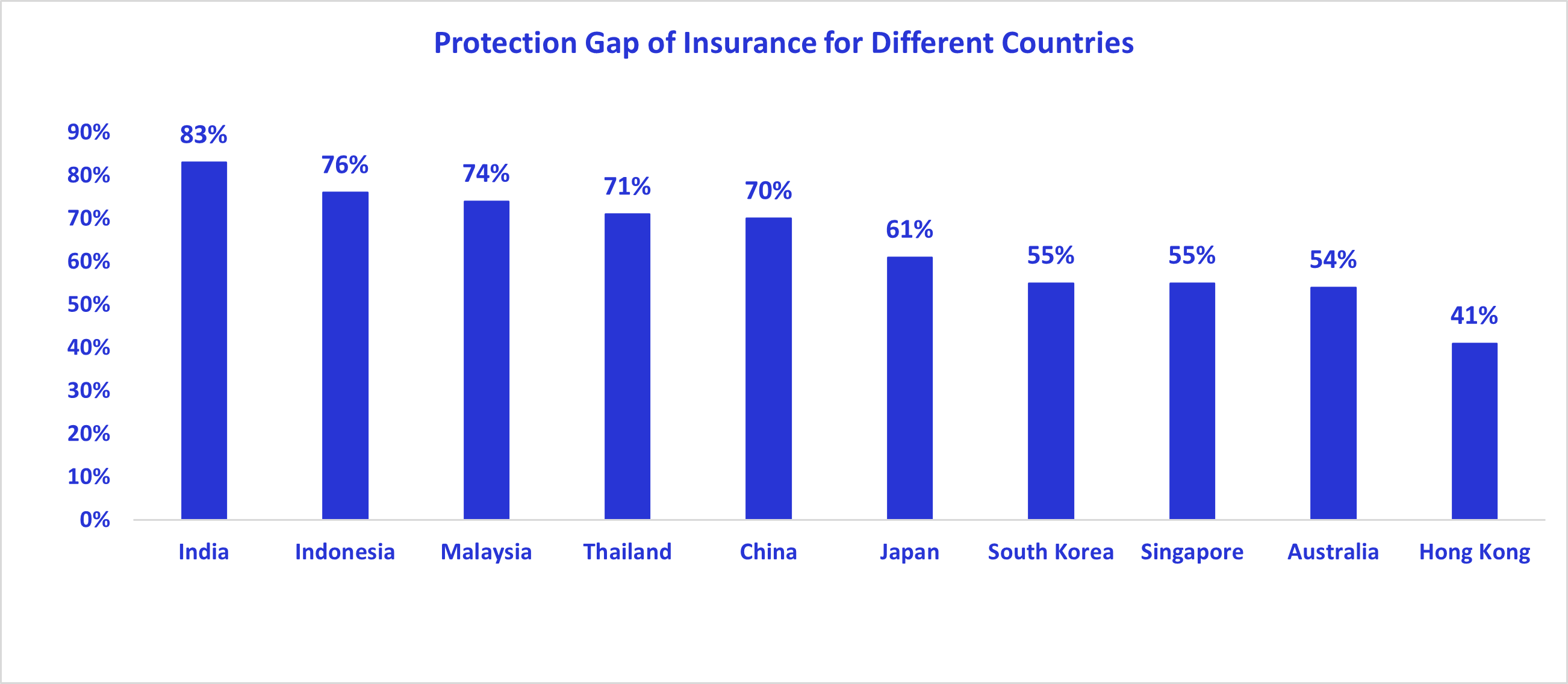

The Indian insurance sector is under-penetrated compared to the world. The protection gap is one of the key metrics to measure insurance penetration. A protection gap is a difference between the resources you need and those available to you in the time of an unfortunate event. India has a significant protection gap. It gives a substantial growth opportunity for the industry to bring down the protection and gap.

And those available with you in the time of an unfortunate event. India has a significant protection gap among its peers. It gives a substantial growth opportunity for the industry to bring down the protection and gap.

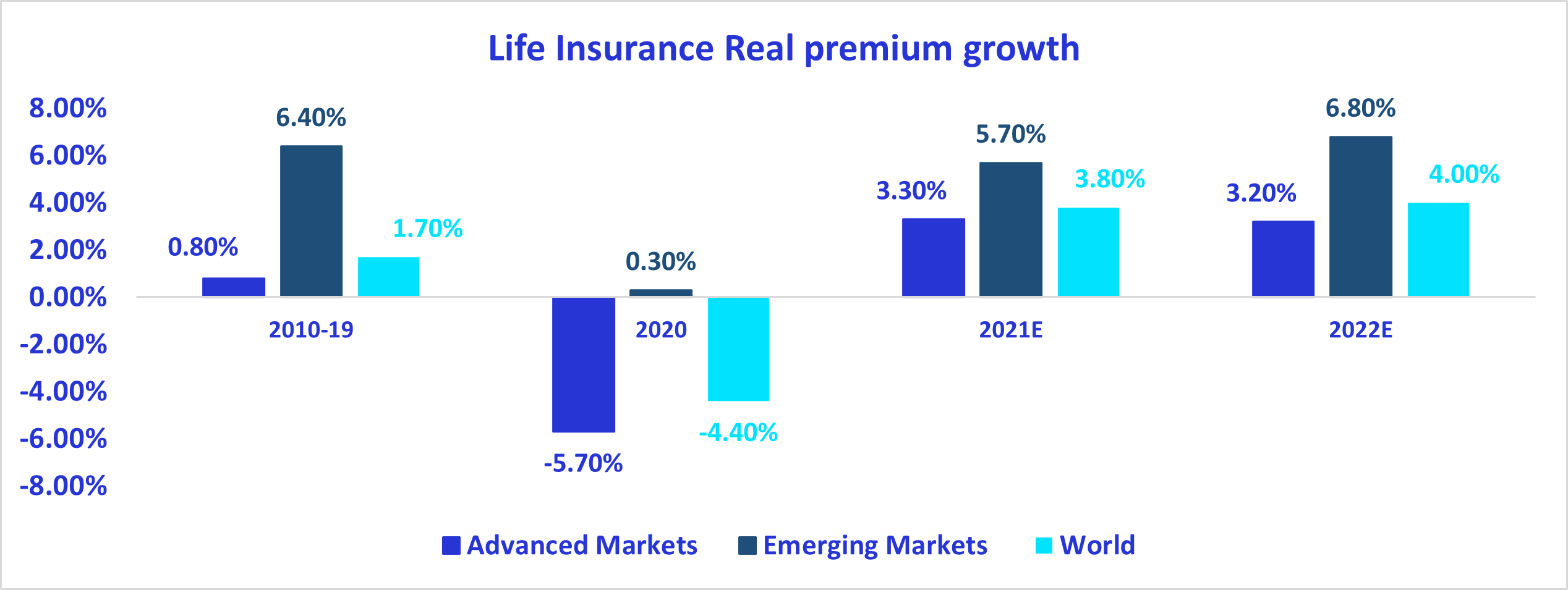

The demographic feature of the country supports the growth story of the economy. The under-penetration of the insurance sector coupled with favourable demographic features provides a strong growth impetus for the insurance sector in India. The industry’s GWP (Gross Written Premium) is expected to reach INR 12.4 lakh Cr with a 14-15% CAGR from FY21 and FY26 as per market estimates.

LIC is the largest insurer with the highest number of clients and has good growth potential over a long period in India. It is the largest fifth-largest insurer globally by the life insurance premium.

Savart Trivia: Gross written premium (GWP) is the amount of money received in a premium. It is the total premium written or the premium a company receives against the insurance protection sold to customers.

Market Share

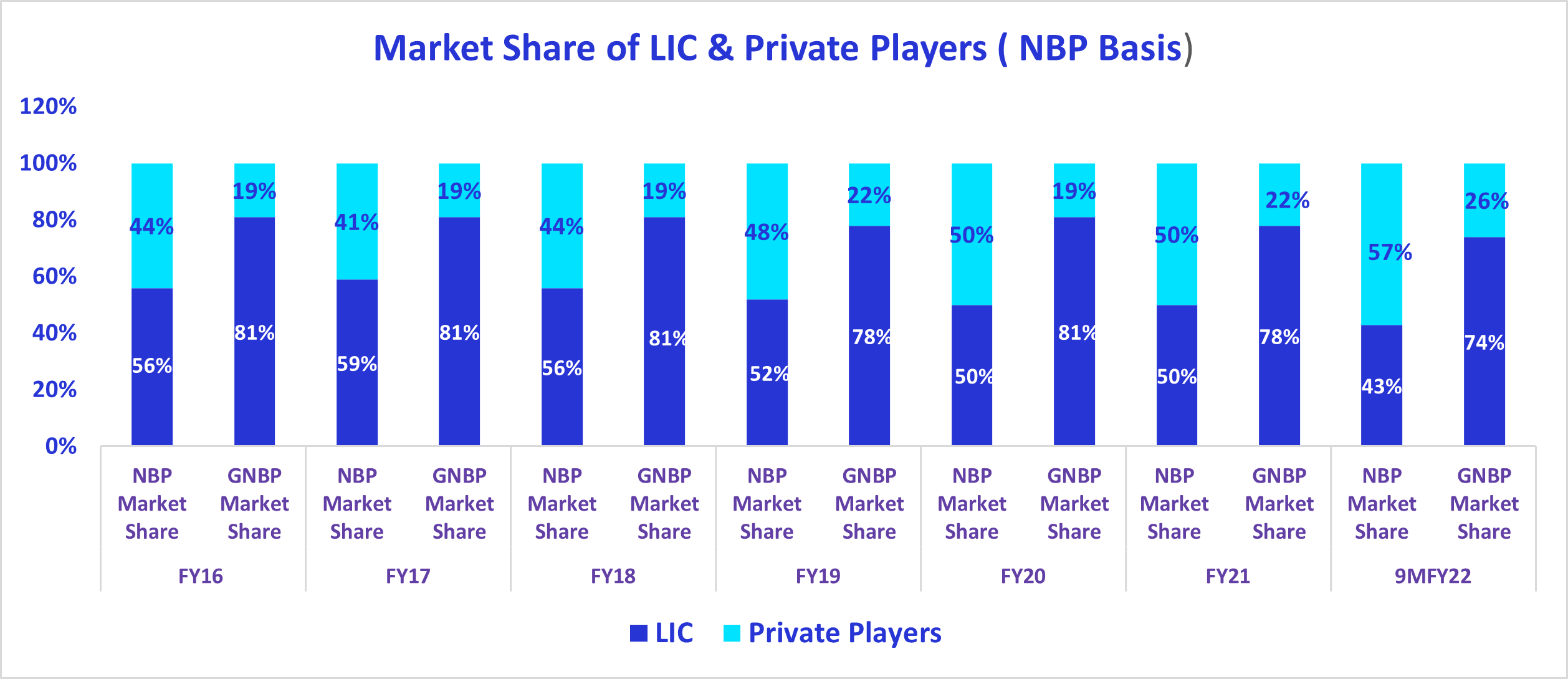

LIC is the market leader in the life insurance industry. It accounts for 66.67% of the Gross Written Premium (GWP) market share and New Business Premium (NBP) in FY22.

LIC accounts for 75% market share in GNBP (Group New Business Premium). The critical levers for LIC’s market share are the individual agent network penetrated in rural areas and a diverse product mix.

LIC is, however, lost its market share in the last few years to private players. Most losses occurred in the New Business Premium (NBP) segment. This is due to the higher digital expansion of private banks and rapid growth in bancassurance channels with local branches, enabling private players to sell insurance products to targeted branch customers.

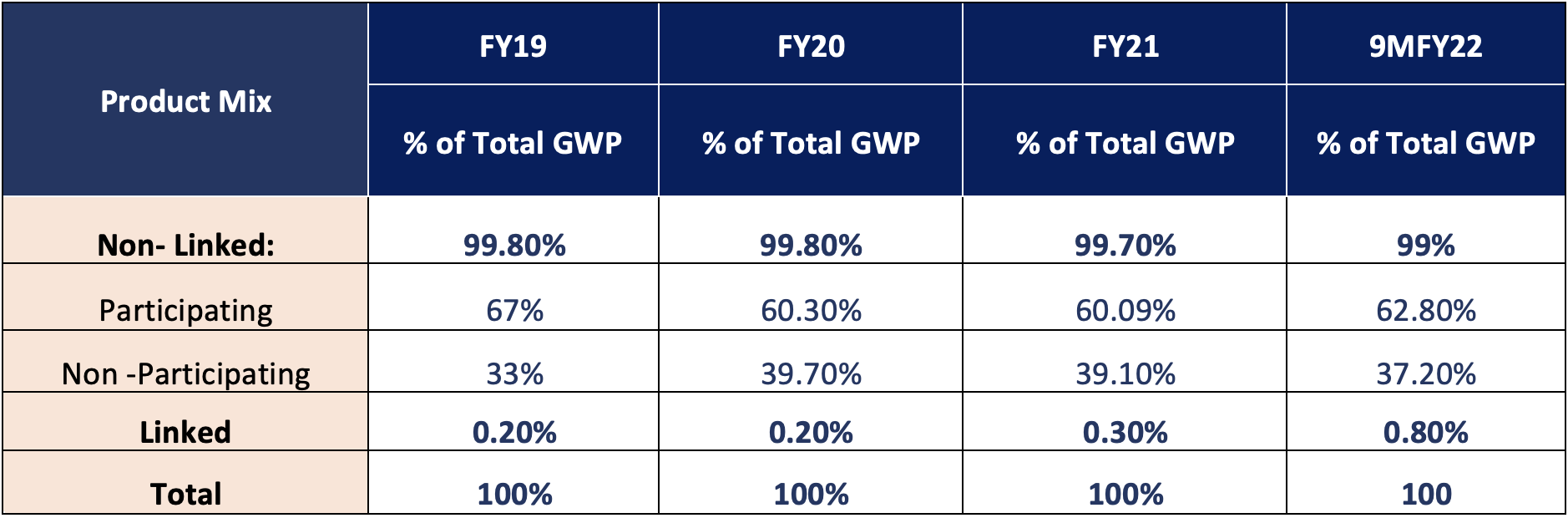

The product mix

LIC has a diversified product portfolio serving clients across age brackets.

LIC’s participating portfolio contributes a large portion of the revenue. The other portions include health insurance services, with approximately 80% of the market share.

LIC mentioned in its RHP that it would continue to diversify the product mix by addressing customer needs at every stage of life. The insurer focuses on increasing sales of their existing participating and non-participating products. LIC has the largest customers in the life insurance segment. It enables LIC to introduce new products quickly to its customers and capitalise on future growth. However, the historical growth indicates a different story, covered in the following points.

Savart Trivia: Linked products are referred to as products that cover insurance and investment instruments linked with markets. Non-Linked products are referred to as either insurance coverage or insurance coverage along with guaranteed returns which are not linked with the market.

Participating in a life insurance policy: It refers to policies which allow policyholders to participate in the profits of life insurance companies. The profits are paid to policyholders in the form of bonuses and dividends.

Non-participating life insurance policy: It does not offer policyholders to participate in its profits.

Growth Trajectory of LIC

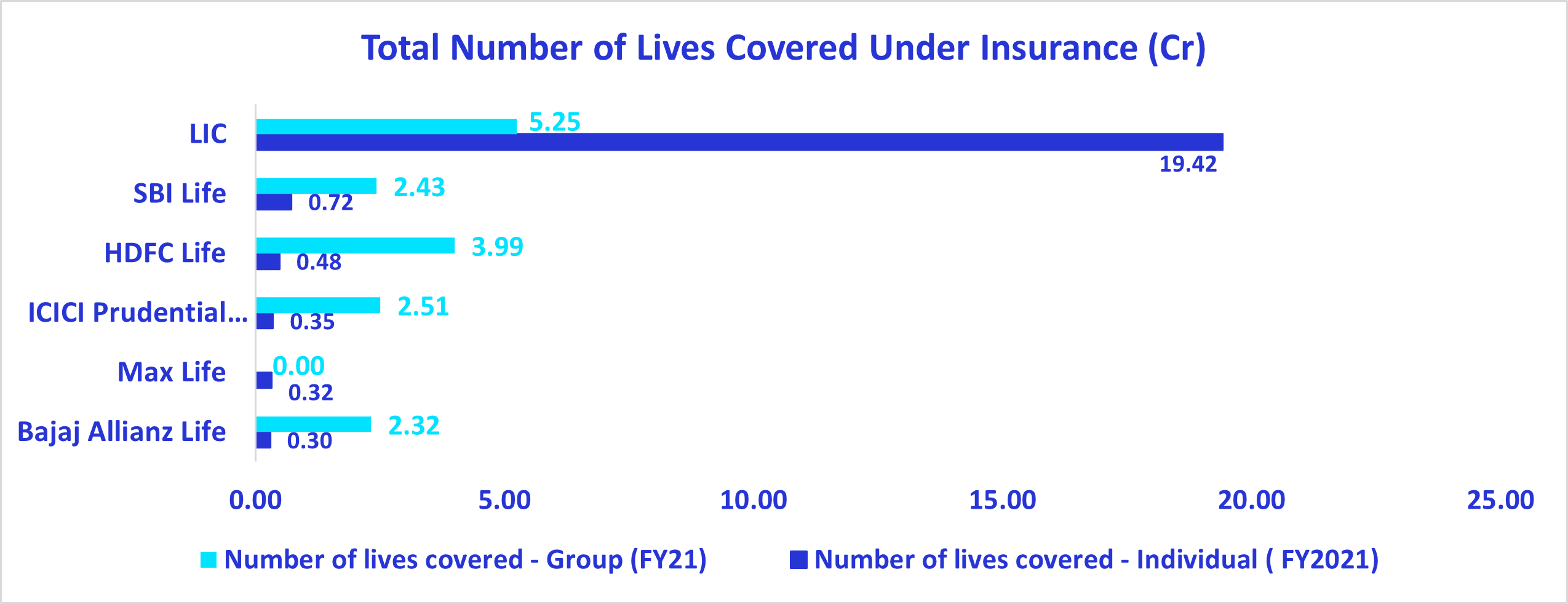

LIC has been the most significant insurance player with the maximum market share and clientele’ for a long time. The difference between the number of lives covered by LIC and the second-largest player under individual and group policies is substantially high for LIC (Please refer above visual). LIC covers 5.25 Cr of individual lives, whereas SBI life covers only 2.43 Cr of individual lives.

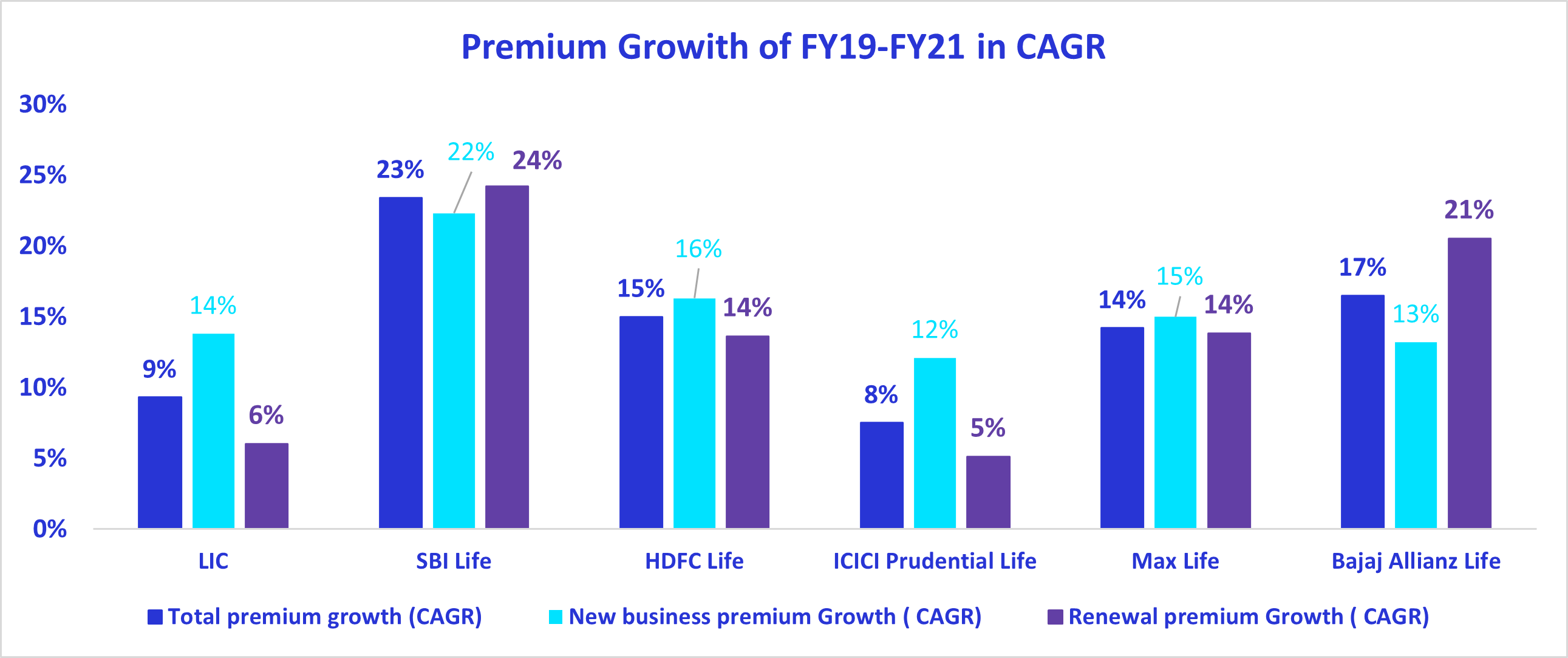

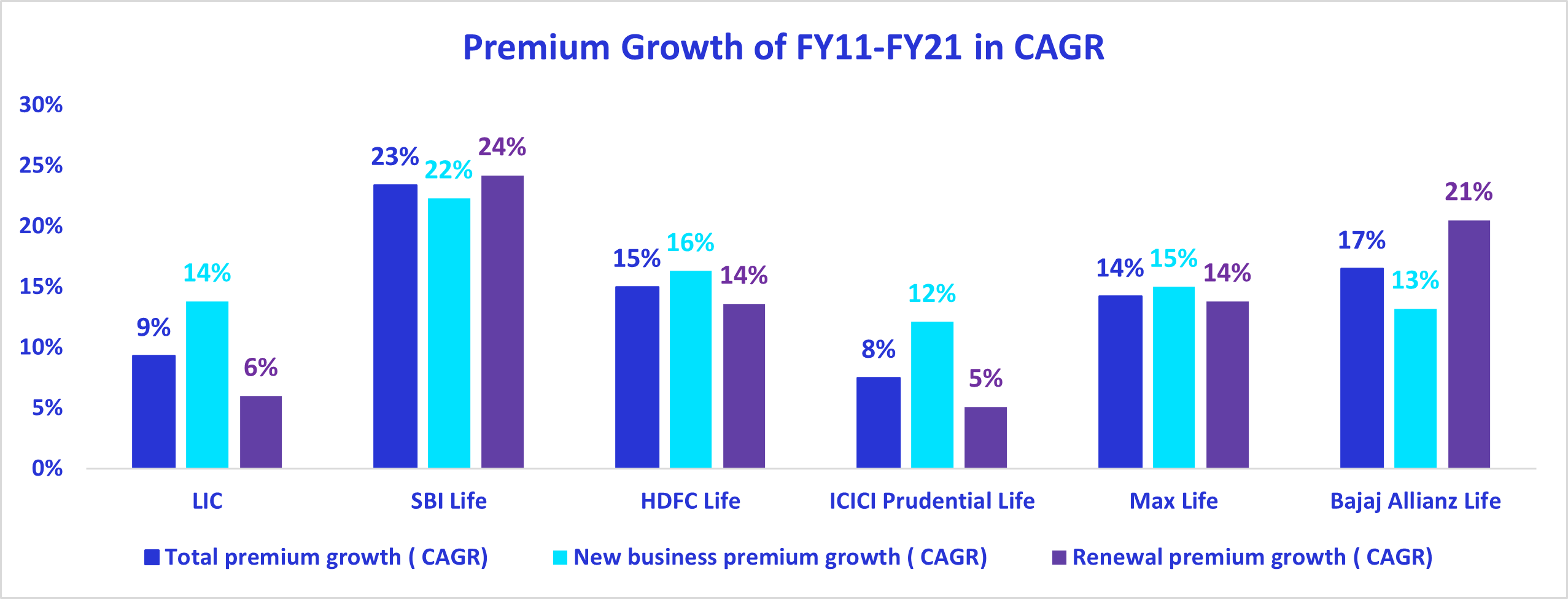

If one considers the market share of LIC, it might seem LIC has been dominating the market for a long time. This data in isolation might look very promising in favour of LIC’s performance. Still, the growth numbers indicate the slowdown of the business in the last decade concerning other industry players.

The premium growth has gained momentum for other private players and smaller government companies.

This growth is primarily driven by their bancassurance channel, enabling the other industry players to directly sell their products in respective bank branches. Another critical point for the faster growth in private players’ businesses is digital penetration with the launch of applications providing better user experience and relevant service coverage for clients.

Channel Mix

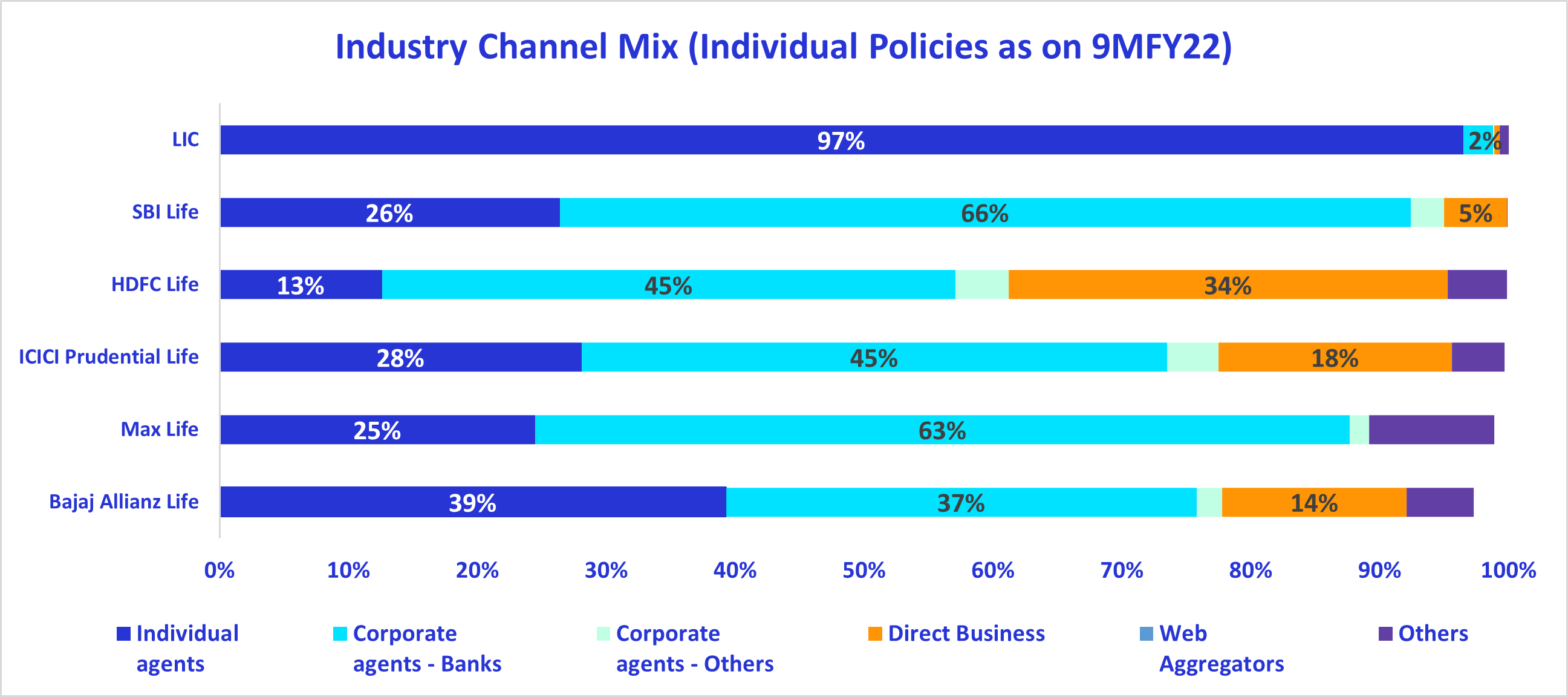

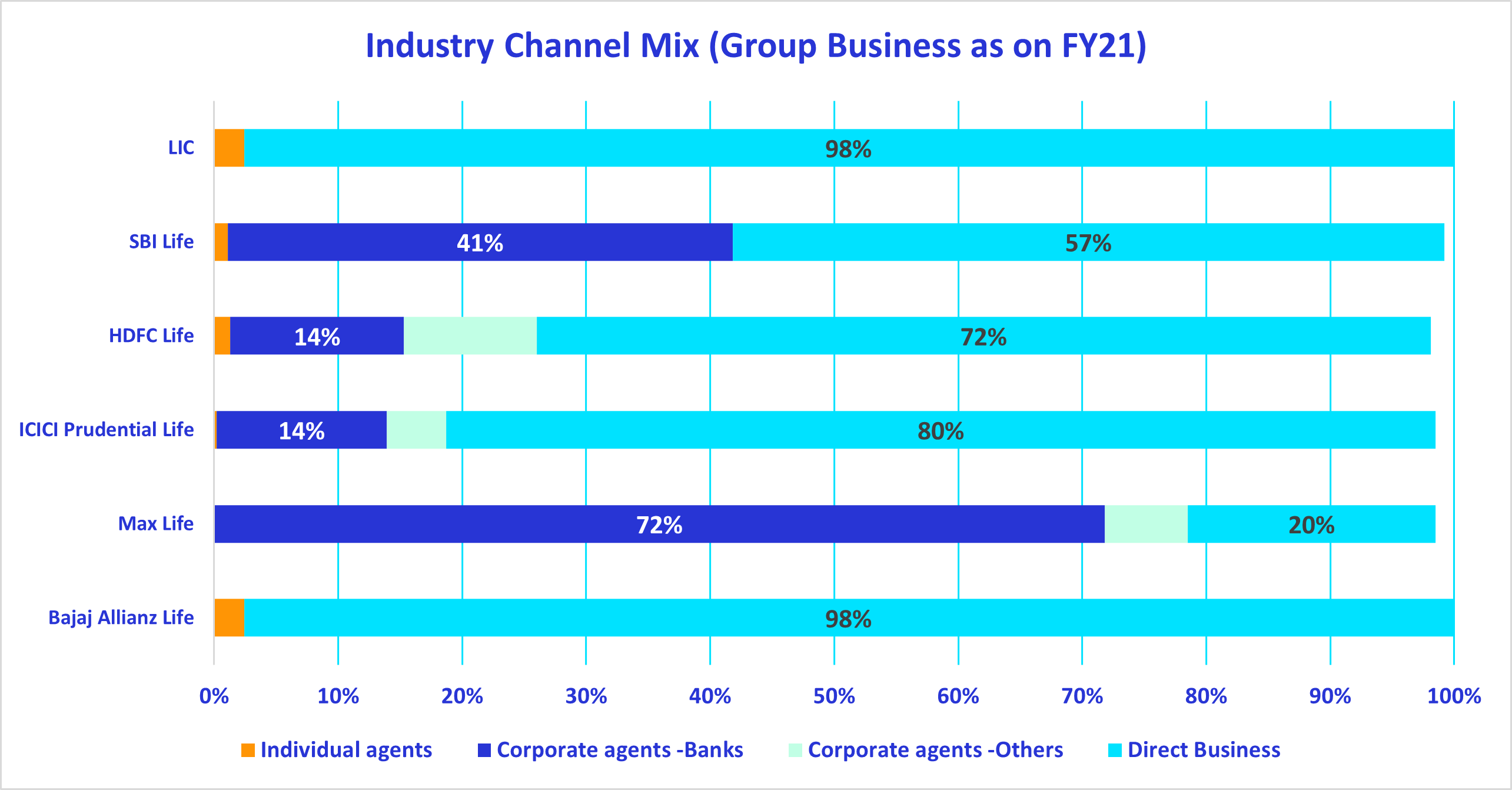

Channel refers to the critical network or relationships that source business. LIC has a mix of different channels for individual products. It has bancassurance partners, individual agents, digital sales, micro insurance agents, corporate agents, brokers, and insurance marketing firms.

LIC primarily distributes individual products through its agents. However, the private players source a higher portion of their business from corporate banks, whereas LIC sources business from individual agents. Consequently, LIC pays a higher commission to its agents than private players. So, LIC has the scope to develop a corporate bank channel to rationalise the commission cost of the company.

In the group insurance business, LIC’s channel mix contribution differs from individual policy business. It sources group insurance businesses directly from the customers, whereas individual policies are sourced from individual agents. The second player and other private players source businesses from both directions and corporate bank channels. As the private players have built strong capabilities on the corporate bank distribution front, it has been propelling their growth with better cost-efficiency.

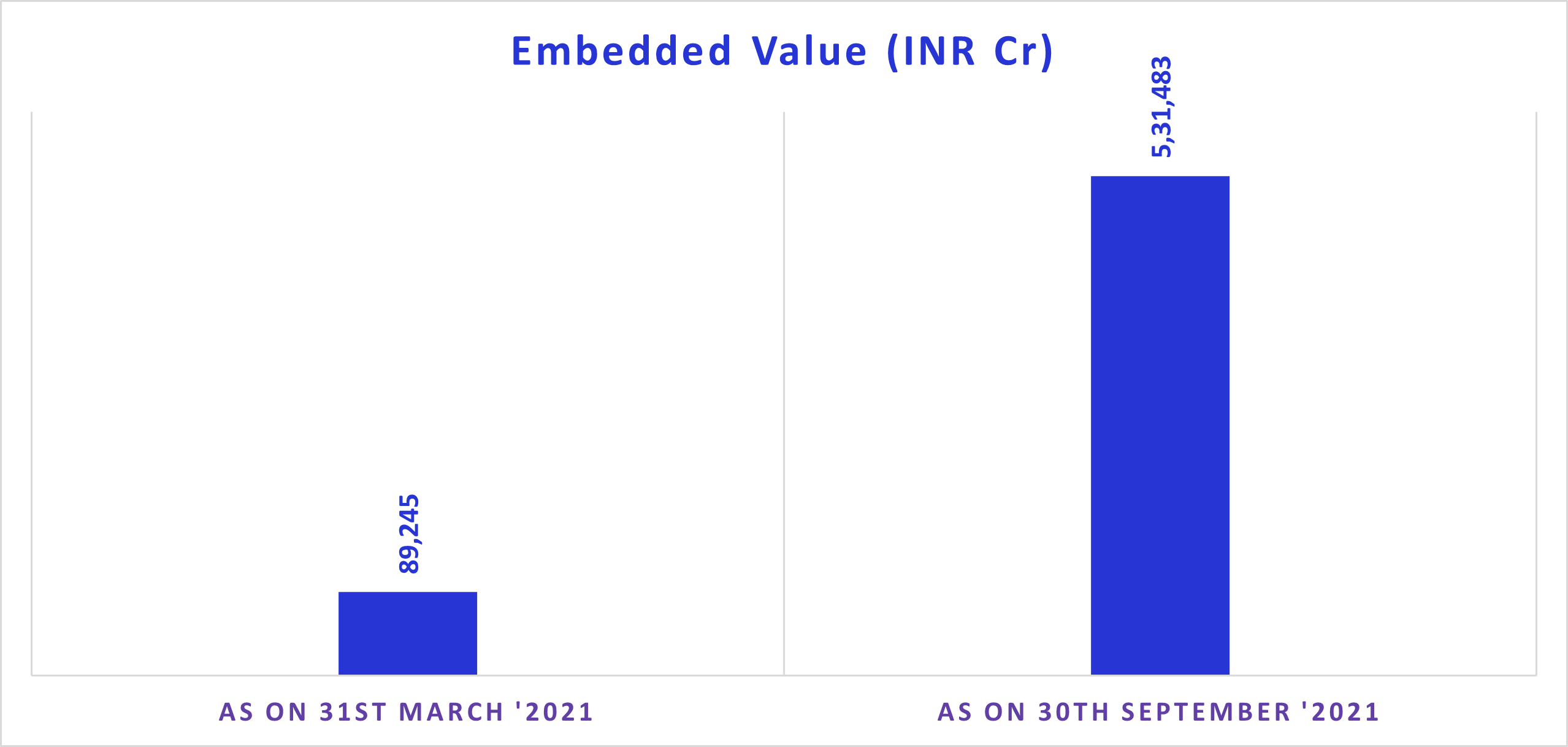

Embedded Value (EV)

The net worth of the largest life insurer in India reflects a multi-fold increase in recent times. Also, at the same time, the company’s embedded value (EV) has increased multi-fold in the last six months. In the draft red herring prospectus, the company stated a net embedded value of INR 539,686 Cr as of 30th September 2021 from INR 95,605 Cr of embedded value as of INR 31st March’2021.

Earlier, the surplus money from the participating and non-participating businesses was distributed between policyholders and shareholders. The distribution among policyholders and shareholders was at 95:5. Post the policy changes, shareholders now would receive the entire surplus of money from non-participating policyholders, and the ratio for participating policy would eventually reduce from 95: 5 to 90:10. Hence, the increase in embedded value.

Savart trivia: Embedded Value is the sum of the current value of future profits and adjusted net asset value. An insurance company makes profits if a policy doesn’t trigger a claim against the premium received by the company. Actuaries calculate the embedded value based on future estimates of profit.

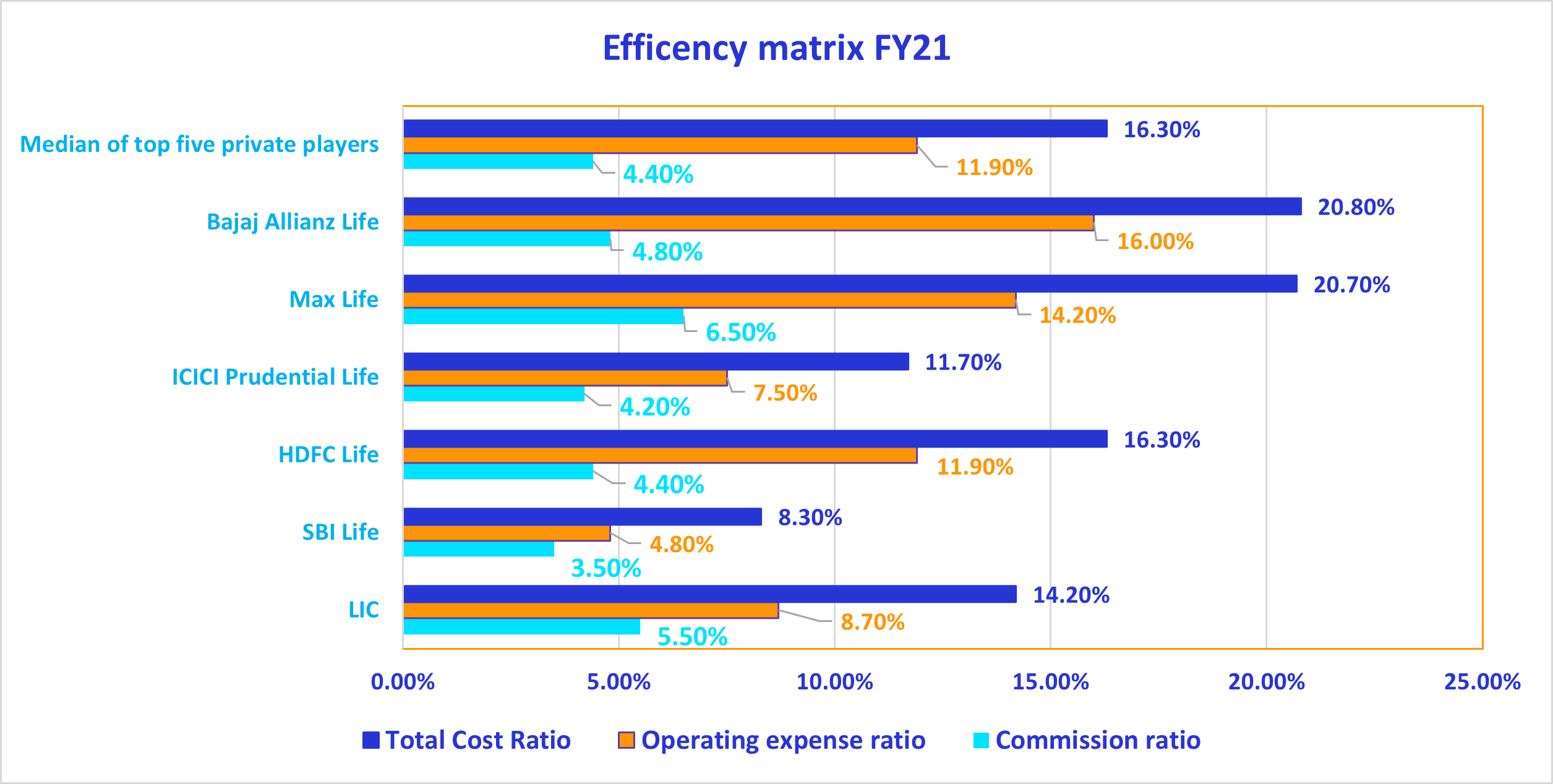

Commission Ratio

For FY 2021, LIC’s commission ratio stands at 5.5% – higher than most private and public players. This is because LIC has the most significant number of agents in the country, thus resulting in higher commission costs.

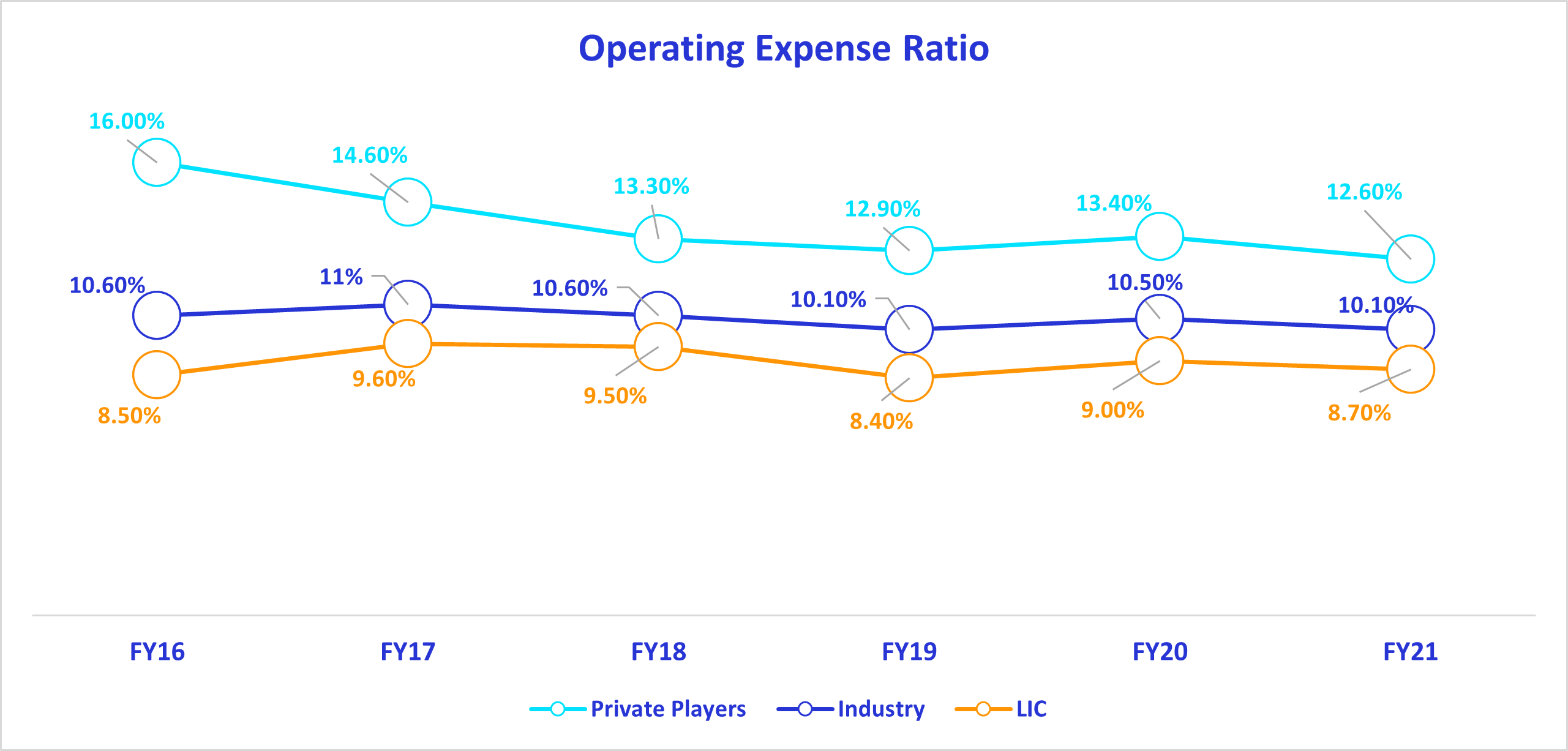

Operating Expense Ratio

LIC has a lower operating ratio because it is older than the existing private players and has attained a maturity level in the business. Thanks to technological penetration, the operating expense for the other private players has improved over the last few years.

Total Cost Ratio

The total cost ratio of LIC stands at 33.8% in the nine months ended FY 2022. This is comparatively lower than private players such as Bajaj Allianz, Max Life Insurance, ICICI Prudential, and other top private players. The fall in the total cost ratio is primarily driven by the branch expansion and other cost rationalization programmed.

Savart trivia: Total Cost Ration is a total of the commission ratio and operating expense ratio. This indicates the cost efficiency of the company as a whole.

Reduction of Debt

LIC’s debt in the consolidated book has come down significantly because of the sale of a stake in the IDBI bank. The stake was 51% earlier and is now reduced to 49%. This makes IDBI an associate of LIC and no longer a subsidiary. The accounting rule for associate companies allows LIC to offload IDBI bank from its consolidated balance sheet. So, the debt reduction is because of a stake sale in an earlier subsidiary and is not associated with any large de-leveraging (repayment of debt) strategy in IDBI.

Value of new business margin

LIC has a lower VBN (Value of new business) margin than the listed private players. The current margin stands at 9.9% in FY2021 compared to the private players with VNB margins of 22-27% due to LIC having a higher share of participation in investment products that require distribution of profit to the clients. In contrast, other private players have relatively lower participation in investment products and higher participation in protection (insurance) products.

Savart trivia: VNP (Value of new business ratio) indicates the profitability of an insurance company. It is the present value of future profits concerning the annualized premium. Higher participation in insurance (protection business) fetches higher profitability than the investment business.

How is LIC IPO Priced?

LIC fixed a price band of ₹902 – ₹949. 10 lakh crore was the initial valuation but altered to 6 lakh crores at the higher end of the price band.

Given the unfavorable market conditions and global geopolitical turmoil, LIC downsized the issue from 5% to 3.5%.

INR 2 lakh is the maximum amount you can invest if you’re investing as a retailer, LIC employee or policyholder. You can get up to Rs 6 lakh bidding on all three quotas. If you are bidding for the shares in policyholders’ and employees’ quotas, you get a limit of Rs 4 lakh. If accepted, policyholders get a discount of Rs 60. Employees and retail investors get a discount of Rs 45.

Track record in servicing customers and honoring claims

LIC has an impeccable track record of servicing its customers. It has been proactive in settlement claims. These two facts are essential in recurring customers and premium renewals for the insurer.

Offering differentiated products and competitive pricing

It has become imperative to have customized products for insurers. Implanting a customer-first culture enables the insurers to engage with the customers. An increase in the competitiveness in the industry led to pricing pressure on insurance players. Offering personalized products and competitive premiums is vital to having a market share.

Strong distribution network

An entrenched distributed chain of networks is a priority for insurance companies. This helps in marketing their products and generating new business. The pandemic forced the insurers to explore new avenues to prospect & engage with customers.

Should You Invest in the LIC IPO?

- Savart strongly suggests that this decision must not be decided by the probable listing gains but by the long-term growth aspects of the business post IPO.

- The LIC IPO’s sheer scale can expand the Indian financial markets & further accelerate the adoption of financial assets, which is part of a long term shift out of physical assets.

Savart’s Take: We avoid investment in most IPOs, except with offers from outstanding companies (rare) driven by great promoters (rarer). Listing gains are of little concern to us, and our AI systems and trained to pick only the best. So, most IPOs fail to pass our benchmark for investment eligibility in terms of the offer price, business, quality of promoters, moat or otherwise.

We at Savart can help you plan your finances and investments with respect to your risk appetite, goals and objectives. Reach out to Savart today and get customized investment advise delivered to you. Download our app from the Google Play Store or the Apple App Store. For a detailed explanation of how to use Savart, please watch the walkthrough video here.

-

Individual investors engage in stock market activity for a variety of reasons, e.g., long-term gains, short-term gratification, experiencing daily highs/lows, learning, applying intellectual strategies, etc. Their approaches to achieving these objectives can be broadly classified as active or passive in terms of the time spent analyzing the markets and their frequency of transactions. Let’s understand […]

-

7 Common Investing Mistakes That Can Reduce Your Returns from the Market Investing is an exciting experience. But it can also overwhelm people, especially those who are starting afresh. By their very nature, stock markets go up and down – disciplined investors understand this, and develop strategies to reduce their risks during market lows (as […]